- Market Twists & Turns

- Posts

- Sick & Tired of Choppy Market?

Sick & Tired of Choppy Market?

Is Europe Leading?

Hey Market Timer!

Thank you for being a committed subscriber

Our premium newsletter has an amazing retention rate of over 90% for paying subscribers, unheard of in the newsletter world.

Are you intrigued why our subscribers love the premium newsletter?

Today we will be covering...

We’d like to take a break in our “regularly scheduled programing” to say Thank You for your responsiveness to our sponsors’ and partner ads, it greatly helps us publish this newsletter for free.

Today we have a sponsored message from: Vinovest

Whiskey: A Hedge Against Market Volatility

Looking to protect your portfolio from the next recession?

Consider investing in rare spirits like whiskey.

Whiskey investing provides a proven hedge against stock market dips driven by inflation and other factors.

With Vinovest, you can invest in high-growth segments such as American Single Malt, emerging Scotch, Bourbon, and Irish whiskey. Thanks to established industry relationships, Vinovest overcomes industry barriers that have made historically whiskey investing expensive and opaque. As a result, you can enjoy high-quality inventory that boosts your portfolio value and enhances liquidity.

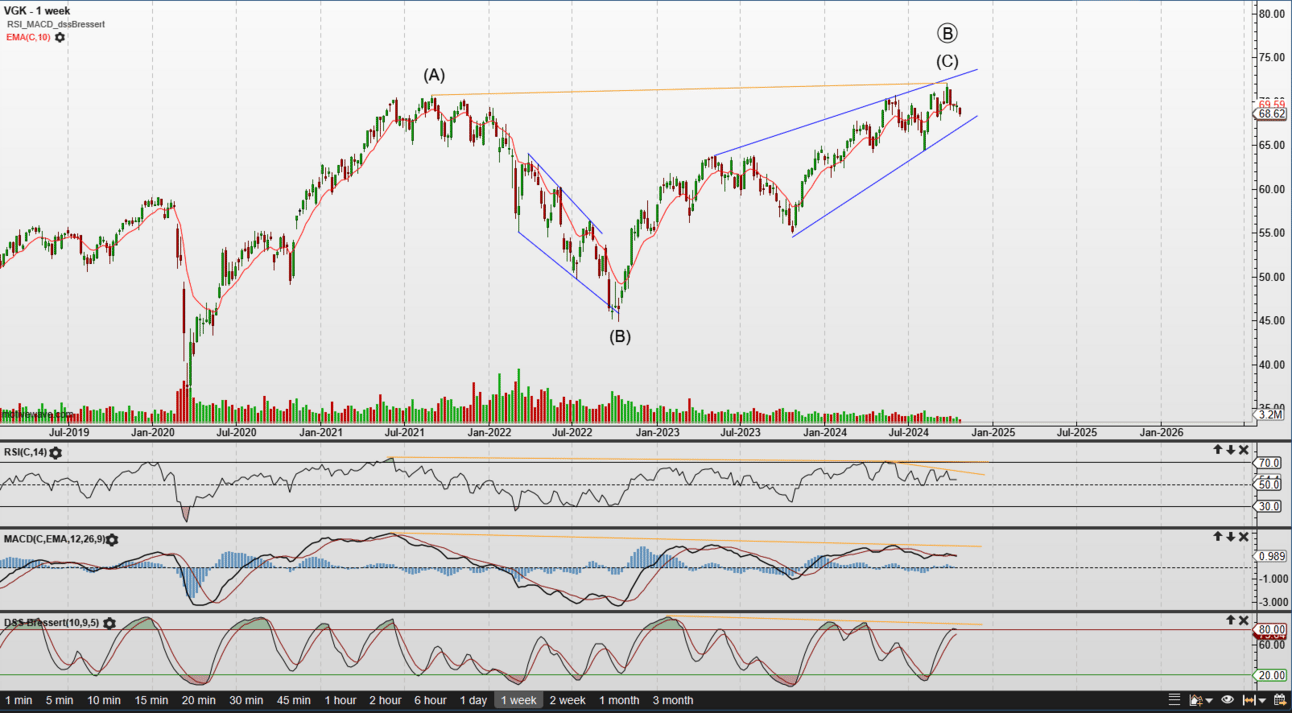

Has Europe Topped?

European ETF VGK appears to have finally topped.

It dropped below the 10W EMA.

VGK exhibits negative divergences in technical indicators, both short-term and long-term.

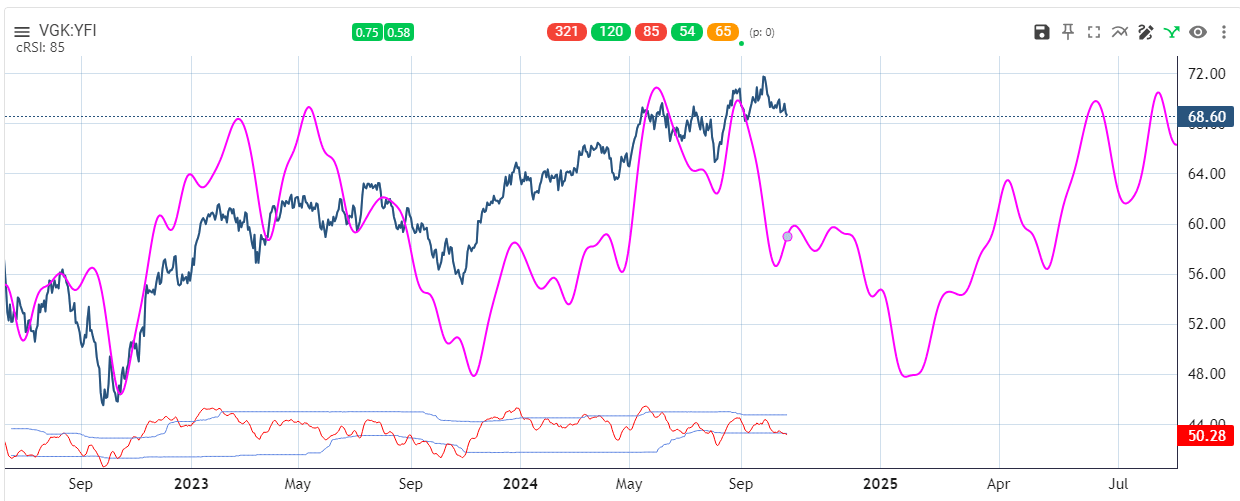

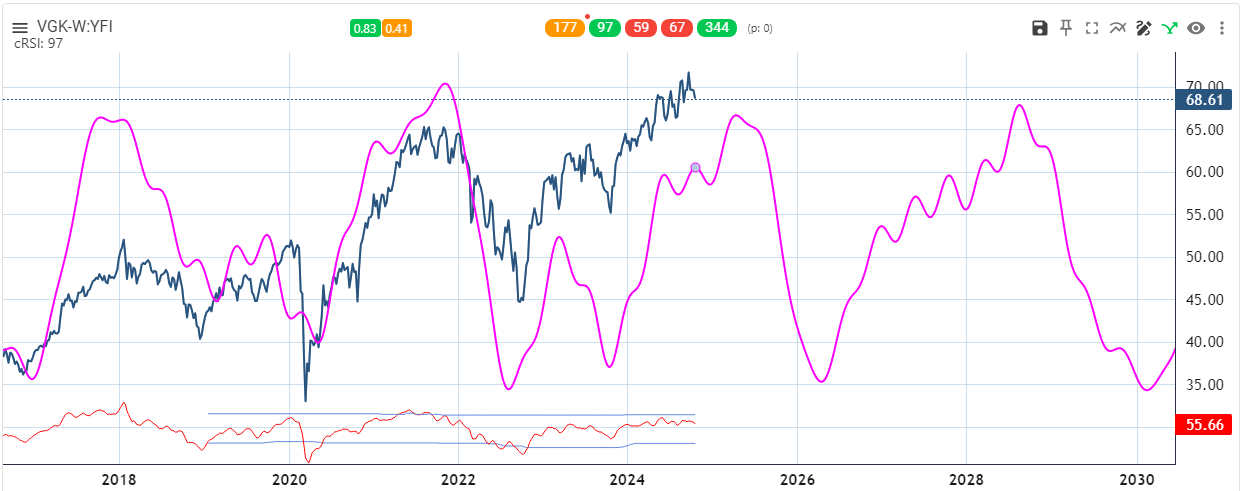

VGK Cycles

The daily VGK cycles suggest an intermediate-term cycle trough in early 2025.

The weekly cycle composite has a similar look as we have seen in several market indexes: cycle troughs in 2026 and 2030, with a cycle peak in 2028 in between.

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

For example, I alerted premium subscribers about potential for the red rectangle target.

When the target was generated, I posted it immediately on X, along with the potential EW micro countdown.

For those unfamiliar with Elliott Wave Theory, after five waves down are completed, a three-wave bounce follows, and another five waves down.

#Bitcoin completing 5 waves down into 10D cycle target. Then 3 up and another 5 down.

#BTCUSD $BTC $BTCUSD #Crypto#cryptocurrencies#cryptomarket#cryptotrading#cryptocurrency— BraVoCycles Newsletter (@BraVoCycles)

3:43 PM • Oct 22, 2024

To continue reading about Market Summary, US Markets, Elliot Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

And make sure to keep your eye out for our next blog out tomorrow! We will update the outlook for Nvidia and the Semiconductors Index.

Calling all newsletter aficionadoes like us, you don’t want to miss your favorites due to a clutter inbox.

Download and try this FREE Meco App. We use it regularly. It is great for organizing & reading newsletters and de-cluttering your email box.

Subscribe to Pro to read the rest.

Become a paying subscriber of Pro to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • All the benefits of our Entry and Basic tiers, plus

- • Daily updates and opportunities (5x/week)

- • International markets and Forex

- • Cryptocurrencies

- • Bonds and Commodities

- • Individual major stocks and ETFs

Reply