- Market Twists & Turns

- Posts

- Stock Market Fireworks

Stock Market Fireworks

Is Stock Market Ready for a Breather?

Hey Market Timer!

Stop Missing Out on Market Opportunities: Get 95% Off Your First 3 Months of Market Twists & Turns Pro!

Unlock exclusive insights and expert analysis to maximize your investment returns. For a limited time, get 95% off for your first 3 months and see how our premium content can help you profit in any market.

*Please be advised that this subscription will automatically renew. This subscription renews at the full price after the end of the promotion period. Cancellation is the responsibility of the subscriber.

Today we will be covering...

Today, we will examine USDJPY, which completes our forex week. Of course, we will try to cover the USD and forex pairs at interesting junctures.

The stock market indices ended the shortened Holiday week with a bang, in line with tradition and expectations.

The question is what is next. There are some warning signals, but the devil is in the details.

Could the tariff letters cause trouble to an already extended stock market? Possible.

Between 10 and 12 letters were supposed to go out on Friday, with more over the coming days, the president told reporters.

The import duties will range from "60% or 70% tariffs to 10 to 20% tariffs," he said, the top end of which is much higher than he had previously outlined.

USDJPY Long-Term Cycles

Although we can’t be sure that USDJPY* bottomed, USD should be favored against JPY in the next few years. Of course, it is usually not a straight line.

More details in the Pro newsletter.

*The abbreviation USD/JPY represents the currency exchange rate for the U.S. dollar and the Japanese yen. The pair shows how many yen are required to buy one U.S. dollar, the quote currency, and the base currency respectively. The pair's exchange rate is one of the most liquid and most traded in the world. https://www.investopedia.com

Sentiment & Technical Analysis

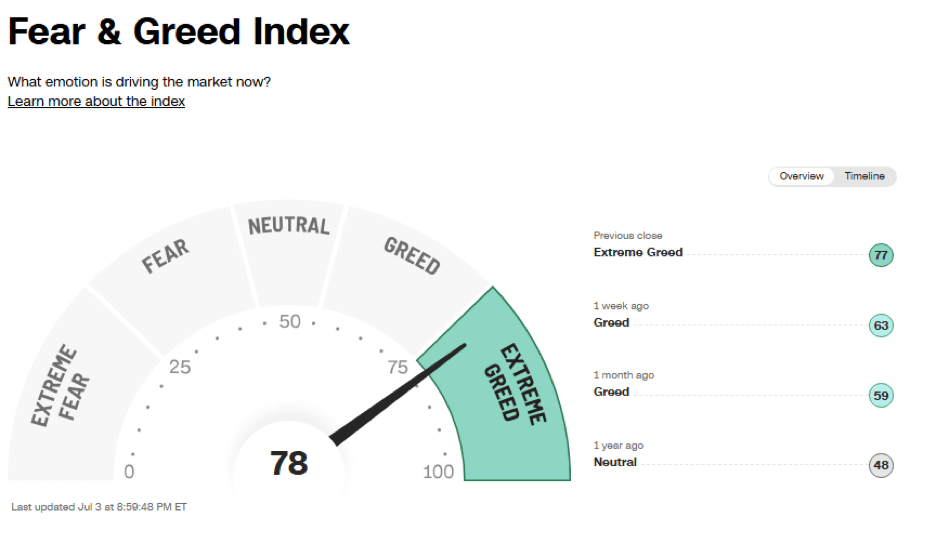

The CNN’s Fear & Greed Index is now in Extreme Greed. We have been waiting for this. Although nothing says it can’t push higher, it is a Red Alert for the stock market, at least on a short-term basis.

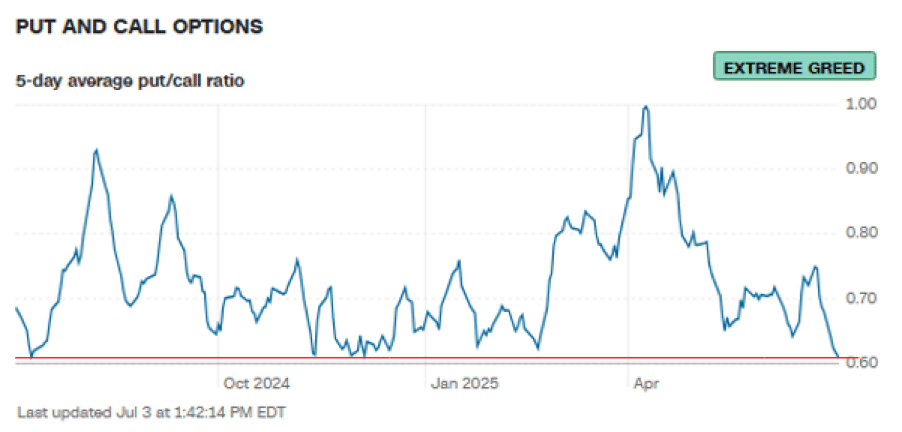

5-day Put/Call ratio is at extremely low levels – Another Red Alert.

NAAIM (National Association of Active Investment Managers) Index is at about a level which in the past resulted in corrections.

BraVoCycles on X

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

To continue reading about Market Summary, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply