- Market Twists & Turns

- Posts

- Market Was Slapped Around by FOMC and Trump’s FED Pick

Market Was Slapped Around by FOMC and Trump’s FED Pick

Will New FED be Bullish or Bearish for Stock Market?

Hey Market Timer!

Money Management Making You Mad?

Most business owners hit revenue goals and still feel cash-strapped.

Not because they're not making money. But because their money flow is broken, their decisions feel urgent instead of strategic, and their systems feel fragile instead of solid.

The Find Your Flow Assessment pinpoints exactly where friction shows up between your business and personal finances.

5 minutes with the Assessment gets you clarity on:

where cash leaks

what slows progress,

whether your current setup actually serves you

No spreadsheets, or pitch. Just actionable insight into what's not working and why.

Educational only. Not investment or tax advice.

Today we will be covering...

Today, we will review the Silver developments, including its 5-year cycle.

Wall Street's consensus on Kevin Warsh as President Trump's nominee for Fed Chair (announced today, January 30, 2026) is generally positive, viewing him as a credible, safe, and hawkish-leaning choice with strong Wall Street credentials and prior Fed experience (as a governor from 2006–2011). Analysts highlight his potential to maintain central bank independence while aligning with Trump's preference for lower interest rates, though there's some uncertainty about his ability to forge a consensus on the FOMC and deliver aggressive easing. Market reactions were muted but slightly negative for stocks (S&P 500 down ~0.3%), with a stronger dollar and rising Treasury yields reflecting expectations of tighter policy on balance-sheet expansion.

Themes from Analysts and Investors:

Hawkish Tilt with Rate-Cut Potential: Warsh is seen as more hawkish than other candidates (e.g., resisting QE-like expansions), which could support a stronger dollar and steeper yield curve, but he's expected to favor gradual rate cuts in line with Trump's goals, potentially one in 2026 and another in 2027, matching current market pricing. However, his limited recent public comments on policy add uncertainty.

Credibility and Independence:

Praised as "central casting" for the role, with ties to figures like Stan Druckenmiller, Warsh is considered a trustworthy steward who could preserve Fed autonomy despite Trump's criticisms of the central bank. This contrasts with a potential shift from Powell's consensus-driven style.

Challenges Ahead:

He'll need Senate confirmation (expected but potentially contentious) and to build FOMC unity, as Fed decisions require broad agreement. However, recent votes like this week's steady rates (10-2) show divisions. Some see him pushing for Fed reforms, higher growth, and a weaker dollar in the long term.

Overall, the pick is among the "better outcomes" for investors compared to alternatives, signaling stability amid economic pressures such as inflation. If confirmed, Warsh takes over in May 2026.

Silver – Dominant Cycle

A couple of weeks ago, I warned about potential tops forming in Gold and Silver.

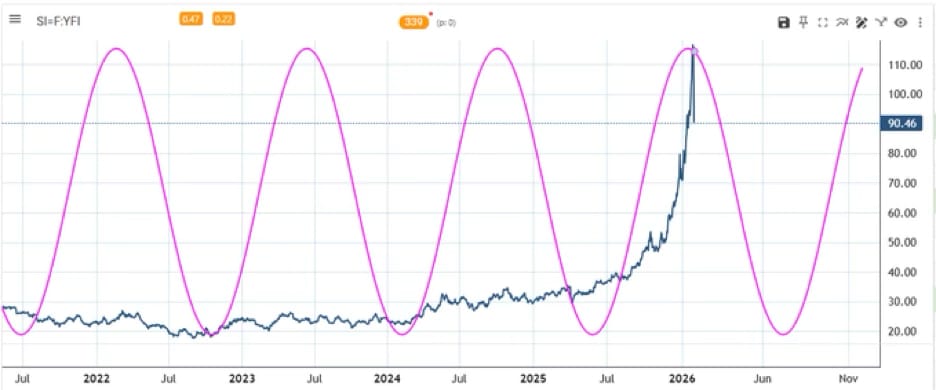

The chart below shows the dominant 5-year cycle in Silver; Multiple cycles and fundamentals drive the price, but the dominant cycle is something to pay attention to.

Those who follow me on X were alerted in the last few days about this cycle and an ending diagonal completing in Silver.

In the Pro newsletter, we will dive into Elliott Wave counts and downside targets for Gold and Silver.

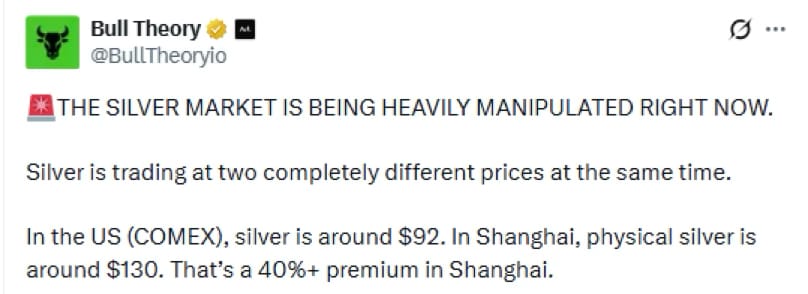

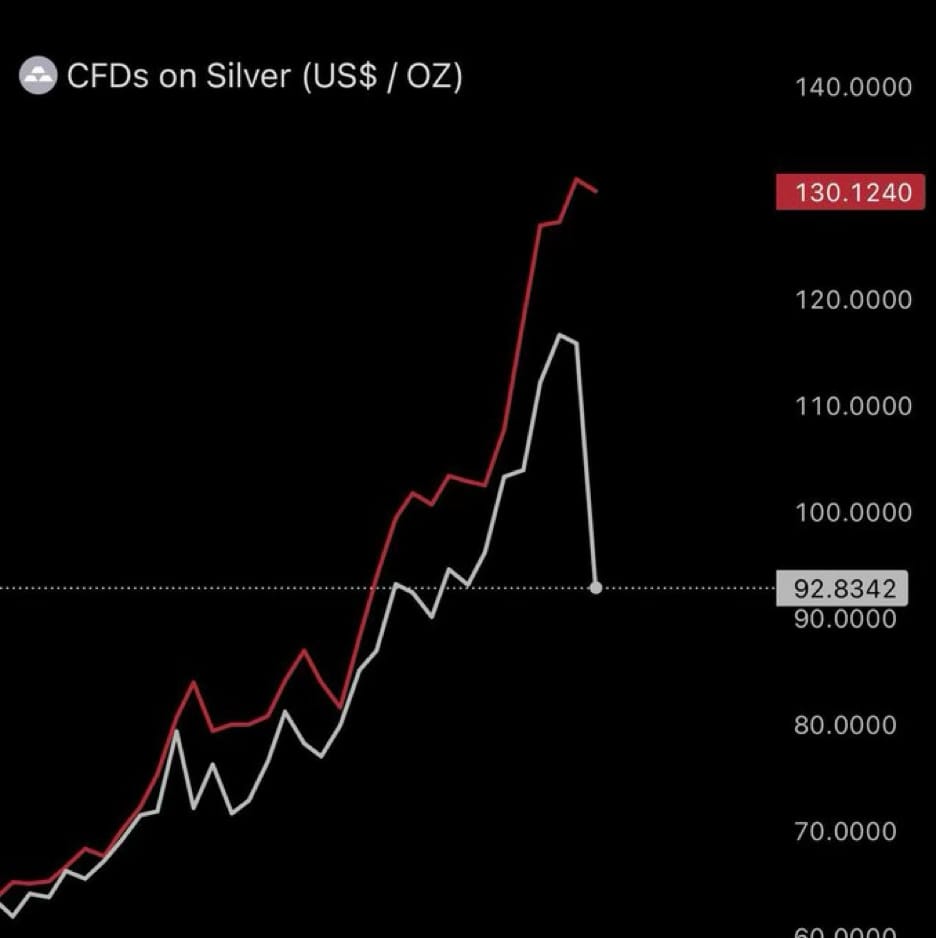

It is interesting that CME has been raising the precious metals margin requirements into cycle peaks! Coincidence, or …?

Upgrade to Premium Pro by claiming your 14 Day Free Trial and read our deep dive into Precious Metals. . .

BravoCyles on Youtube

Watch my latest YouTube video, Midterm Election Years: Bearish Trap or Hidden Bull Bias?

BraVoCycles on X

If you are interested in financial markets, you are missing a lot by not following me on X, as I do not have enough canvas space in the newsletter to post all my research, which I try to post on X. Also, I often post important real-time updates between the newsletters.

We just joined Threads. Follow BravoCycles on Threads!

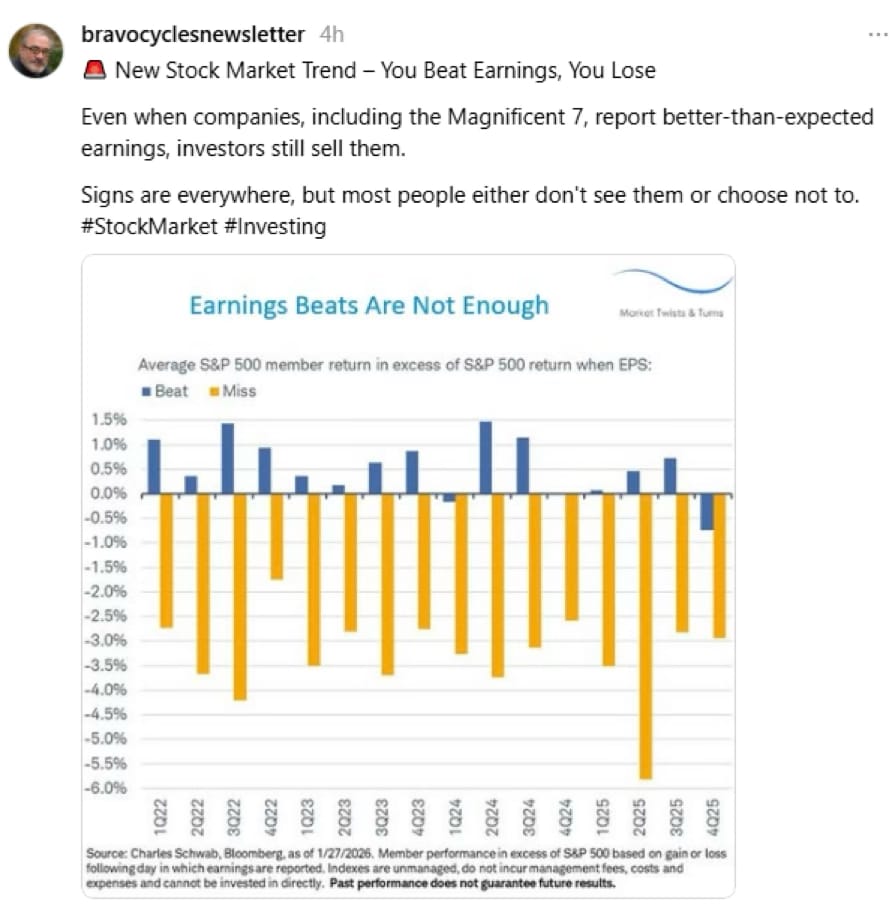

What’s Next for the Stock Market?

We expected some corrections and consolidations in the latter part of the week. We got it.

Our expectation was based on the turn in a relatively strong 10-day trading cycle. We did not know what would appear on the front pages of major newspapers.

Others may argue that the late-week choppiness was related to Trump's announcement of the new FED Chair candidate.

Cryptos continued to bleed, and precious metals crashed on Friday.

Was the crash in precious metals due to cycles, overvaluation, CME margin hike, manipulation, or all of the above? You judge.. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto claim your Free Trial to Premium Pro. . .

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply