- Market Twists & Turns

- Posts

- Stock Market Was Due for a Breather

Stock Market Was Due for a Breather

Is the Israel-Iran Conflict a Catalyst for a Deeper Correction?

Hey Market Timer!

Prompting to Problem-Solving

AI is already reshaping how top companies work across finance, operations, risk, marketing, and more.

But while the hype is everywhere, real business applications are just getting started.

This is your opportunity to go beyond ChatGPT and learn real practical use-cases for AI.

The AI for Business & Finance Certificate from Columbia Business School Exec Ed + Wall Street Prep helps you close that gap.

✅ Earn a certificate from a top business school

✅ Learn from a fantastic line-up of guest speakers from BlackRock, Morgan Stanley, OpenAI, and more

✅ Join live “virtual” office hours with Columbia Business School faculty

8 weeks. 100% online. No coding required.

👉 Save $300 with code SAVE300.

Today we will be covering...

Today, we will examine crude oil futures. Higher oil prices due to supply disruptions may harm the economy and the stock market.

Crude Oil Futures

How will the crude oil price be affected by the Israel-Iran conflict?

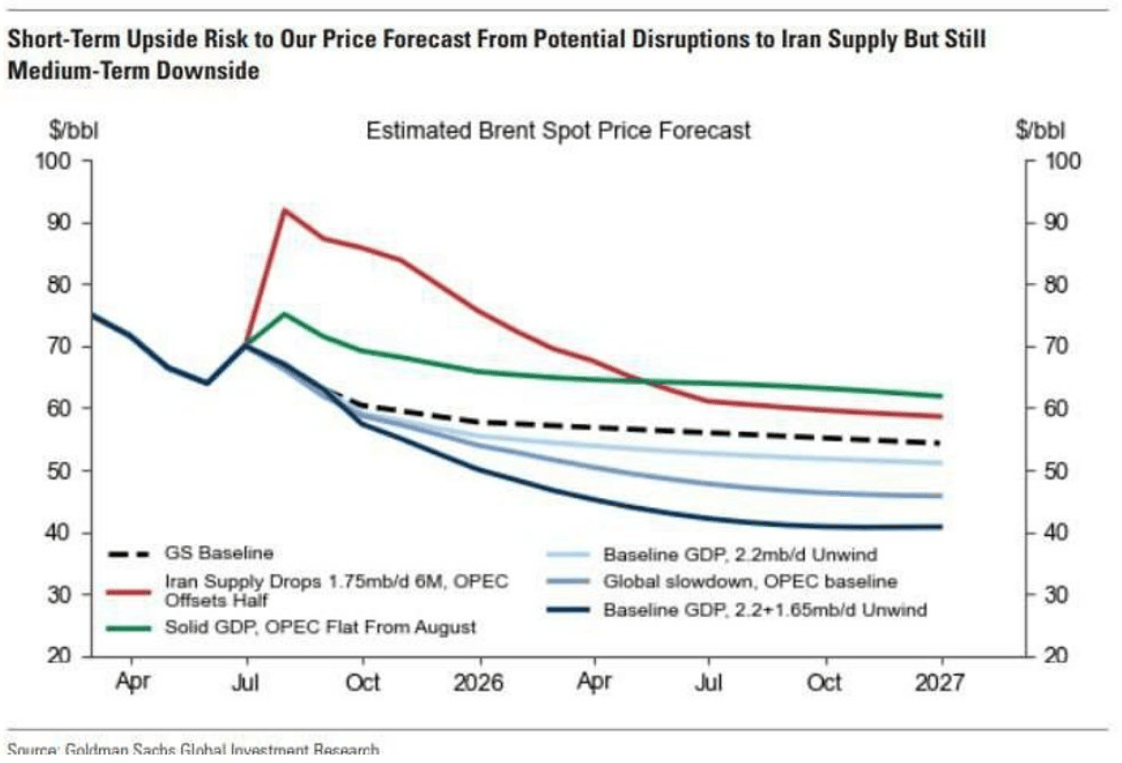

Below are Goldman Sachs models for Brent crude – It does not account for a possible closure of the Strait of Hormuz.

What do cycles say?

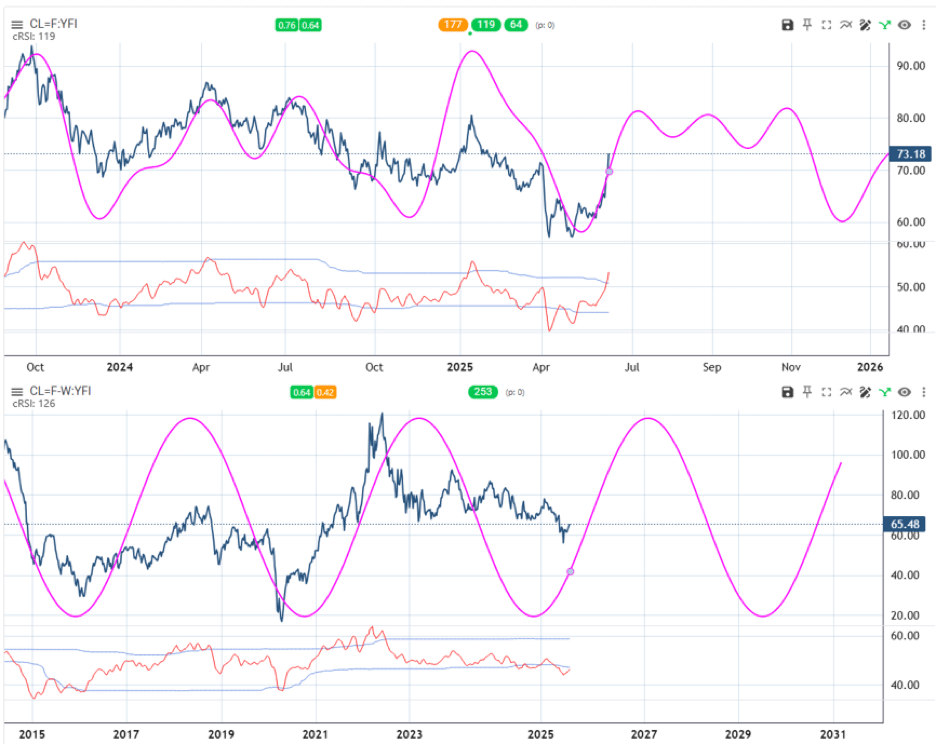

Both the daily cycle composite (upper) and the 4-year cycle (lower) suggest higher prices for crude oil futures, CL.

Sentiment & Technical Analysis

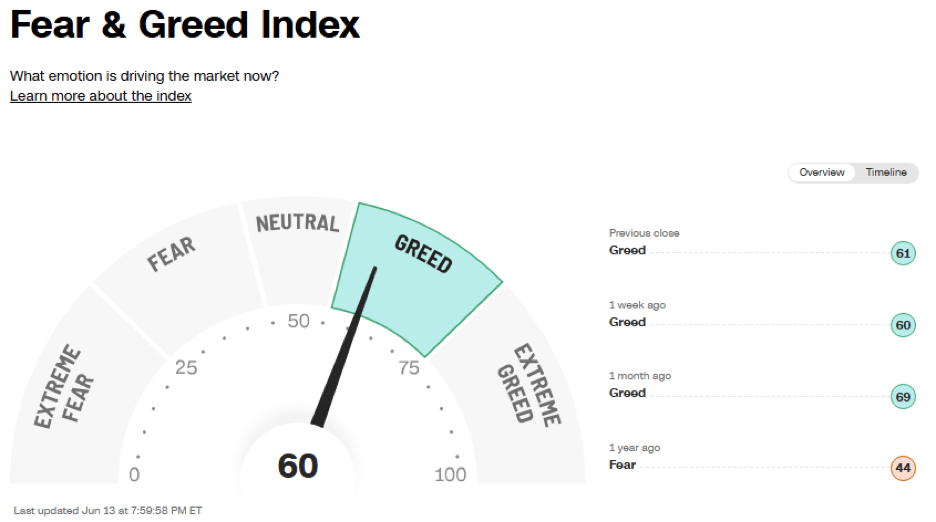

The CNN’s Fear & Greed Index barely moved on Friday. Complacency, or investors are betting that the Israel-Iran conflict will be a few-day affair?

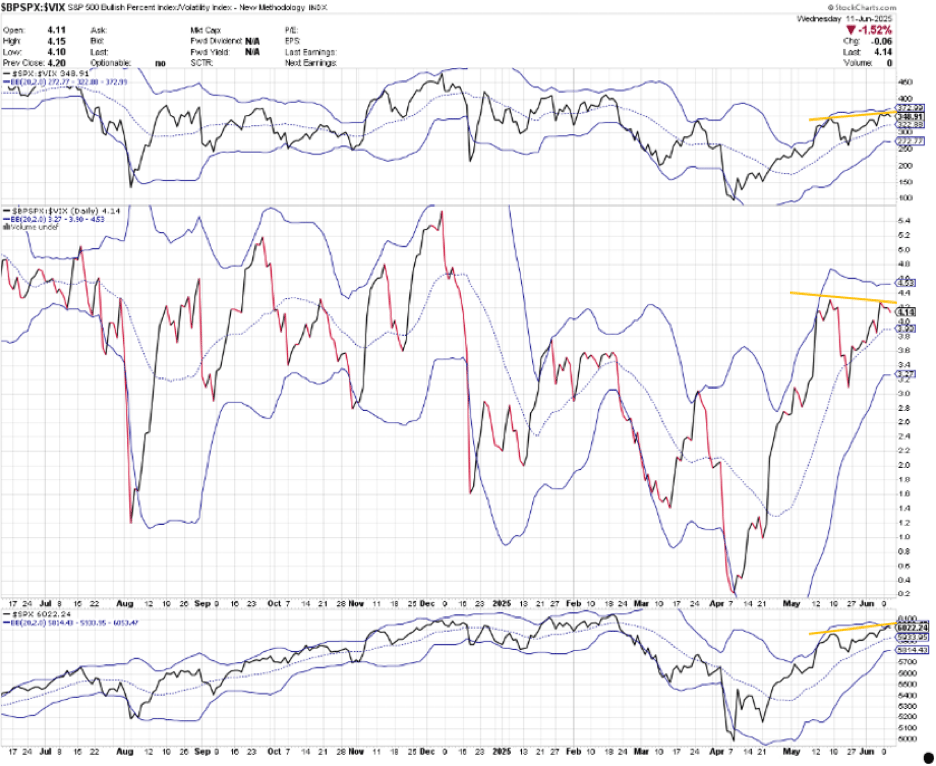

BPSPX/VIX (SPX Bullish Percentage Index over VIX, middle window) was warning about the reversal for a few days.

SPX/VIX (top) and SPX (bottom) curled down from their upper Bollinger Bands.

Consider adding $BPSPX/$VIX to your pool of technical indicators.

It would be reasonable to expect that SPX/VIX and SPX will at least hit the lower Bollinger Band, perhaps more.

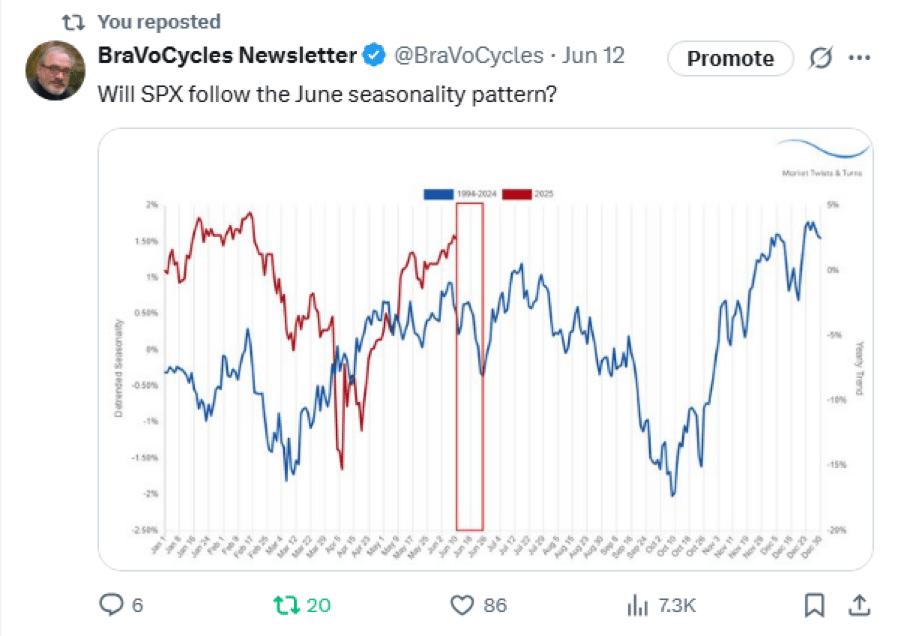

BraVoCycles on X

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

To continue reading about Market Summary, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply