- Market Twists & Turns

- Posts

- Profit Taking in Stock Market After FOMC Rate Cut Continued

Profit Taking in Stock Market After FOMC Rate Cut Continued

Is This a Buy the Dip Opportunity?

Hey Market Timer!

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

Today we will be covering...

Today, we will examine Palantir (PLTR).

Palantir (PLTR) – Long-Term Cycle Analysis

$PLTR ( ▲ 2.26% ) has been a stellar performer, not without controversies among investors.

Core Business: Palantir Technologies builds software platforms for big data analytics, integrating and analyzing vast datasets to empower data-driven decisions and operations.

Key Products: Includes Gotham (for government/intelligence pattern detection), Foundry (central data operating system for commercial enterprises), Apollo (deployment management), and AIP (AI platform transforming data for LLMs and agents).

Main Customers: Serves government agencies (defense, intelligence, counterterrorism) and commercial sectors (healthcare, finance, manufacturing), with growing emphasis on AI applications.

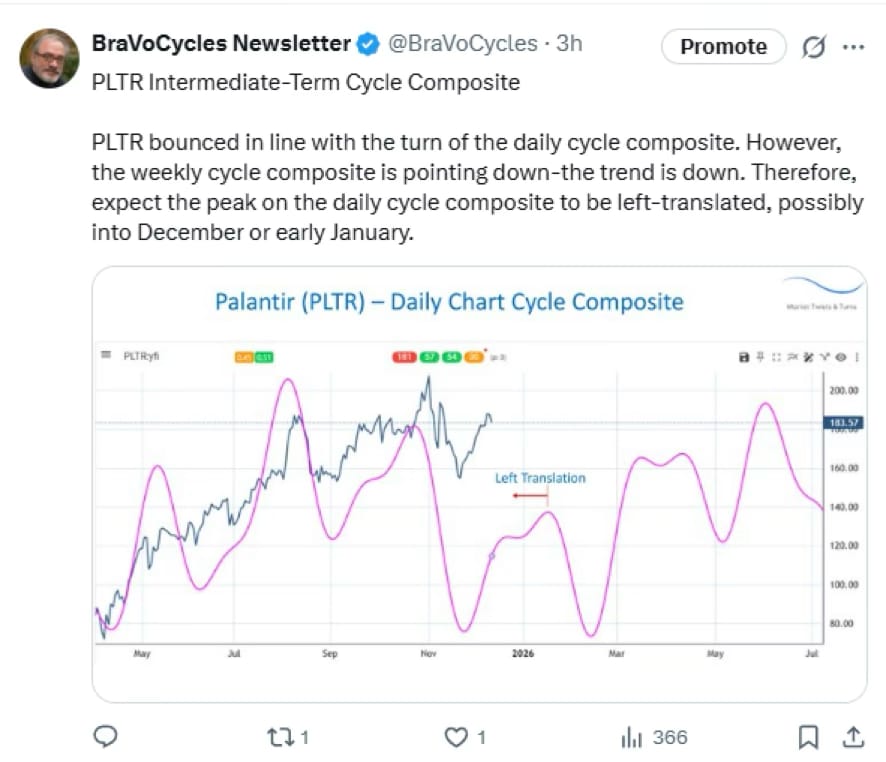

PLTR has bounced strongly, but the weekly chart cycle composite suggests this is just a bounce and the trend should be down.

See my X post below for the analysis of the daily chart cycle composite.

BravoCyles on Youtube

Watch my latest YouTube video about Apple: As Apple Goes, the Market Goes: Top Incoming in Early 2026?

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

The post-FOMC profit taking continued. I remarked a week ago in the newsletter or on X that there may be some “sell the news.”

If it continues much longer, it will start to raise some yellow flags.

The bond yields are firm, not budging. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply