- Market Twists & Turns

- Posts

- Stock Market – What Government Shutdown?

Stock Market – What Government Shutdown?

It Seems Stock Market Loves Shutdowns

Hey Market Timer!

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

Today we will be covering...

Today, we will examine some S&P 500 $SPX ( ▼ 0.43% ) technical indicators.

S&P 500 Technical Picture

I posted in the last couple of weeks the blowoff cycle price projections that are still several percent higher.

But here is something intriguing.

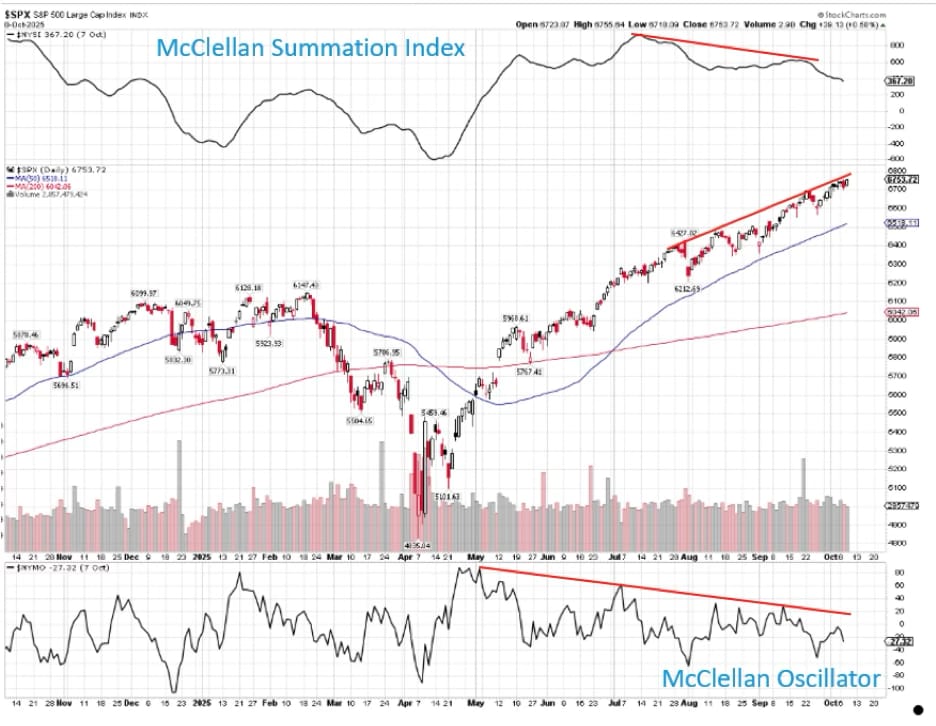

The McClellan Summation Index ($NYSI) has been pointing lower for weeks while the S&P 500 has been relentlessly pushing up.

The McClellan Oscillator ($NYMO ( 0.0% ) ) has also been weakening.

The $NYSI is one of the better swing-trend indicators, but it is failing. I have encountered this failure a couple of times before, but it remains a puzzling issue.

It will either right itself by reversing, or a continuing weakness may be sending a message that a significant correction is in the cards in a not-so-distant future.

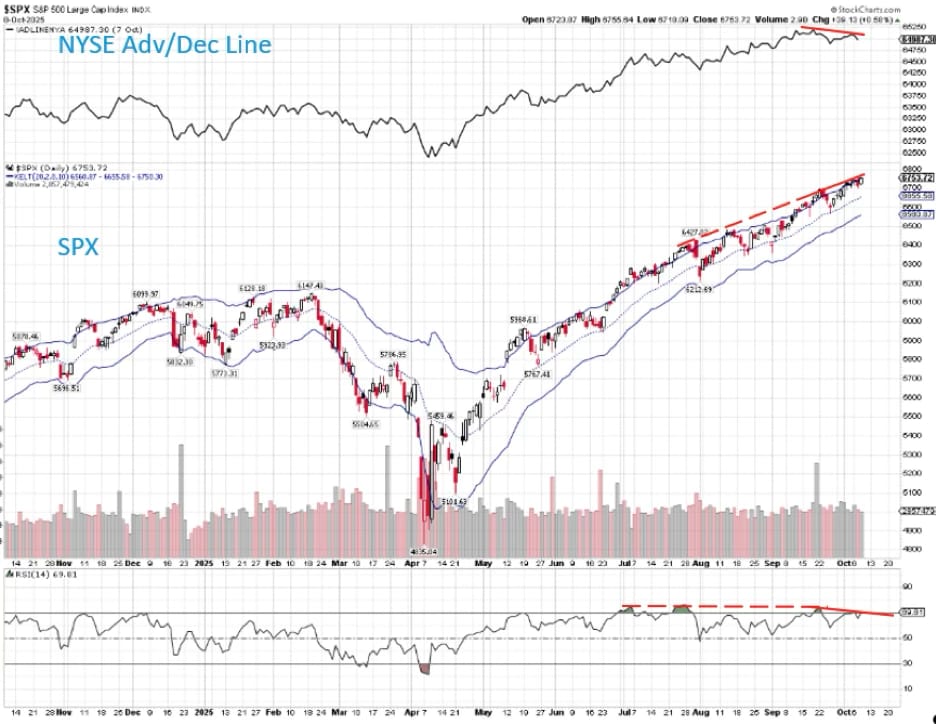

The NYSE Advance-Decline Line and RSI are also negatively diverging.

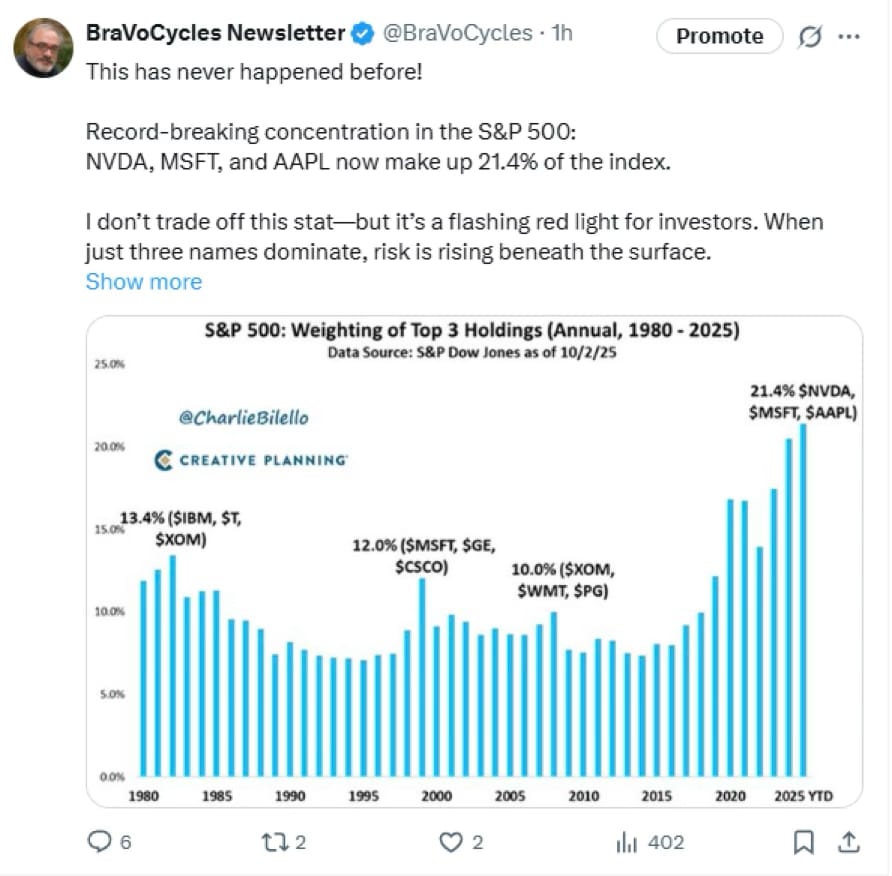

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters. Follow @BraVoCycles.

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto, claim your 95% off for 3 months introductory rate and upgrade to Premium Pro. . .

Busy isn’t the goal

Wing turns busy days into real progress. A full-time virtual assistant runs calendars, inboxes, and follow-ups, removing the drag that burns leaders out.

The result: more focus, more output, and the headspace to lead.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply