- Market Twists & Turns

- Posts

- Wall Street Analysts are Bullish for 2026

Wall Street Analysts are Bullish for 2026

Could This be a Contrarian Signal?

Hey Market Timer!

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

Today we will be covering...

BraVoCycles and the Team wish you a happy, healthy, and prosperous New Year

Today, we will examine what Wall Street analysts expect from the stock market in 2026.

Wall Street Analysts are Unanimously Bullish for 2026

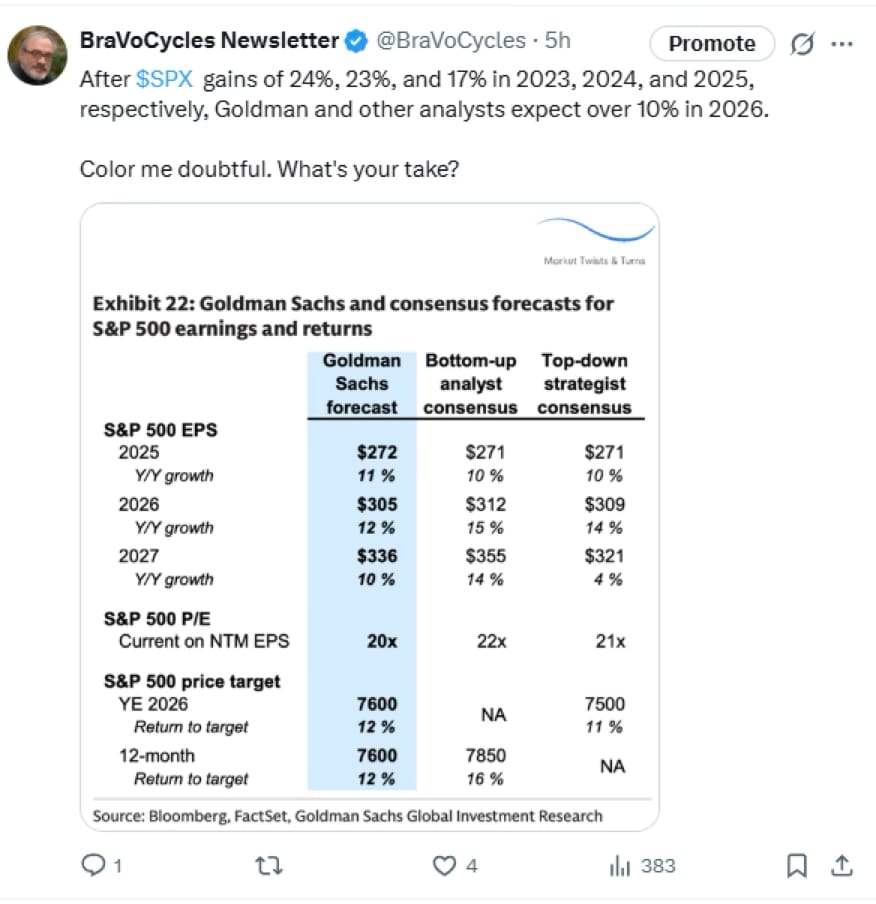

Bloomberg reported that all 21 strategists surveyed expect U.S. stocks to rise in 2026, marking a rare, unanimous bullish consensus for a fourth straight year of gains, driven by AI, solid earnings, and growth. However, some see the consensus itself as a risk.

Key Details from the Bloomberg Survey:

Unanimous Optimism: Not even one of the 21 forecasters predicted a stock market decline in 2026, with the average forecast calling for a 9-11% gain in the S&P 500.

Reasons for Optimism: Strategists cite resilient economic growth, cooling inflation, strong corporate earnings, and the ongoing AI revolution as key drivers.

Longest Streak: This would be the fourth consecutive year of gains, the longest winning streak in nearly two decades.

A Potential Risk: Some analysts find the extreme consensus concerning, noting that unanimous bullishness can sometimes signal a market nearing a peak or vulnerable to setbacks, according to a separate Bloomberg piece. In essence, Wall Street is overwhelmingly positive on 2026 equities, though the lack of dissent is a point of caution for some observers, as noted by others.

Is this a red flag for contrarian investors?

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

We suggested a week ago that there might not be a Santa Claus rally, which proved correct so far. The Santa rally period extends to the first two trading days of January, which also rhymes with a positive seasonality due to pension fund inflows.

Remember that seasonality patterns are not guarantees. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply