- Market Twists & Turns

- Posts

- Stock Market Intraday Turbulence

Stock Market Intraday Turbulence

Firing of Powell News Caused Some Concerns

Hey Market Timer!

Stop Missing Out on Market Opportunities: Get 95% Off Your First 3 Months of Market Twists & Turns Pro!

Unlock exclusive insights and expert analysis to maximize your investment returns. For a limited time, get 95% off for your first 3 months and see how our premium content can help you profit in any market.

*Please be advised that this subscription will automatically renew. This subscription renews at the full price after the end of the promotion period. Cancellation is the responsibility of the subscriber.

Today we will be covering...

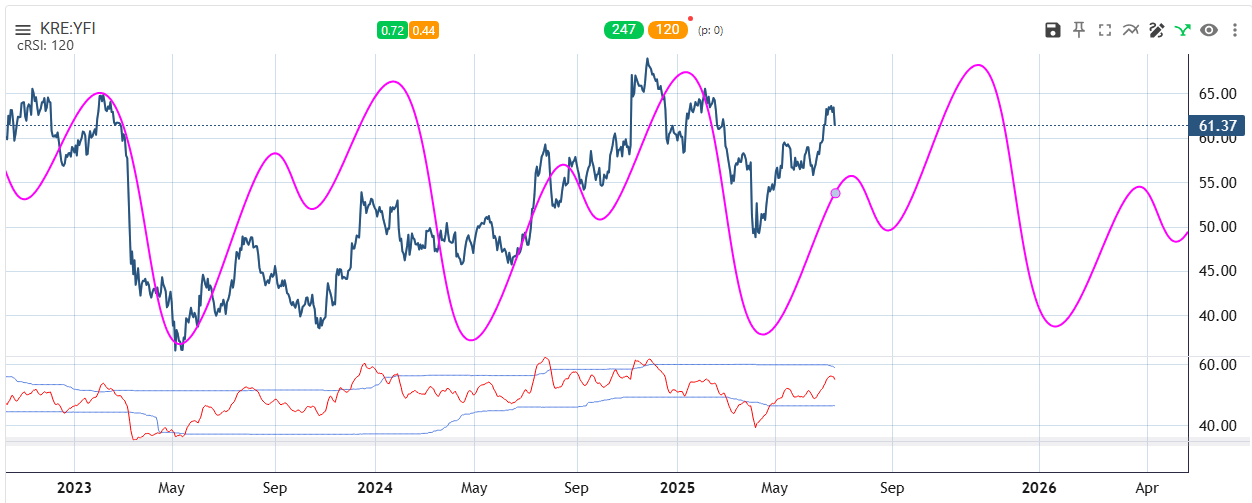

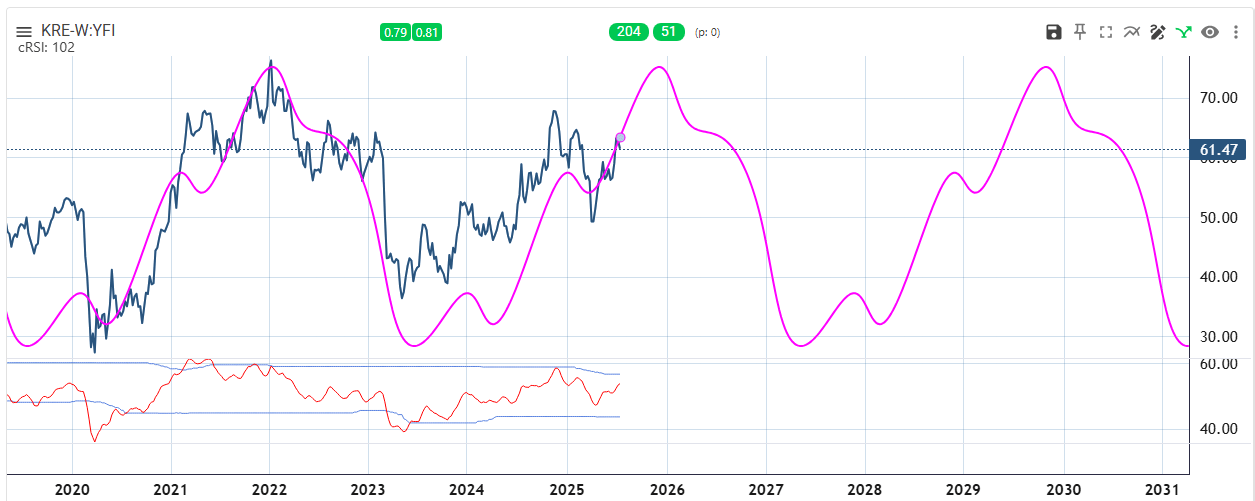

The financial sector was one of the market leaders. Today, we will examine the small banks ETF, KRE.

On Sunday, we will look at the financial sector ETF, XLF.

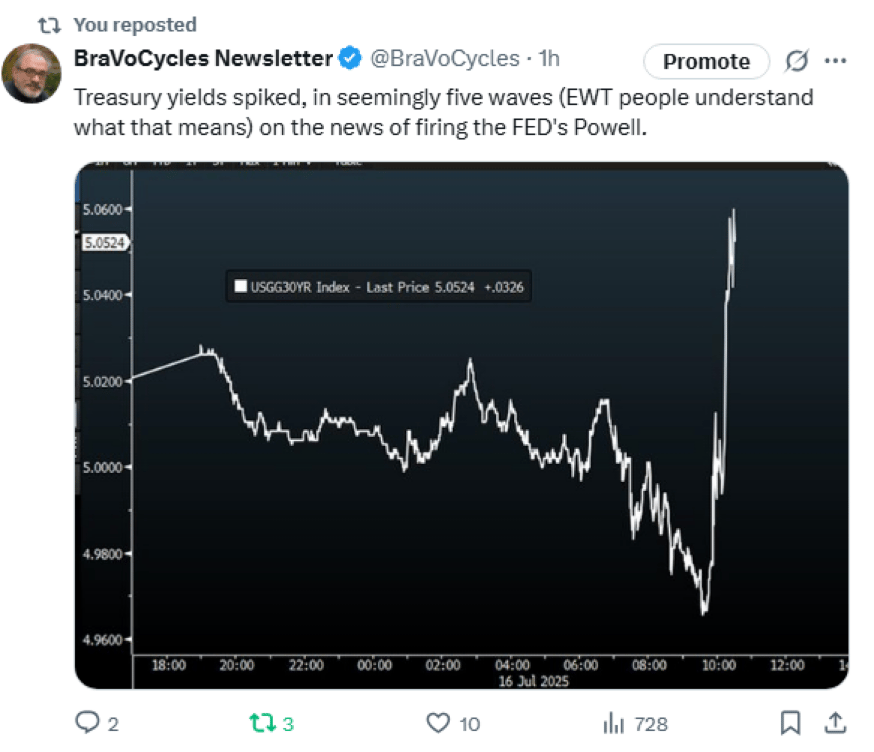

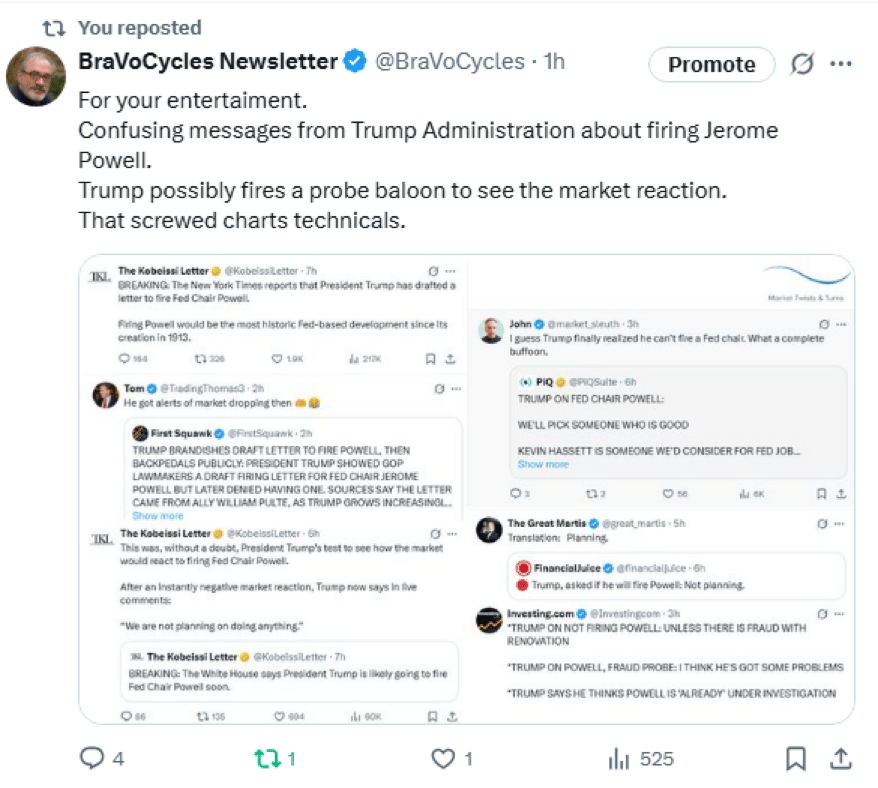

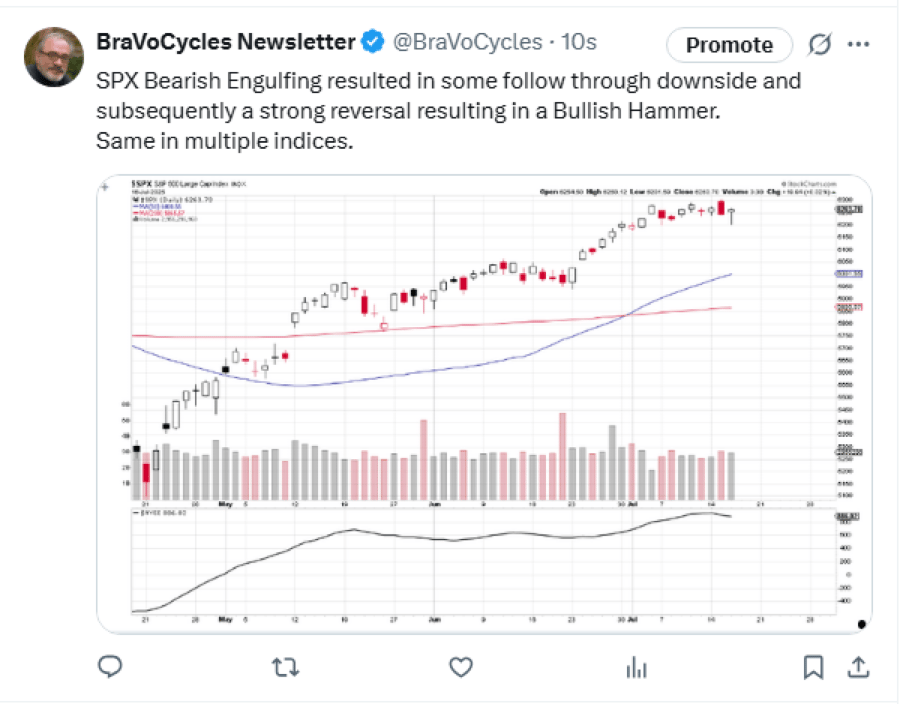

There were announcements yesterday from the Trump Administration about the firing of the FED’s Jerome Powell. They were seemingly retracted later by the President.

The news caused a spike in Treasury yields and a drop in the US dollar and stock market indices. Apparently, the financial markets did not like the news. See my related X posts below.

Small Banks ETF - KRE

Small banks have smaller reserves and are sensitive to the economic impacts, such as: 1) Changes in interest rates; 2) Tariffs and trade disruptions; 3) Consumer weakening, and 4) Local downturns.

The bigger banks are less sensitive to economic changes due to bigger reserves and more diversified business, including e.g., investment banking, wealth management, trading

The daily chart cycle composite suggests more strength in 2025.

The weekly chart reveals a powerful 4-year cycle.

The weekly chart cycle composite suggests a down bias from late 2025 to early 2027.

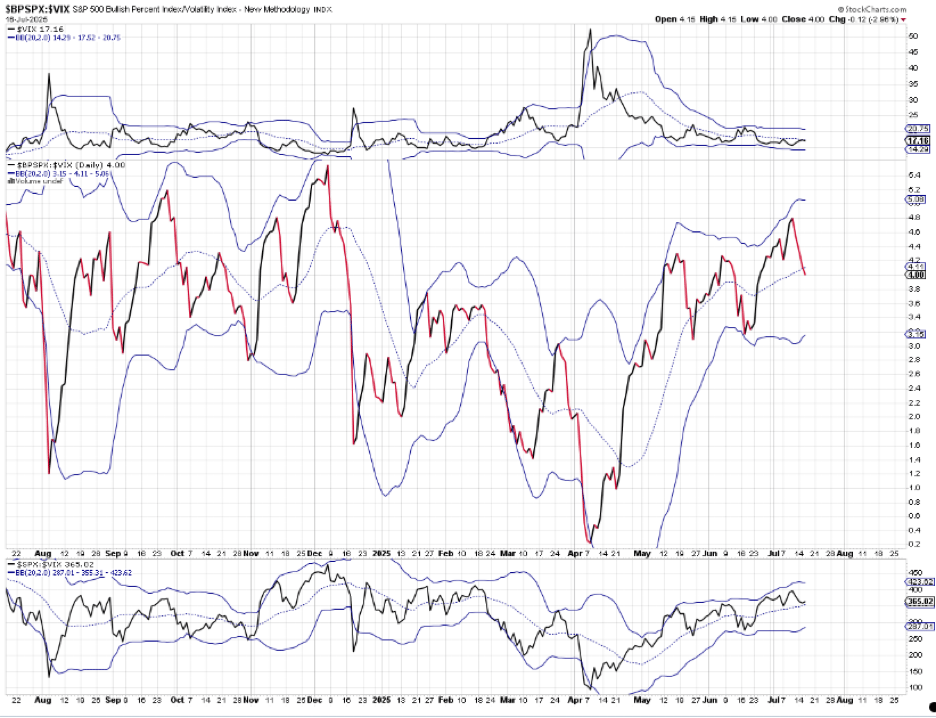

Sentiment & Technical Analysis

The CNN’s Fear & Greed Index retreated from Extreme Greed to the top of Greed.

The ratio of the Bullish Percentage of S&P 500 stock over VIX retreated as expected.

It may bounce off the mid Bollinger Band (BB) before continuing to the lower BB.

BraVoCycles on X

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

Noticed in the bottom window below that the McClellan Summation Index curled down.

To continue reading about Market Summary, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply