- Market Twists & Turns

- Posts

- Stock Markets Relentless Push Higher – Short Squeeze?

Stock Markets Relentless Push Higher – Short Squeeze?

Bears Cannot Get a Breather

Hey Market Timer!

Cinderella Meets Next-Gen Tech - Limited Shares Available

What happens when the world’s most recognizable characters merge with AI? Elf Labs, holder of 500+ copyrights and trademarks, including Cinderella and Snow White, is about to show us. They’re bringing 12 tech patents to turn these iconic characters into dynamic, interactive experiences—on 200M+ screens globally. Join Elf Labs as they redefine global entertainment.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Today we will be covering...

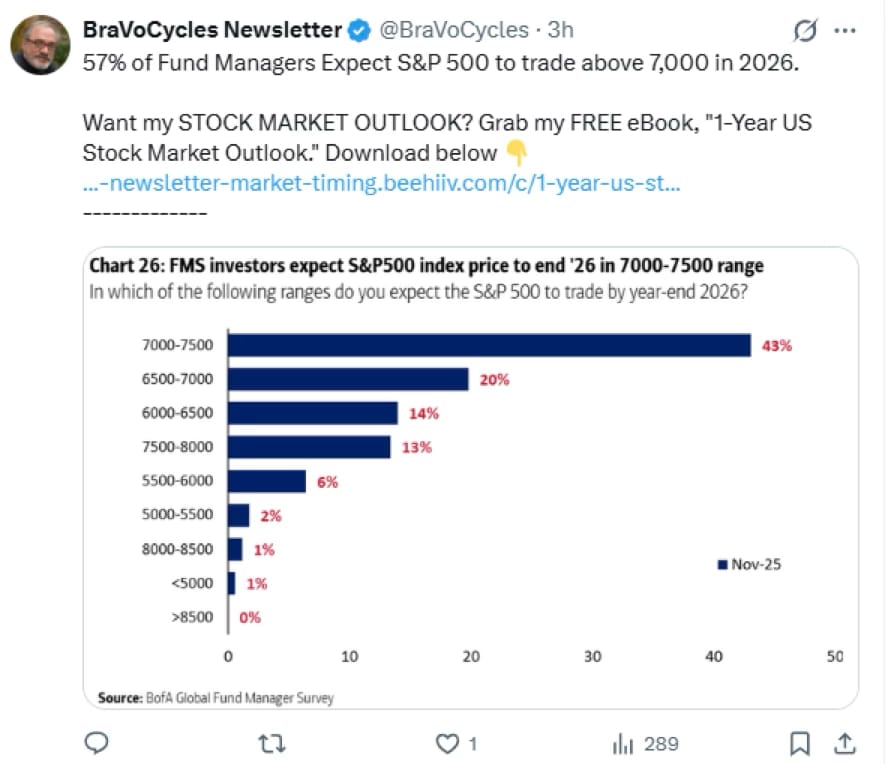

Today, we will look at excerpts from a Fund Managers Survey conducted by BofA.

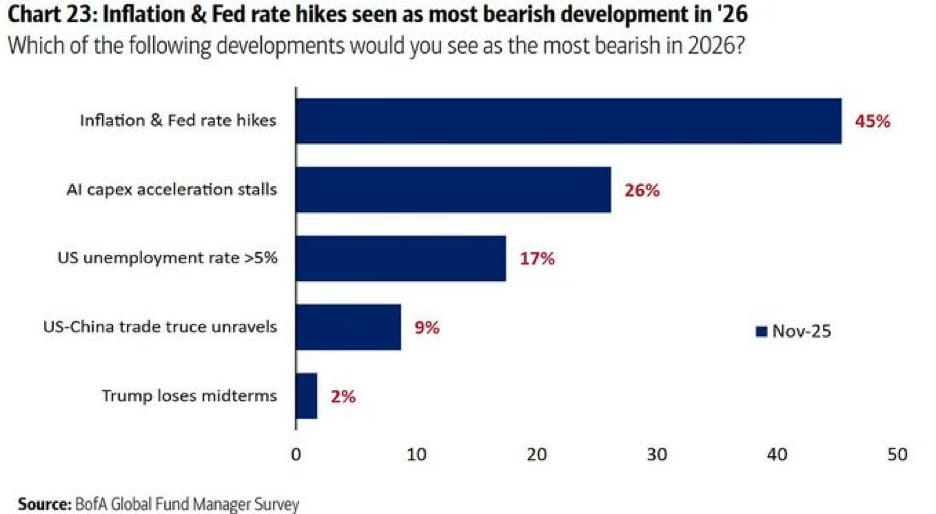

What are the Risks in 2026?

Highest risks in 2026, as per Fund Managers Survey:

Inflation/Rates Rise - 45%

AI CAPEX Slowdown - 26%

Unemployment >5% -17%

[...]

BravoCyles on Youtube

Watch my latest YouTube video about intermediate- and long-term Bitcoin cycles.

Expect short- and intermediate-term cycles to give way to long-term cycles.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

Market Summary

A week ago, and multiple times ago, I mentioned that when a diagonal is completed, “it should be quickly retraced toward the origin,” which we are witnessing now.

I also warned that the Fear & Greed Index had a similar wedge setup as in early April of this year.

On 20 Nov, the 5-day Put/Call spiked to the second-highest level this year, except during the April bottom.

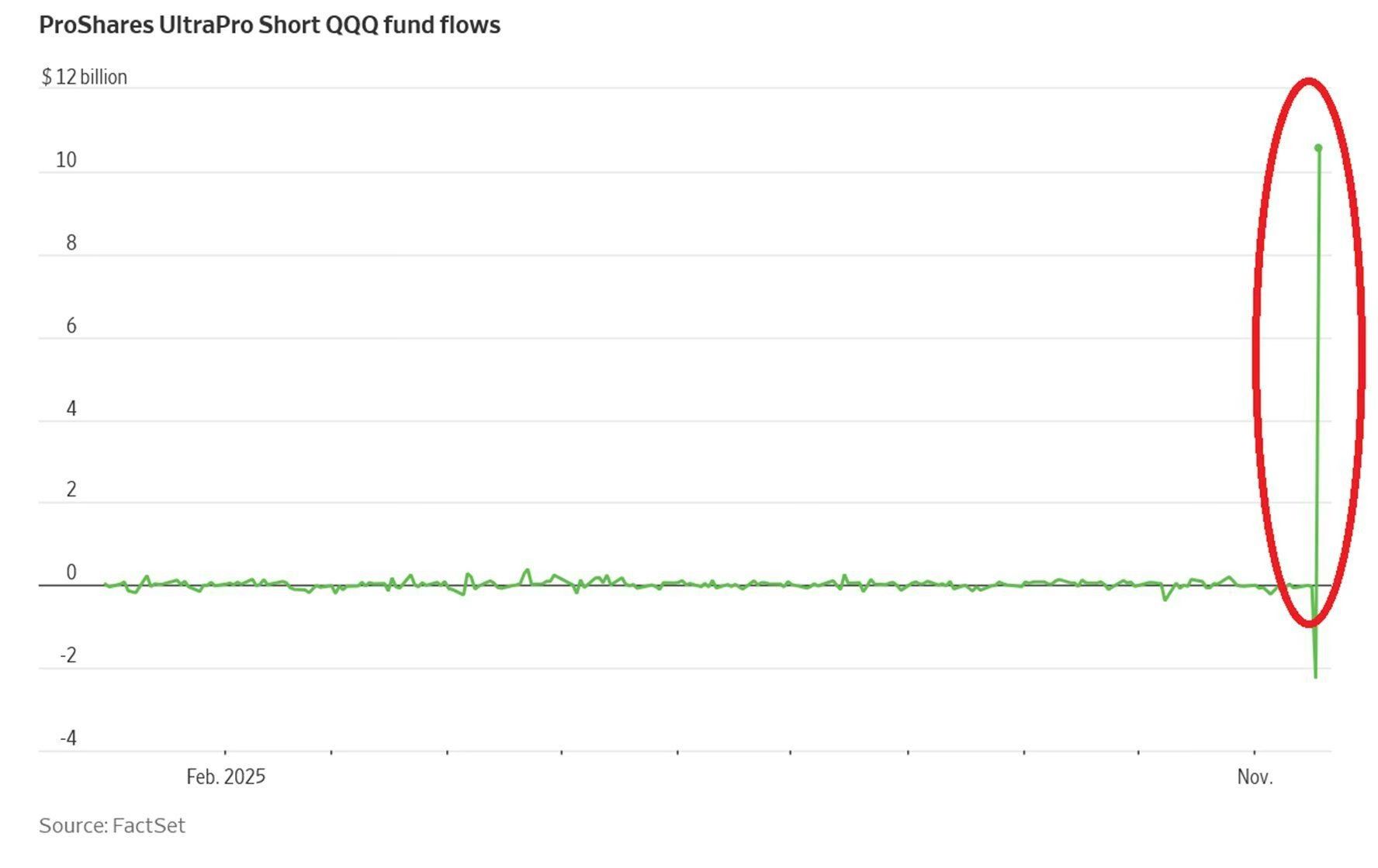

Retail investors bought heavily SQQQ (3X short QQQ ETF) for a net inflow of $12 billion, which was an extraordinarily high level (see the figure below).

The short covering likely contributed much to the speed and strength of the rebound.

But that has been. The $64k question is what is next?

We know the options, and some “tea leaves” are sending more explicit messages than the others. Let us address them one by one.

As you can see from the time cycle analysis, at least three to four relatively important cycles can support additional strength in December. However. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply