- Market Twists & Turns

- Posts

- Stock Market Summer Doldrums?

Stock Market Summer Doldrums?

Firing of Powell News Caused Some Concerns

Hey Market Timer!

Stop Missing Out on Market Opportunities: Get 95% Off Your First 3 Months of Market Twists & Turns Pro!

Unlock exclusive insights and expert analysis to maximize your investment returns. For a limited time, get 95% off for your first 3 months and see how our premium content can help you profit in any market.

*Please be advised that this subscription will automatically renew. This subscription renews at the full price after the end of the promotion period. Cancellation is the responsibility of the subscriber.

Today we will be covering...

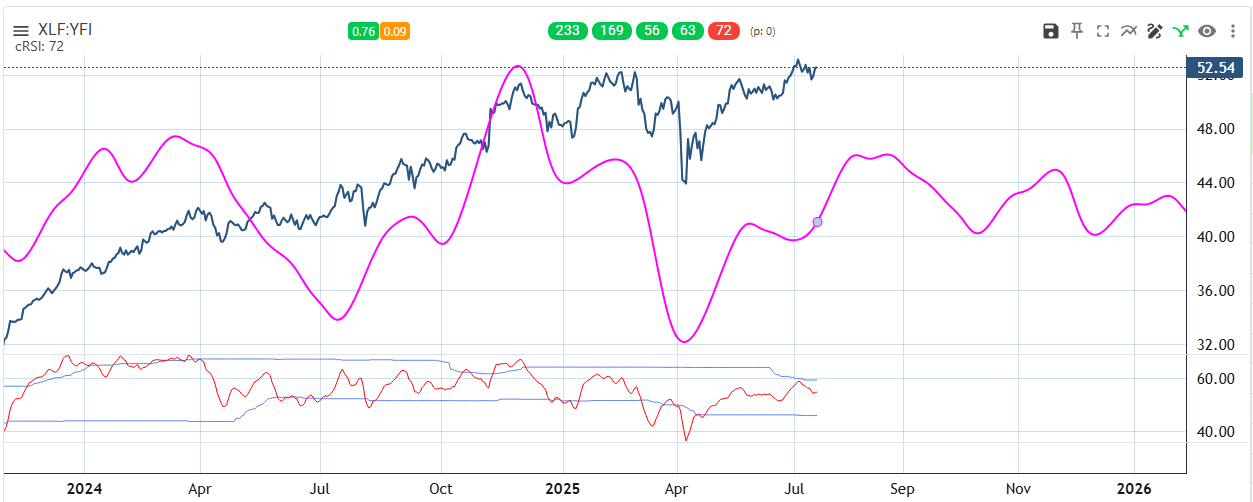

As promised, today, we will examine the financial sector ETF, XLF.

Financial Sector ETF -XLF

Besides tech, the financial sector was one of the strongest sectors, leading the market higher.

Although there is more upside potential for XLF (Financial Select Sector SPDR Fund), in a few months it may start a multi-month correction.

Strengths and weaknesses in XLF and QQQ should correlate with market in the next several months.

We will examine XLF in more detail in the Pro newsletter.

Sentiment & Technical Analysis

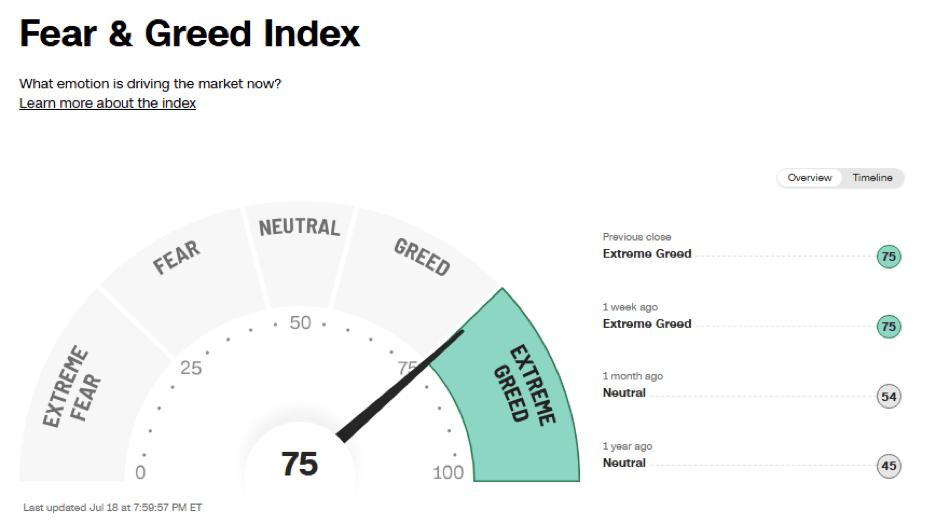

The CNN’s Fear & Greed Index is hanging there between Greed and Extreme Greed.

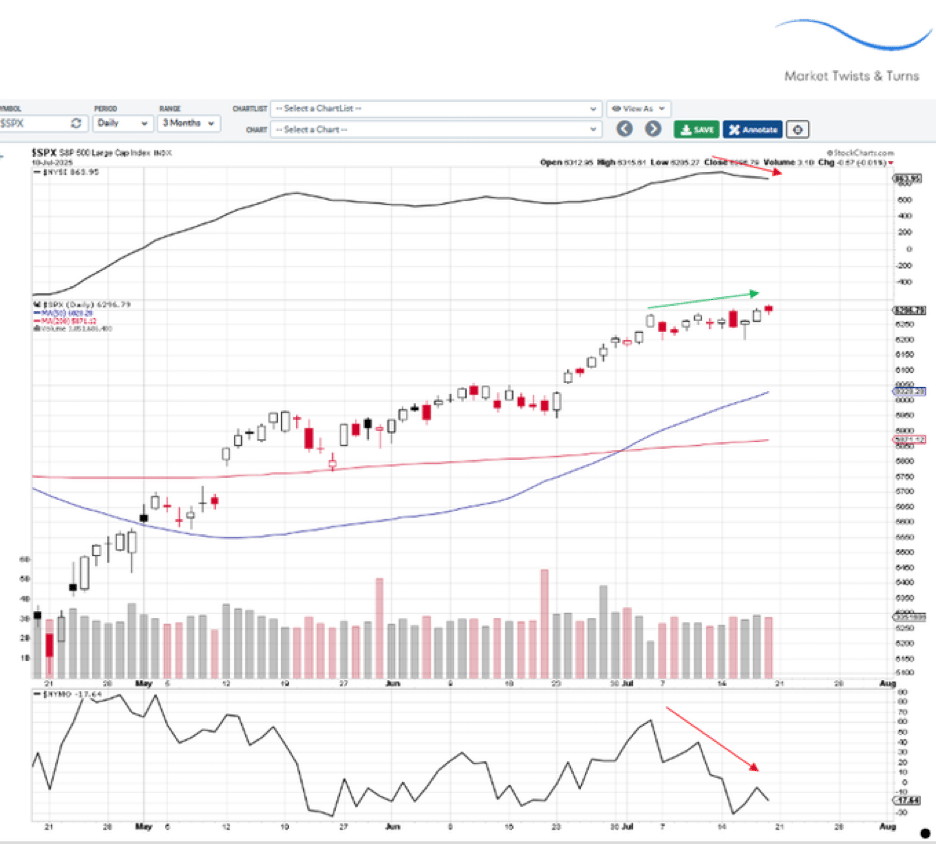

McClellan Summation Index (NYSI) and McClellan Oscillator (NYMO) update.

NYSI (top) and NYMO (bottom) are getting weaker despite SPX rising to an all-time high.

When NYMO drops below 0, it usually suggests additional downside action.

When NYSI, a swing trend indicator, turns down/up it suggests that SPX will turn down/up.

However, in strong stock market trends, these indicators can whipsaw.

For example, indicators “sell” signals after the May SPX peak, only produced a sideways action in SPX.

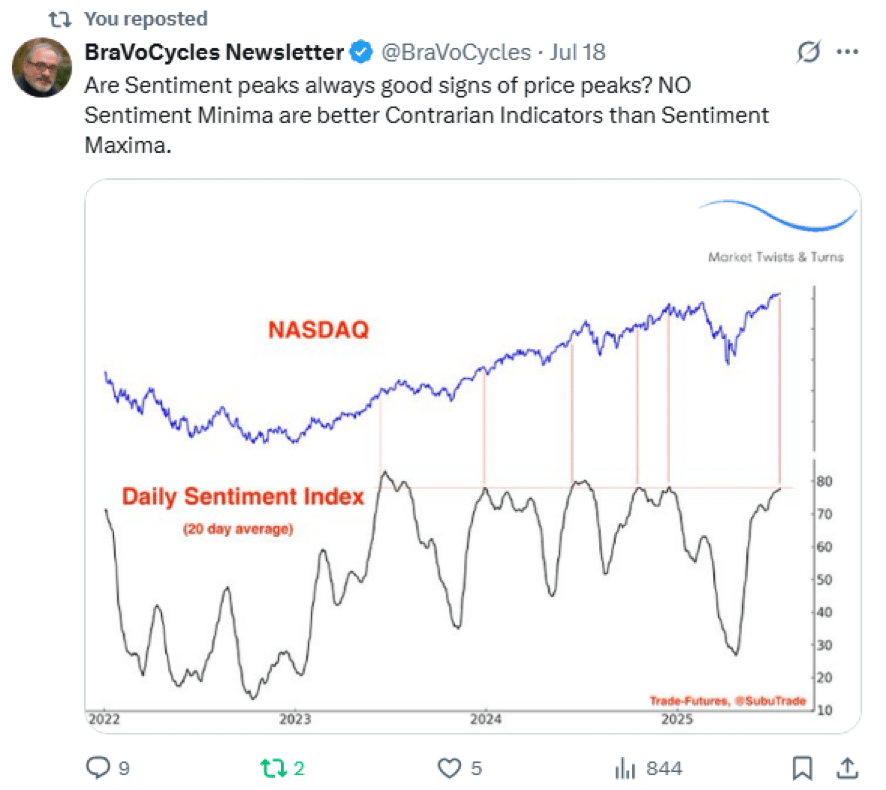

BraVoCycles on X

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters. You're missing out if you're not following me on X.

To continue reading about Market Summary, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply