- Market Twists & Turns

- Posts

- Santa Did Not Come to Wall Street This Year

Santa Did Not Come to Wall Street This Year

What Are the Implications of Santa Rally Failure?

Hey Market Timer!

The CX platform redefining AI’s next decade

In customer experience, cost savings don’t mean much if loyalty declines.

Gladly helps brands achieve both—maximizing efficiency and lifetime value.

With 240M+ conversations powered and $510M in cost savings delivered, Gladly has the evidence that customer engagement, not deflection, drives stronger economics. Our unified architecture and context-aware AI enable brands to serve customers faster, more personally, and with higher satisfaction—without compromising long-term profitability.

Explore the awards, research, and momentum behind this shift in our Media Kit.

Today we will be covering...

Today, we will examine the Benner Cycle that predicts that 2026 is a good year to sell stocks and other assets.

Benner's Cycles

Samuel Benner, an Ohio farmer, published "Benner's Prophecies of Future Ups and Downs in Prices" in 1875, based on his analysis of historical economic patterns in agriculture, commodities, and business cycles.

The figure shows the original Benner Cycle chart. Apparently, the diagram was initially compiled by Tritch (1872), but it was not attributed to him.

The cycle chart published 150 years ago suggests that 2026 should be a good year to sell stocks and other valuable assets.

What’s the accuracy of the Benner Cycle?

Dewey (1967), the Director of the Foundation for the Study of Cycles, assessed Benner's pig iron price forecasts and thought that they accurately gave “the years in which to buy, the years in which to sell.

If you had used these dates for trading, your percentage gains between 1872 and 1939 would have been 50 times your losses!” He also regarded Benner's work as “the most notable forecast of prices in existence.”

Interesting improvements by Frost and McMinn, including a 9/56 grid possibly correlated with the Moon Sun Cycle, are discussed in McMinn, D., 2022. Benner Cycles & the 9/56-year grid. Cycles Magazine. Vol 51. No 5. p 8-29.

Note: A rigid calendar application of the Benner Cycle has a mixed record, but adding or subtracting a year or two yields remarkable results. One should realize that some cycles vary over time but generally return to their stable state. Their accuracy and duration are also affected by shorter and longer cycles, as well as “random” events such as new technological breakthroughs.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

Santa Claus rally did not happen this year, not entirely unexpected; The positive seasonality of the first trading day in January did not help.

The adage "If Santa Claus should fail to call, bears may come to Broad and Wall" holds statistically as a cautionary signal, but it's not foolproof.

Since the mid-1990s, the Santa rally failed 6 times; In 5 out of these 6 times, the market had mildly negative returns in January.

The Benner Cycle suggests a top in 2026. The 18.6-year real estate cycle presented in a previous issue indicates a peak in home prices.

But these are long-term cycles that allow for much tolerance. The devil is in the details, i.e., short-term market timing, to pinpoint market peaks and troughs.

This is a tough nut to crack and is one of the aspects of the Pro newsletter.. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

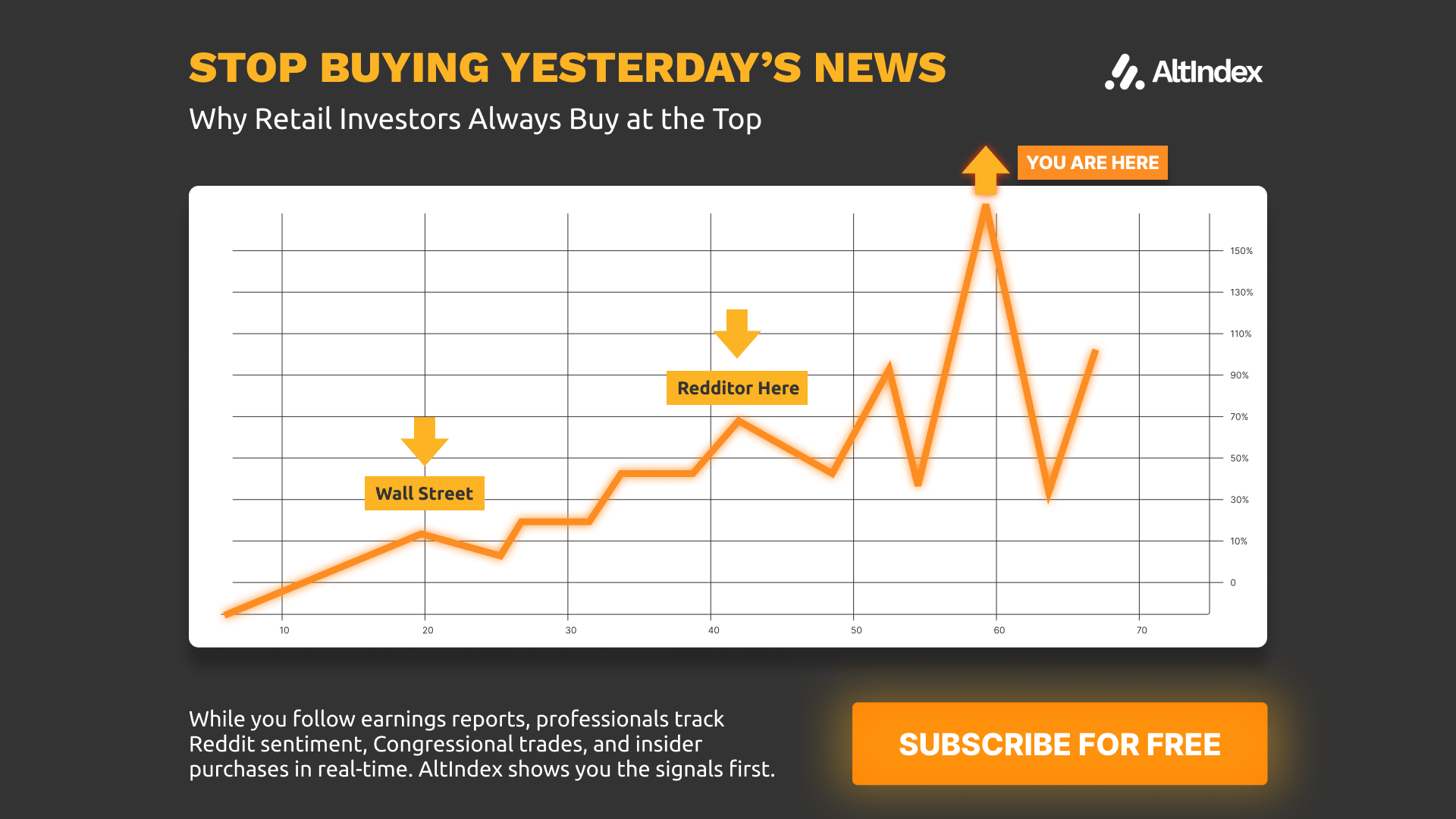

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply