- Market Twists & Turns

- Posts

- Weekend Report – Part II

Weekend Report – Part II

Stock Market Update, Tariffs Again

Hey Market Timer!

Dictate prompts and tag files automatically

Stop typing reproductions and start vibing code. Wispr Flow captures your spoken debugging flow and turns it into structured bug reports, acceptance tests, and PR descriptions. Say a file name or variable out loud and Flow preserves it exactly, tags the correct file, and keeps inline code readable. Use voice to create Cursor and Warp prompts, call out a variable like user_id, and get copy you can paste straight into an issue or PR. The result is faster triage and fewer context gaps between engineers and QA. Learn how developers use voice-first workflows in our Vibe Coding article at wisprflow.ai. Try Wispr Flow for engineers.

Today we will be covering...

Announcements: All major U.S. stock markets will be closed on Monday, January 19, in observance of Martin Luther King Jr. Day. Regular trading will commence on Tuesday.

Today, as a part of a series of Magnificent 7 posts, we will review MSFT.

On Wednesday, we will review AMZN.

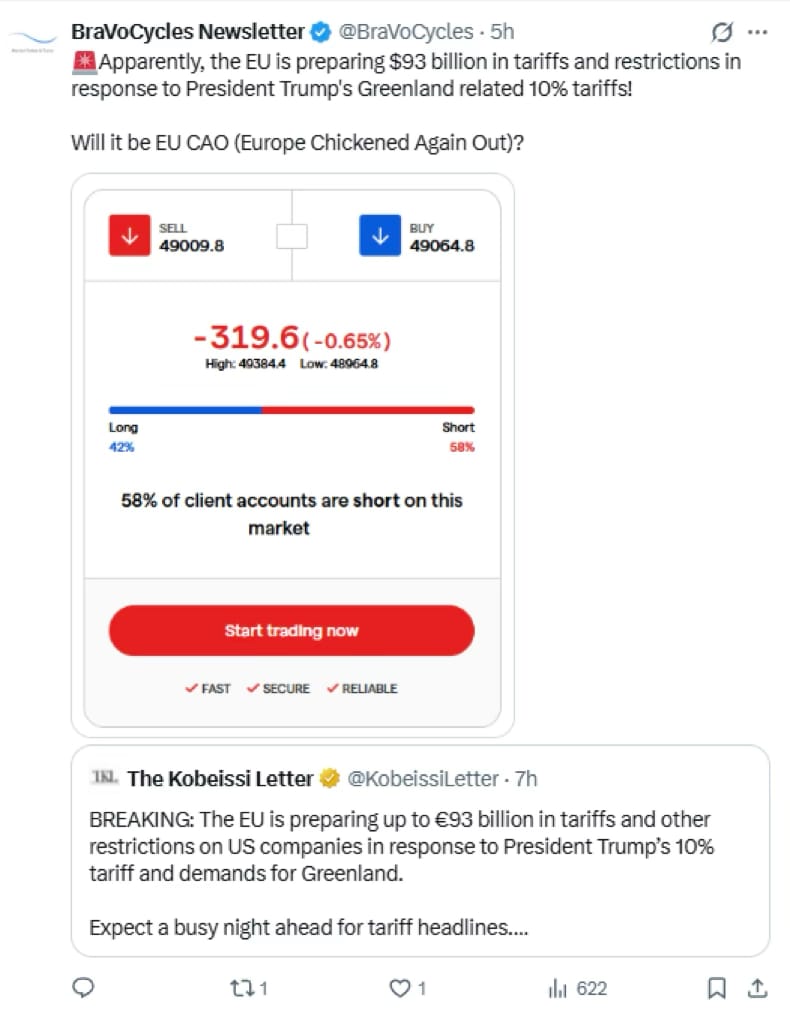

President Trump is issuing 10% tariffs on 8 European countries, including Denmark, for opposing U.S. control of Greenland.

In a lengthy Truth Social post, he said “Denmark, Norway, Sweden, France, Germany, The United Kingdom, The Netherlands, and Finland have journeyed to Greenland, for purposes unknown”, adding: “This is a very dangerous situation for the Safety, Security, and Survival of our Planet.”

He goes on to say 10% tariffs will be imposed on all goods the countries’ export to the United States from February 1st, followed by a 25% rate starting June 1st.

Source: FOX4

In response, Europe is threatening to suspend trade negotiations and potentially retaliate with its "trade bazooka" after President Trump announced new tariffs on several European countries (Denmark, Germany, UK, etc.).

MSFT Cycles

MSFT may bounce from a 40W cycle trough, which is dominant on the daily chart.

After a bounce, the next cycle trough is expected in October.

However, the bounce due to the 40W cycle may not be strong as longer cycles from the weekly chart are pressing down toward October.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

Several days ago, we called for a pullback into January OPEX +/-, due to a relatively strong 10 TD cycle that was expected to start a down phase.

The pullback started early in the week and culminated with a gap down in the futures caused by a new trade escalation (Greenland-related) between the US and Europe.

Initial reaction by traders was negative. Some traders and investors may come on Tuesday and think this does not make sense, it will be resolved somehow, and buy the dip.

But in an overvalued and extended market, one should pay attention to further developments; if unresolved, this trade war between the US and Europe could cause significant economic troubles.

It may be that the technology infrastructure spending slowdown (see my X post above) may cause trouble for the stock market in 2026, even if the trade war is resolved satisfactorily. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply