- Market Twists & Turns

- Posts

- Solid Green Monday on Wall Street

Solid Green Monday on Wall Street

Happy Autumn Trading and Investing

Hey Market Timer!

Stop Missing Out on Market Opportunities

Get 95% Off Your First 3 Months of Market Twists & Turns Pro!

Unlock exclusive insights and expert analysis to maximize your investment returns. For a limited time, get 95% off for your first 3 months and see how our premium content can help you profit in any market.

*Please be advised that this subscription will automatically renew. This subscription renews at the full price after the end of the promotion period. Cancellation is the responsibility of the subscriber.

What's Inside...

Today, we will revisit precious metals, silver (SI), the poor man’s gold, and gold (GC), in the Free and Pro newsletters, respectively.

Although we reviewed SI and GC 2-3 weeks ago in the Pro newsletter and snippets in the free one, I am prompted to do this after seeing many outlandish calls on the social networks.

The most outlandish are some posts on YouTube and X about Ray Dalio calling for a 9X performance gain of silver relative to gold in 2026.

I seriously doubt that Dalio would make such a claim, and I could not find a post regarding this by Dalio himself.

Early subscribers and followers may remember that I was very bullish on gold since October 2023, caught the exact bottom then, and somewhat later, I got bullish on silver too.

One can make a strong fundamental story regarding gold, and there are technical indications that still suggest higher.

However, there are also technical arguments that suggest that a reversal is not far away. I think that strong run is running out of fuel, but there is still some more fuel in the tank, though not enough to go “to da moon.” At least a longer-term consolidation is likely, if not a deeper correction, once this power move is completed. My 2 cents.

Silver – A Simple Cycle Analysis

You do not have “sophisticated” cycle analysis tools?

No problem, I’ll show you a visual cycle detection method that cyclists used before these tools were available. Many cycle analysts still use this method.

The approach is to use a ruler and eyeballing to identify periodic troughs and peaks.

Since there are typically multiple periodically related cycles, one would also like to detect nested harmonic cycles.

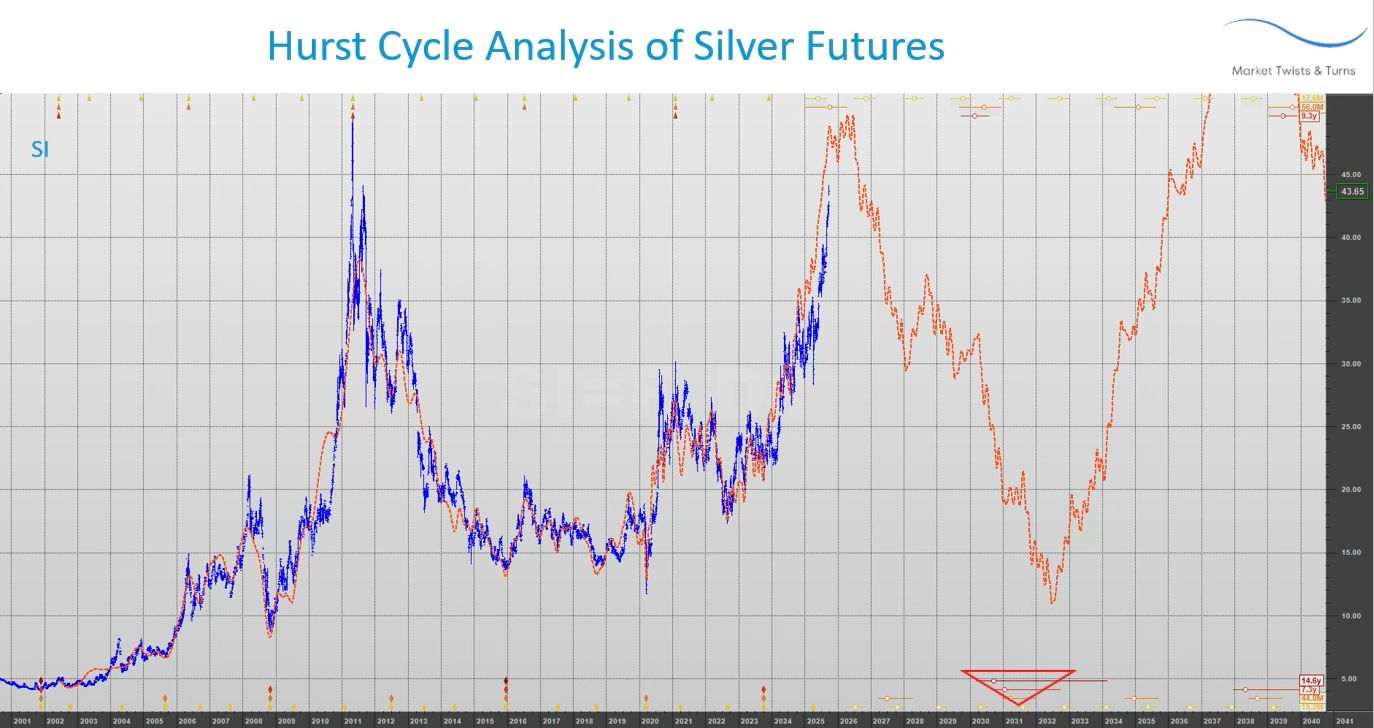

Such an analysis for silver futures, SI, is shown below.

It includes the three largest harmonic cycles in the considered time period.

Of course, there are shorter cycles, and possibly longer cycles.

The vertical dashed lines identify the present phase of the three cycles, and the same phase in the previous period of the longest cycle.

According to that aspect, SI should have reversed the trend. Still, it has not yet, probably because of the impact of other cycles, or cycle attributes changed somewhat, or because of fundamental developments that could affect cyclical behavior.

Nevertheless, I expect a reversal in a not-too-distant future, based on my Elliott Wave and dynamic cycles analysis.

Another important thing to note from this chart is the synchronous trough of these three cycles in late 2029. That’s about a 14-year cycle trough.

Not surprisingly, the Hurst cycle default analysis identified the same troughs for these three cycles, which validates my simple analysis.

Without going into the gory details of this analysis, note that the center of gravity of the estimated troughs is about a year later. This is because of the latest period estimates by the program

The cycle composite (orange) suggests that a silver peak can be expected in the near future. The composite cycle includes parameters from both the peak and trough analyses, as I did not attempt to determine which one is more accurate.

Note: The cycle composite provides approximate turning points in time. The instrument price should not be inferred from the amplitudes of the cycle composite signal.

We will look at more details about silver and gold in the Pro newsletter.

Unlock exclusive market insights with BraVoCycles’ Premium Reports on Gumroad!

As a Market Twists & Turns subscriber, enjoy 40% off all reports using code MARKETTWISTSTURNS40 at checkout.

We will be adding additional reports on cryptocurrencies, international markets and individual stocks soon!

BravoCyles on Youtube

Watch my latest YouTube video about Nvidia and the semiconductor ETF, SMH. Are Nvidia and Semiconductor Stocks Peaking?

BraVoCycles on X

If you are interested in financial markets, you are missing a lot by not following me on X as I do not have enough canvas space in the newsletter to post all my research in it and which I try to post on X. Also, I often post important real-time updates between the newsletters.

A few days ago, I showed PPI and CPI cycles that suggest inflationary pressures for the next 2 years.

My X post below shows a record fear by consumers that the income will not cover the cost of living increase due to inflation in the next 1-2 years (top chart).

On the other hand, the CNN Fear & Greed Index suggests that investors and traders are fearless and greedy. They are not extremely greedy, but they may become so by the time the move from April is completed.

As a further indication of complacency by investors and traders is a very low 5-day Average Put/Call Ratio in Options.

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto, claim your 95% off for 3 months introductory rate and upgrade to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply