- Market Twists & Turns

- Posts

- Stock Market Looking Higher – Top When?

Stock Market Looking Higher – Top When?

Bulls Are in Control Again

Hey Market Timer!

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

Today we will be covering...

Today, we will examine the debt burden and [un]profitability of Russell 2000 (small-cap) companies.

Small Caps – Debt & Profitability

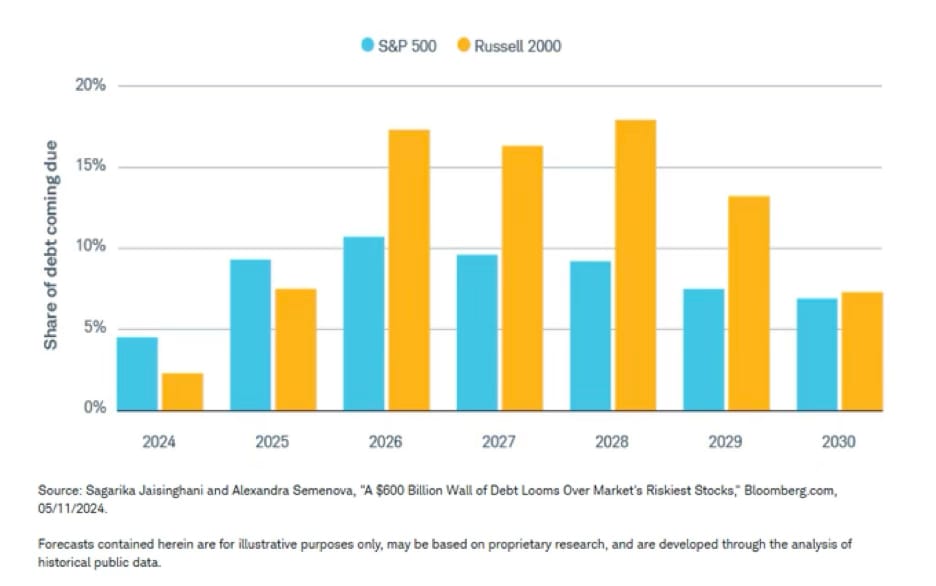

Small caps face rising debt from 2026-2029.

They carry more short-term and floating debt, more sensitive to rate hikes.

Higher debt loads and reliance on credit mean rising interest rates will increase borrowing costs, squeezing profits.

If there is a recession, God forbid, in 2026 or later, the problems for small caps and possibly some S&P 500 companies will intensify.

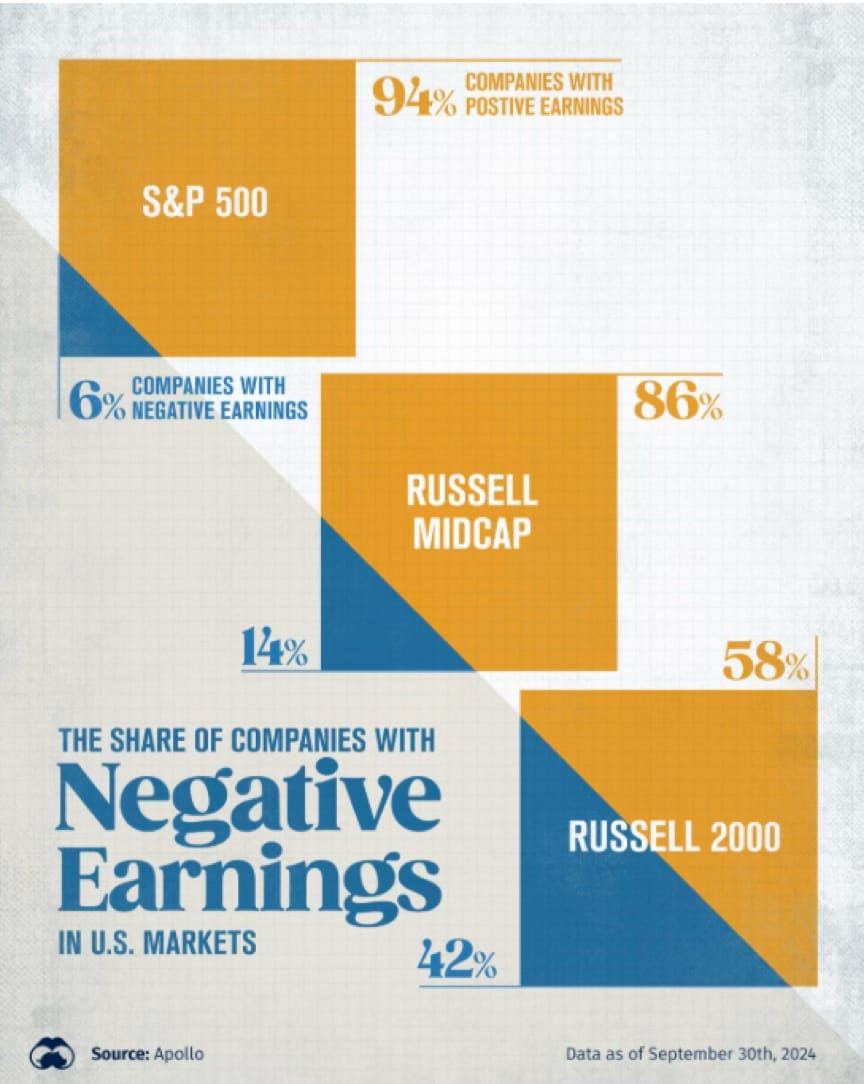

42% of Russell 2000 companies have negative earnings.

That's 7 times and 3 times, respectively, compared to the S&P 500 and Russell Mid-Cap companies.

Increased interest rates and a potential earnings recession could create financial difficulties for many small-cap companies.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

Yet another yellow/red flag about a dangerous market.

However, the long-term sentiment or overvaluation indicators may not short- to intermediate-term prospects of the stock market; they are not automatic sell signals.

What’s Next for the Stock Market?

The early-month positive seasonality worked again, despite missing the Santa rally.

Looks like the bulls will be in control again for some time. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, do not ignore this. This card could put $100s back every year and gives you the chance to earn cash back on the purchases you already make. You could get approved extremely fast and unlock a massive welcome bonus instantly. Amazon Prime members: See what you could get, no strings attached

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply