- Market Twists & Turns

- Posts

- Stock Market Delivered Green in Pre-Christmas Trading

Stock Market Delivered Green in Pre-Christmas Trading

Next Five Trading Days are “Reserved” for Santa Rally – Will Santa Come to Wall Street?

Hey Market Timer!

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Today we will be covering...

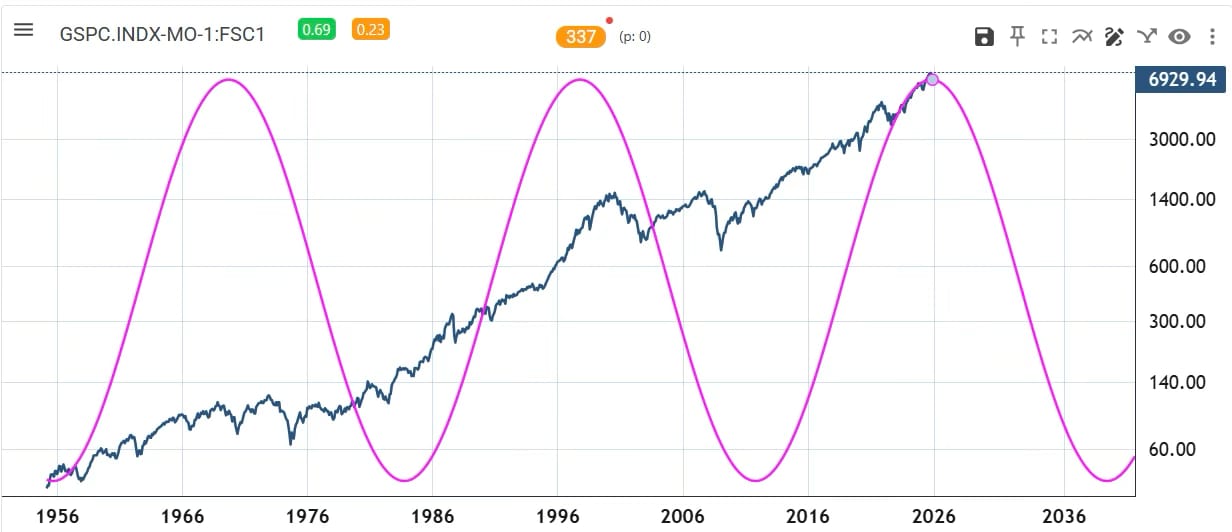

Today, we will examine long cycles from the monthly SPX chart.

SPX Monthly Chart – Cycle Analysis

The monthly SPX chart below shows a cycle composite comprising 3.5Y, 9Y (8.6Y) and 28Y cycles.

Note that the 28Y cycle is reaching its peak and could also rollover soon.

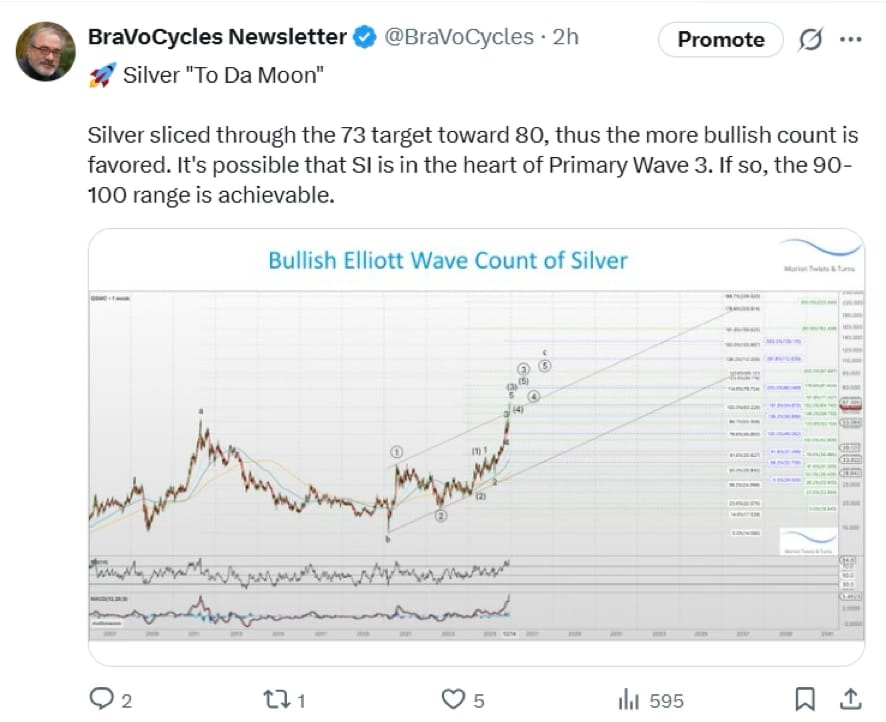

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

The Christmas week positive seasonality played out as expected.

The rest of December and the first two trading days of January correspond to the traditional Santa Claus rally, as described in the last newsletter.

Will the Santa rally play out according to tradition? . . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

AI in CX that grows loyalty and profitability

Efficiency in CX has often come at the cost of experience. Gladly AI breaks that trade-off. With $510M in verified savings and measurable loyalty gains, explore our Media Kit to see the awards, research, and data behind Gladly’s customer-centric approach.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply