- Market Twists & Turns

- Posts

- Market Timing and Price Projections: Intraweek Update, December 12, 2023

Market Timing and Price Projections: Intraweek Update, December 12, 2023

The Santa Rally is early this year, but what will Santa bring for 2024?

Happy Holidays from BraVoCycles Newsletter! Enjoy a 14 day free trial PLUS a 25% Discount for life when you upgrade to our premium subscription from now until January 6th.

Table of Contents

Introduction

Despite technical and sentiment indicators flashing yellow/red flags, the US stock market is pushing relentlessly higher, which is still supported by higher cycle price targets in some indexes, incomplete EW counts, and positive seasonality in the 2nd half of December.

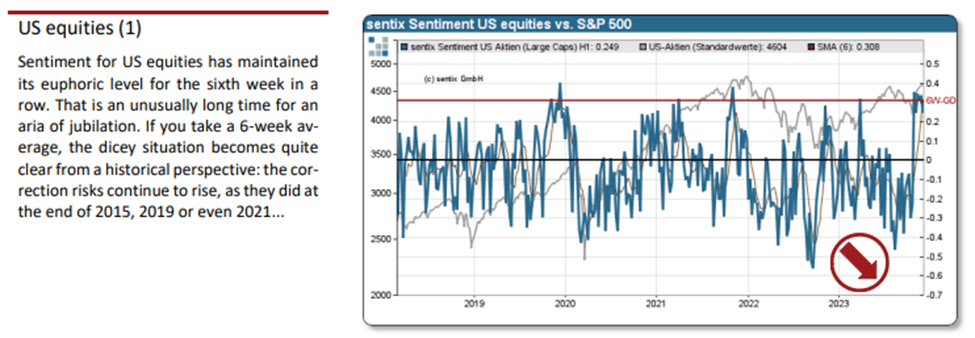

The sentiment index in Figure 1 is comparable to its values before the 2020 and 2022 market peaks. CNN’s Fear & Greed Index is at 68, close to the extreme territory.

Note that the sentiment indicators are not short-term timing signals but rather descriptive of the state of the market.

Figure 1 – Sentiment of US equities by sentix.

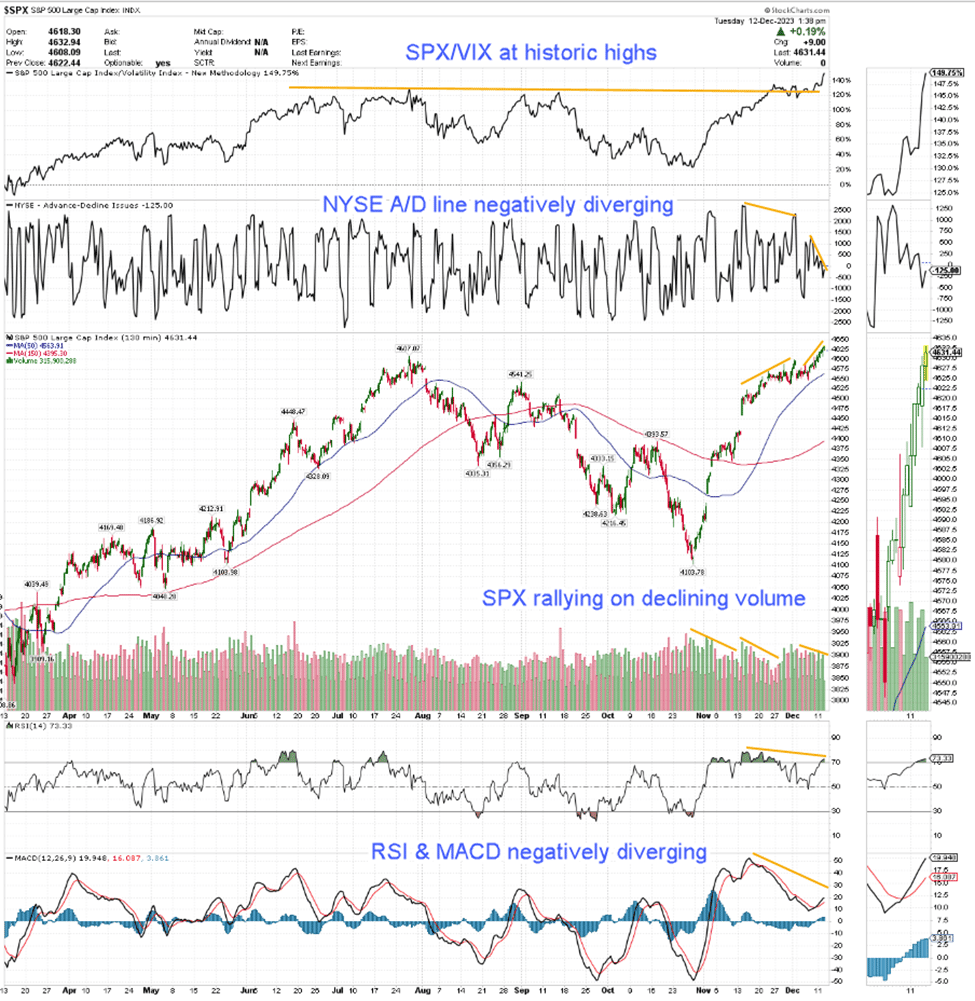

SPX technical picture is shown in Figure 2 – “Running on Fumes!”

SPX/VIX ratio is at historic highs. Extremes in this ratio usually precede significant corrections but could be early by several days/weeks, as illustrated a week ago on a weekly chart.

NYSE Adv/Dec line is strongly diverging relative to SPX – ominous sign?

RSI and MACD are positioned for negative divergences at the potential peak.

Figure 2 – SPX technical picture.

Overall, the longer-term picture is bearish, but in the shorter term, there is still potential for higher, rallying on the fumes (low volume and weak A/D line), but supported by cycles, EW counts, and seasonality.

Buy the dip (BTD) and sell the rip (STR) that I have been mentioning last several weeks have worked like a charm for short-term traders, and may continue so, perhaps in a somewhat broadened range;

In this report, we will review EW counts and cycle projections of NDX, SPX, and DJI.

VIX is on the sale on the Wall Street. For how much longer?

We will also provide updates on bitcoin and gold, which played out as expected, but let’s examine what’s next.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Cryptocurrencies, bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply