- Market Twists & Turns

- Posts

- Markets Caught in Cross-Currents

Markets Caught in Cross-Currents

Is Gold Going to Lose Its Shine?

Hey Market Timer!

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Today we will be covering...

Today, we will examine the intermediate-term cycle for gold in the Free newsletter and provide an in-depth analysis of precious metals in the Pro newsletter.

Gold Cycles

Our YouTube video from a few weeks ago suggested a possible cycle peak in October. It is still relevant to watch that video for a longer-term picture.

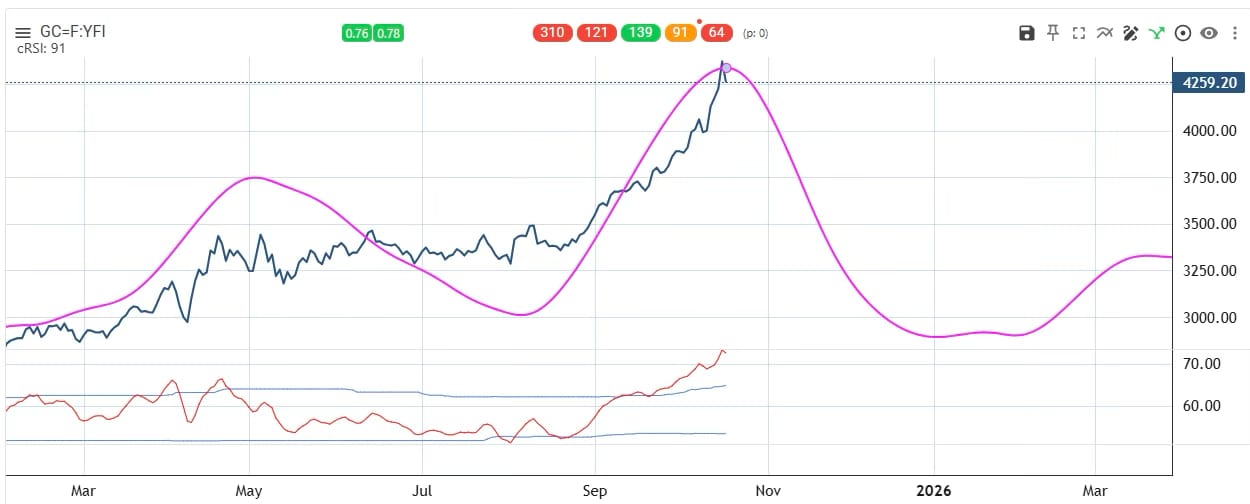

The chart below shows the cycle composite comprising five dominant cycles detected on the daily chart.

Gold is very overbought, and the cycles suggest it is due for a pause in the next few months.

For a deep dive into precious metals, please refer to the Pro newsletter.

BTW, those who have followed me since 2023 might remember that I made a very bullish call on the exact day of the gold bottom in October of 2023, and I made a bullish call on GDX sometime in early 2024.

They played out great. Gold may still head higher after a consolidation/correction (see my analysis in the Pro newsletter) but my interest will be renewed if and only if a possible drop will be clearly corrective.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters. Follow @BraVoCycles.

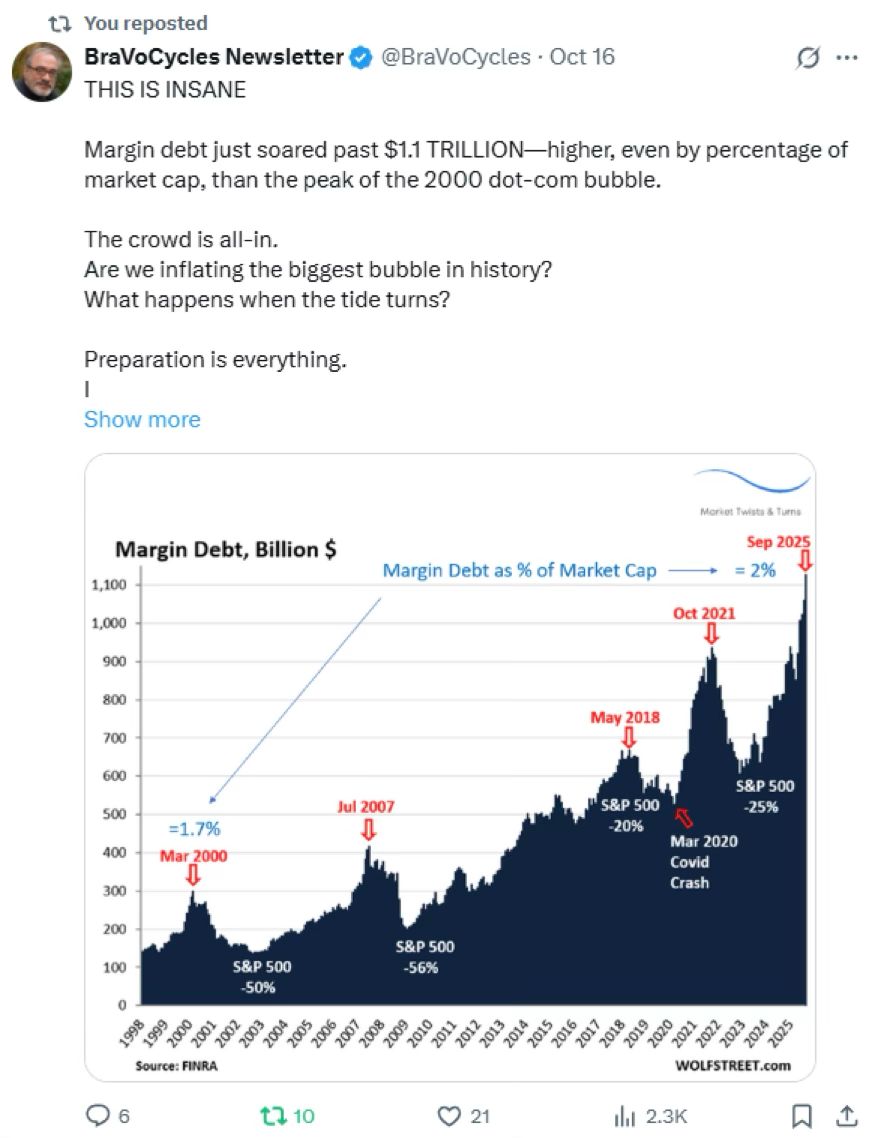

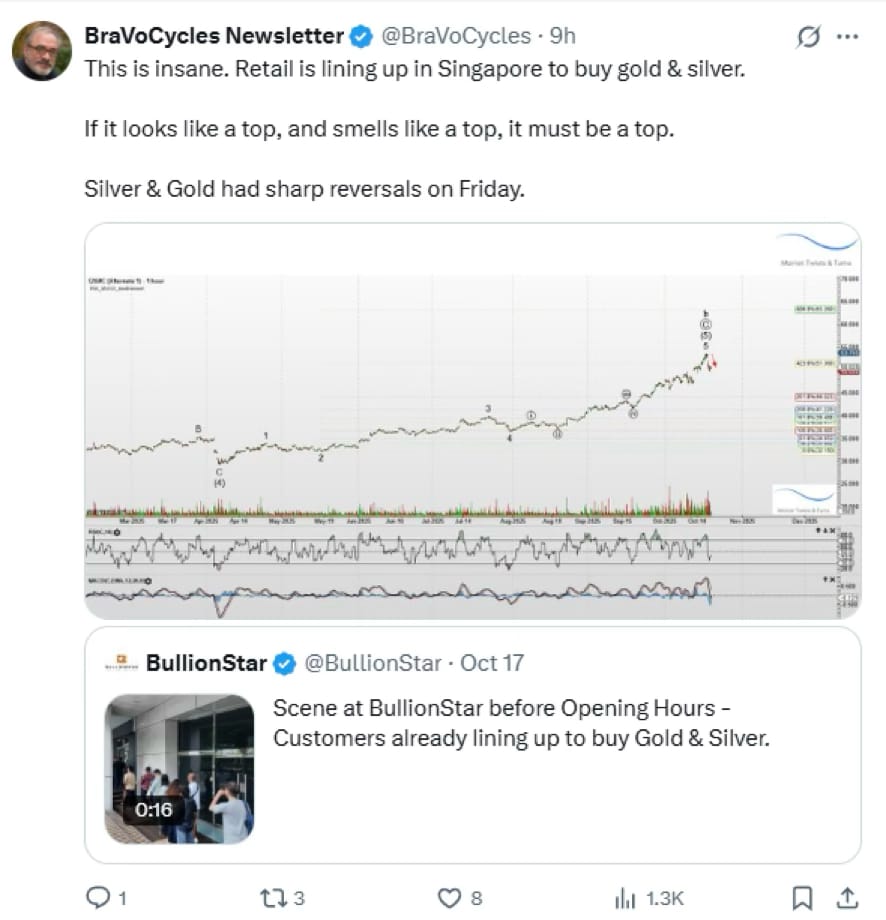

People on X posted videos about lines to buy gold and silver in Australia, Singapore, Vietnam, …

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto, claim your 95% off for 3 months introductory rate and upgrade to Premium Pro. . .

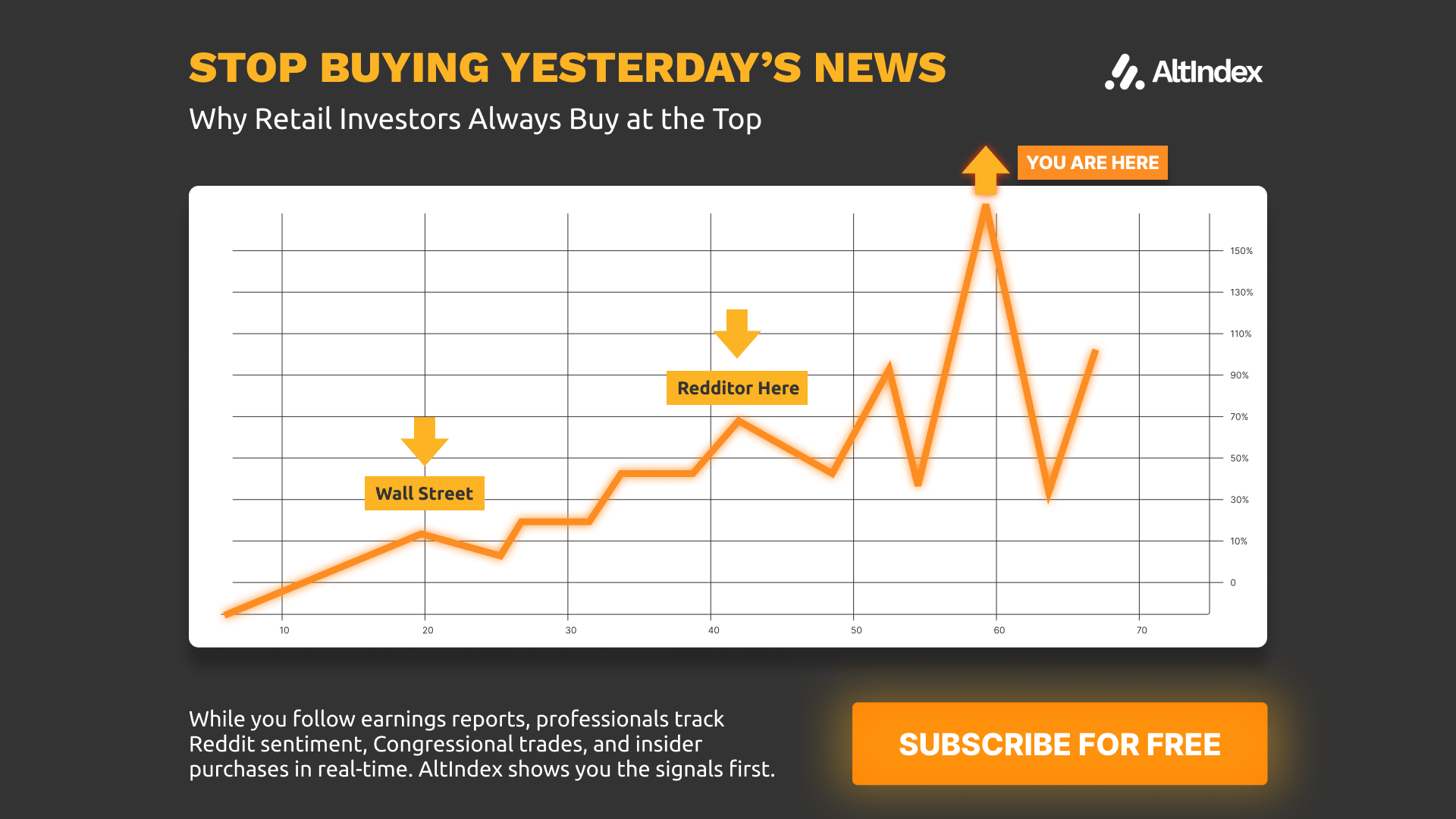

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply