- Market Twists & Turns

- Posts

- Weekend Report – Part I

Weekend Report – Part I

Review of TSLA, Crypto, Natural Gas, and EURJPY

Hey Market Timer!

You Can't Automate Good Judgement

AI promises speed and efficiency, but it’s leaving many leaders feeling more overwhelmed than ever.

The real problem isn’t technology.

It’s the pressure to do more with less — without losing what makes your leadership effective.

BELAY created the free resource 5 Traits AI Can’t Replace & Why They Matter More Than Ever to help leaders pinpoint where AI can help and where human judgment is still essential.

At BELAY, we help leaders accomplish more by matching them with top-tier, U.S.-based Executive Assistants who bring the discernment, foresight, and relational intelligence that AI can’t replicate.

That way, you can focus on vision. Not systems.

Today we will be covering...

Announcements: Weekend Report Part II, covering the stock market, will be published on Monday. All major U.S. stock markets will be closed on Monday, January 19, in observance of Martin Luther King Jr. Day.

Today, as a part of a series of Magnificent 7 posts, we will review Tesla (TSLA).

Tomorrow, we will examine Microsoft.

FED's Beige Book Jan'26 - Long Story Short

National Summary

Economic activity grew slightly in most Fed Districts. 3 saw no change, 1 declined. This is an improvement from previous cycles.

Consumer spending rose, boosted by holiday shopping, especially among higher-income groups. Lower-income consumers remain cautious. Auto sales were flat or down.

Manufacturing was mixed. Nonfinancial services were steady or up. Banking was stable or improving.

Residential real estate and lending softened.

Agriculture was mostly stable.

Energy demand was flat to slightly down.

Outlooks are mildly optimistic, expecting slight growth.

Labor Markets

Jobs were mostly flat.

Temp workers use rose for flexibility. Hiring was mainly for vacancies, not expansion. Skilled labor remains hard to find.

AI use is rising, but its current impact is limited.

Wages grew moderately and are back to "normal."

Prices

Prices increased moderately in most Districts.

Tariff costs are rising, and some firms are passing them on.

Retail and restaurants hold back due to price-sensitive customers.

Energy and insurance costs strain margins.

Firms see price growth moderating but staying high.

Source: Federal Reserve Bank of St. Louis

TSLA – Elliott Wave Counts

TSLA played out largely as expected; we had several consecutive great calls on TSLA’s reversal points over the last couple of years.

At the December peak, TSLA exhibited negative divergences in RSI and MACD indicators, which confirmed the bearish outlook.

Right now, it is squeezed between the 10D EMA and 50D MA from above, and 100D MA from below; IMO, at least an intermediate-term trend is down.

Unfortunately, both the black and red Elliott Wave counts are still alternatives, in part because of the double bottom in April’2025.

The ideal target for black circle-b is the 61.8% Fibonacci retracement level, which rhymes with the triangle apex.

Under the red count, TSLA should target below the April low.

We will not be able to delineate between the black and the red count until we see more wave structure on the downside.

Thus, we will have to use more guidance from time-cycles turning points and cycle price projection targets.

I will review these in the TSLA Deep Dive section in the Pro newsletter for those who might be interested.

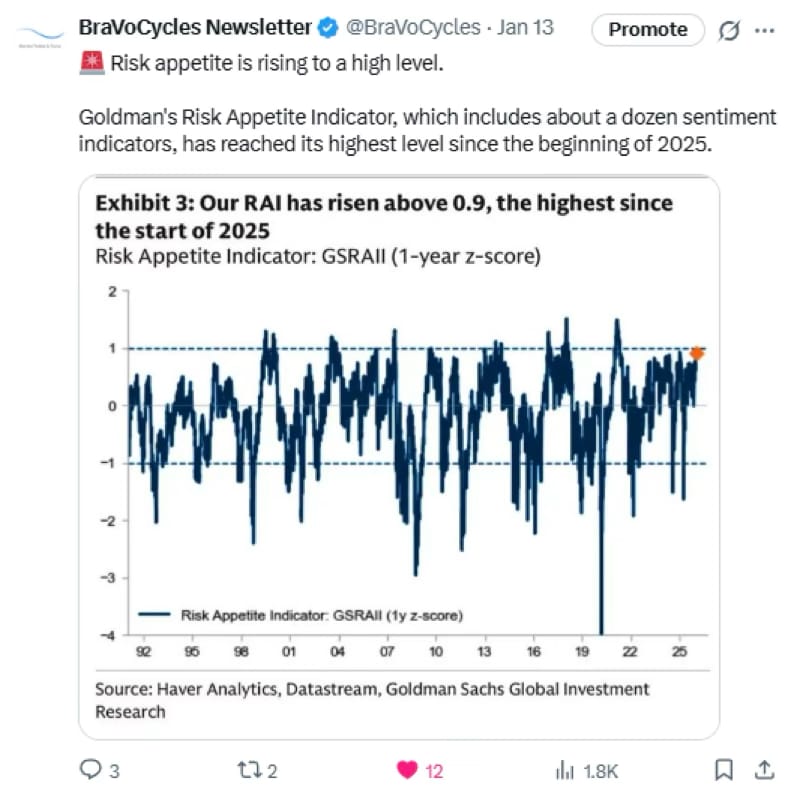

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

To read our deep dive into TSLA upgrade to Premium Pro. . .

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply