- Market Twists & Turns

- Posts

- Stock Market Bulls Are Running Without a Breather

Stock Market Bulls Are Running Without a Breather

Where Are the Bears?

Hey Market Timer!

Will 2025 be the year you take your investing portfolio to new heights?

Gif by ninjawarrior on Giphy

Learn to profit in both Bull & Bear markets with our Pro Subscription.

Today we will be covering...

We’d like to take break in our “regularly scheduled programing” to say Thank You for your responsiveness to our sponsors’ and partner ads, it greatly helps us publish this newsletter for free.

The Daily Newsletter for Intellectually Curious Readers

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

Today, we will look at some fascinating long-term stock market valuation charts – JP Morgan CEO Dimon said: “ASSET PRICES 'KIND OF INFLATED' IN U.S. STOCK MARKET.”

NVDA and AI-related stocks were strong yesterday. This must be related to President Trump's announcement of the $500Bil Stargate Project for AI data centers for Open AI. Do you recognize the players in the picture in front of the White House?

Stock Market Valuation

Note that the valuation charts presented below are not short-term sell signals; they provide a long-term perspective (a yellow/red flag) for investors and traders alike.

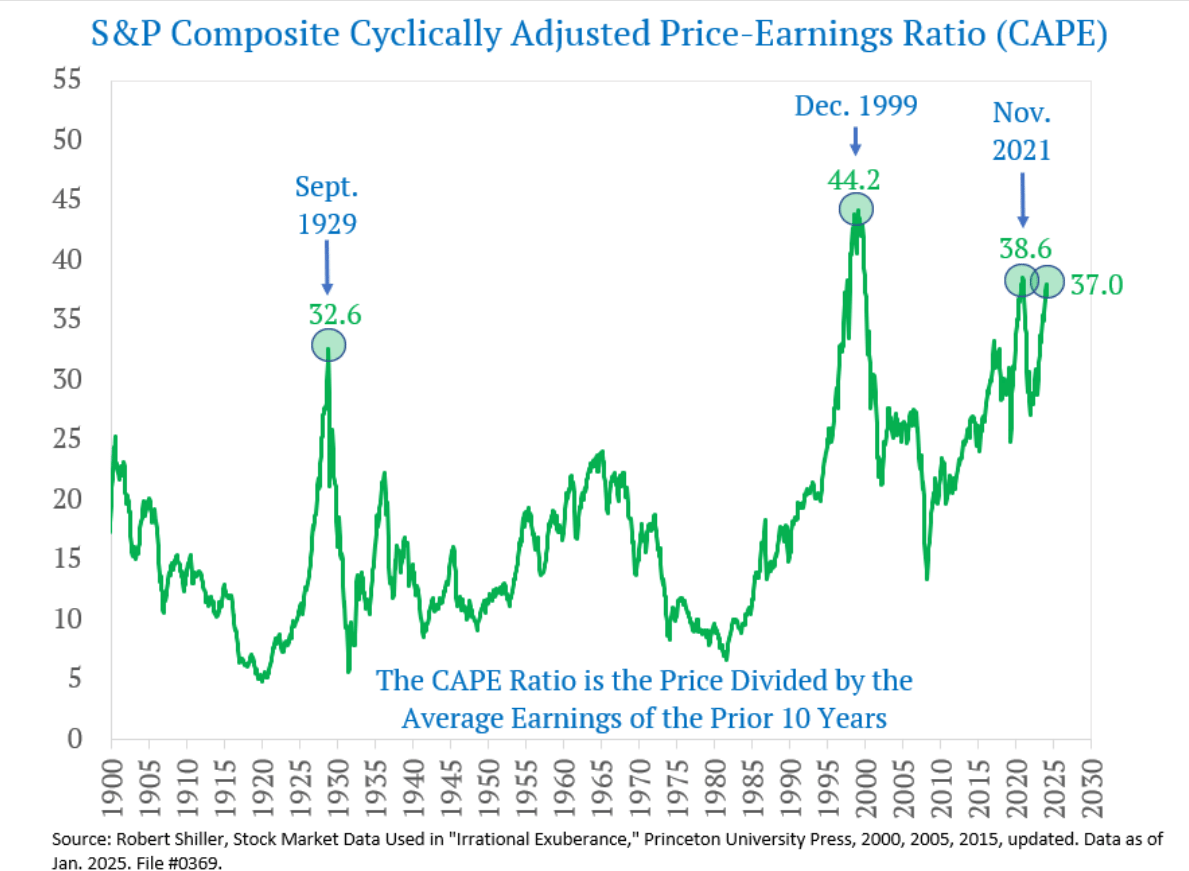

Updated Shiller’s Cyclically Adjusted PE (CAPE) Ratio is among the highest in history and close to the 2021 high.

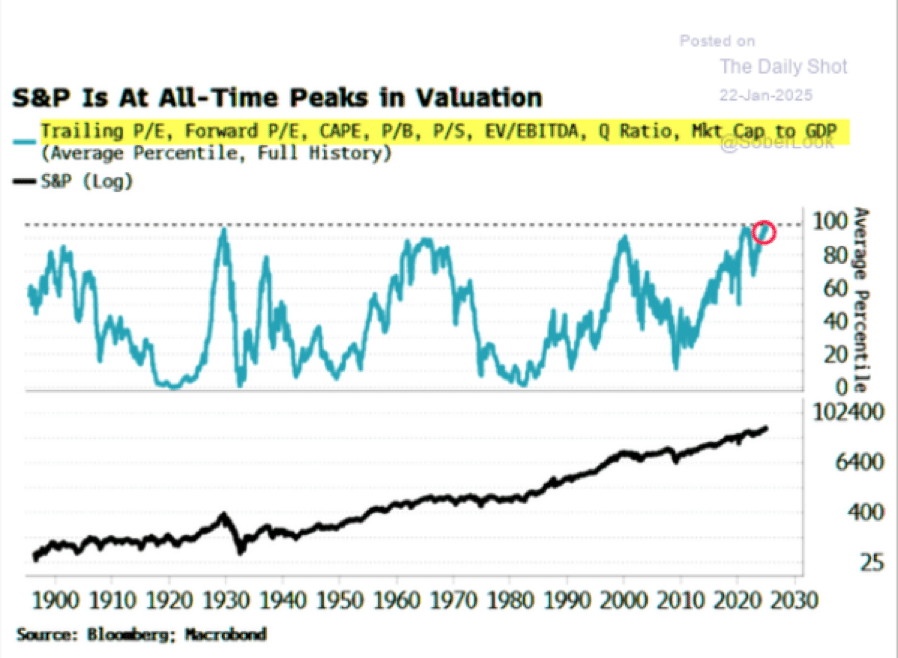

The chart below may be a better measure as it includes the average of several valuation metrics, including CAPE.

When valuation is at historic highs, I pay attention. What can go wrong?

Sentiment & Technical Analysis

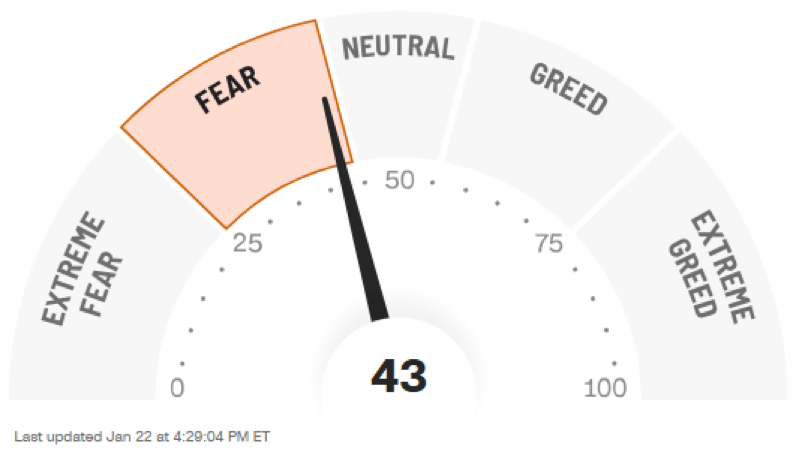

The Fear and Greed Index has difficulties getting out of Fear. It is puzzling; things do not add up.

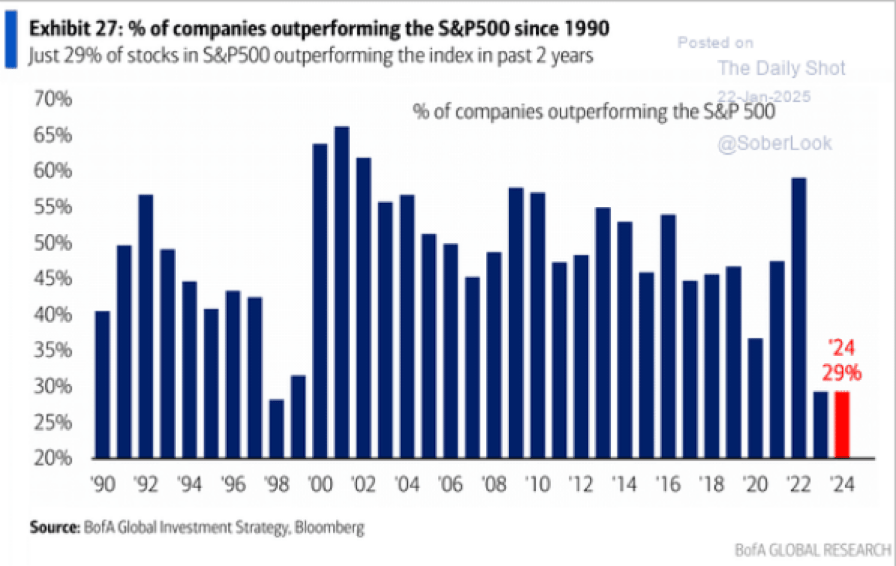

The chart below illustrates internal technical market strength and recalls the 1998-1998 bubble period.

At that time, 70% of stocks were underperforming the S&P 500, led by the market’s “darlings of that period.”

Then, in the early 2000s, about 65% of stocks outperformed the S&P 50. In most cases, that outperformance manifested in most stocks falling less than the market's “darlings.”

Will history repeat in 2025-2026? It is TBD, but it might. Magnificent 7's and similar stocks' extreme outperformance may revert to the mean, especially if their earnings growth slows.

To continue reading about Market Summary, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Its been a while since we shared how we Interested make our charts? The answer is Motivewave.

An excellent charting software makes a big difference. I tried virtually all of them, but I have been using MotiveWave for the past 15 years.

MotiveWave is an easy-to-use full-featured professional charting, analysis and trading platform. Whether you're new to trading or an experienced trader, MotiveWave was built for you, the individual trader. Advanced strategy analysis tools, like Elliott Wave, Fibonacci, Harmonics, Gartley, and Gann, as well as Volume and Order Flow Analysis tools help you find key points for entering and exiting the market. Support for multiple brokers and data service providers, multiple ways to place trades, hundreds of built-in indicators, built-in strategies, trade simulation, full strategy backtesting and optimization, advanced Replay Mode, and pattern matching algorithm scanners are just some of the features you'll find in MotiveWave.* Get your free 14 day trial now!

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • All the benefits of our Free and Basic tiers, plus

- • Ad free

- • Downloadable pdf version of the full length newsletter

- • Updates and opportunities 4-5x/week on

- • Individual major stocks and ETFs

- • International markets, forex, cryptocurrencies, bonds and commodities

- • All featuring advanced cycle methods for market timing with expert Elliott Wave and technical analysis, and more...

Reply