- Market Twists & Turns

- Posts

- Market Timing and Price Projections: Intraweek Update

Market Timing and Price Projections: Intraweek Update

Will Santa Claus Rally This Year?

38% Discount Promotion at $49/month expires this Saturday, December 09, 2023! Do Not Miss it!

Table of Contents

Introduction

NQ/NDX Cycles. Price Projections and EW Counts Update

VIX update

Energy Sector Update

Introduction

Did the market top for now? Perhaps last week, still not confirmed. Certainly, indexes are losing momentum and on the weekly charts give some bearish vibes (see the last two reports).

The cycle picture was “easy” in late October as several cycles were bottoming synchronously and we scored a major “win.” See my October 27th X post below.

- Short term cycles, from hourly charts, for SPX, NDX, DJI and RUT paint similar pictures next 10-15 trading days, which is UP

- Expected mid-Novemebr high could be ((a)) of minor 2 counter trend bounce twitter.com/i/web/status/1…— BraVoCycles (@BraVoOnX)

12:59 AM • Oct 28, 2023

Shorter term, in December, the cycle constellations is still convoluted with some cycles going up and some down, forming a complex top I mentioned a couple of times. I will try to dissect the cycle picture further down in the report.

Longer term the cycle picture is clearer. See my last YouTube video from December 3rd.

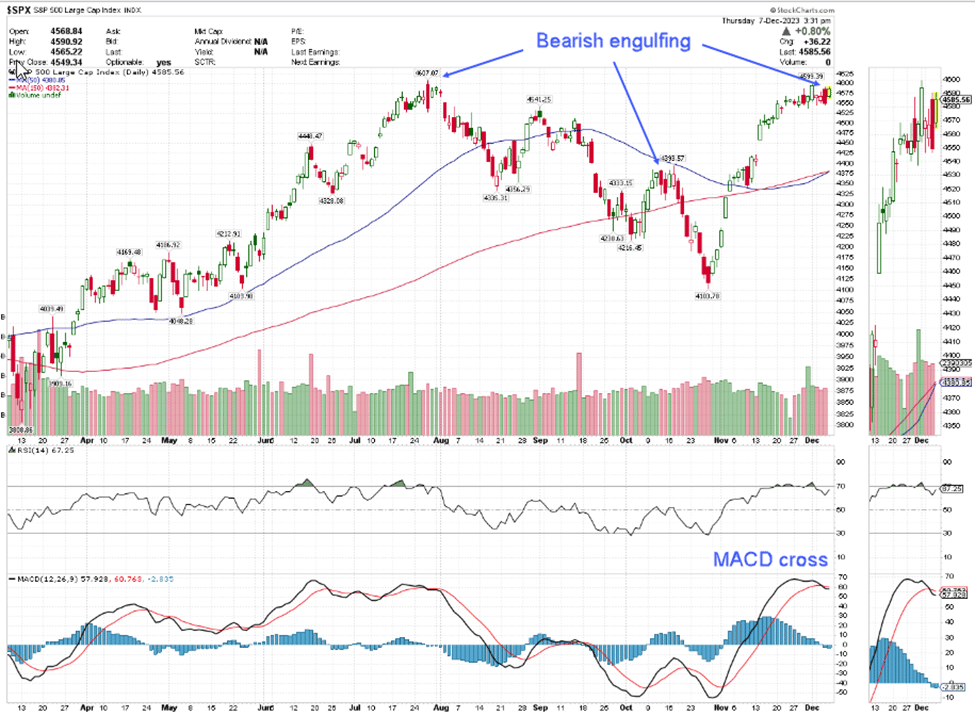

Notably, SPX had a bearish engulfing yesterday which often happens around tops (see July and October highs in the chart below), with a nice bounce today but still an inside day. Was today’s bounce a “gift” to the bears? Is it bullish? Generally, it is not bullish, but anything is possible considering that SPX still has a higher target. Moreover, the last several days of this complex top look like a sideways consolidation before another pop higher, which I suspect might happen, despite longer-term bearish signs.

Figure 1 – SPX bearish engulfing.

Sentiment indicators, as I elaborated on Sunday, are in over-confidence region but not extreme. Looks like the bullishness is primarily driven by the “soft landing” scenario, no more FED raises and all—achieving AI.

I think investors and traders might get disappointed as “soft landings” are rare and if the FED starts to lower rates that would be a bearish sign, IMO;

Overall, the longer-term picture is bearish, but shorter term there are options. The easy part is behind us, in my opinion;

Buy the dip (BTD) and sell the rip (STR) that I have been mentioning last two weeks has worked very nicely lately, and may continue so, perhaps in a somewhat broadened range;

Econ calendar: NFP tomorrow, CPI on Tue, FED on Wed, and OPEX next Fri may be catalysts to get SPX/NDX out of the narrow trading range of the last two weeks.

Since NDX did not have higher targets, unlike SPX, DJI, and RUT, until today, and has been the leader both up and down, we will pay attention to NQ/NDX today.

We will also provide an update on crude oil and national gas.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Cryptocurrencies, bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply