- Market Twists & Turns

- Posts

- Greenland Tariff Tantrum is Cracking Stock Market

Greenland Tariff Tantrum is Cracking Stock Market

Will There Be a Trade War Between the US & Europe?

Hey Market Timer!

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

Today we will be covering...

Today, as a part of a series of Magnificent 7 posts, we will review AMZN.

On Sunday, we will review META.

Amazon CEO Andy Jassy told CNBC at the World Economic Forum in Davos that President Trump's tariffs are now showing up in prices as sellers decide whether to absorb or pass on costs.

Amazon and third-party merchants had pre-purchased inventory to avoid tariff impacts and keep prices low, but Jassy said most of that supply ran out last fall, forcing price changes now.

This marks a shift from last year, when Jassy said Amazon hadn't seen prices go up much; he had predicted some sellers would need to raise prices because margins are too thin.

Greenland Tariff Tantrum and Trade War:

Global stocks sold off sharply on Tuesday after President Trump threatened tariffs on European allies over opposition to the U.S. acquiring Greenland.

Major U.S. indexes fell: Dow -1.76% (48,488), S&P 500 -2.06% (6,797), Nasdaq -2.39% (22,954).

Treasuries sold off, the dollar weakened, the yield curve steepened, and the VIX spiked +10.3% to 20.78—signaling rising fear.

Safe-haven gold surged +3.6% to a new record above $4,760; cryptocurrencies dropped (Bitcoin -3.3%, Ether -7%).

Market reaction reflects uncertainty over potential EU trade retaliation and reduced demand for U.S. debt, though analysts caution that details are limited and not all tariff threats materialize.

AMZN Cycles

As I noticed a couple of times, Magnificent 7 stocks have been losing momentum and have underperformed the Equal Weight S&P 500 since the October high.

$AMZN ( ▲ 1.0% ) is not different; both the daily and the weekly chart cycle composites are pointing down, at least for another couple of months.

It may bounce during a potential summer rally, but it will likely be under pressure for the balance of 2026.

BravoCyles on Youtube

FED's Reverse Repos Are Out, Money Market Funds Are In. Why and what it means? Watch my YouTube video to find out:

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

An example of cycle price projection “magic” we use regularly in Market Twists & Turns Pro.

Study Lesson Price Projection Method Using FLDs in Educational Material; this technique will improve significantly your profitability:

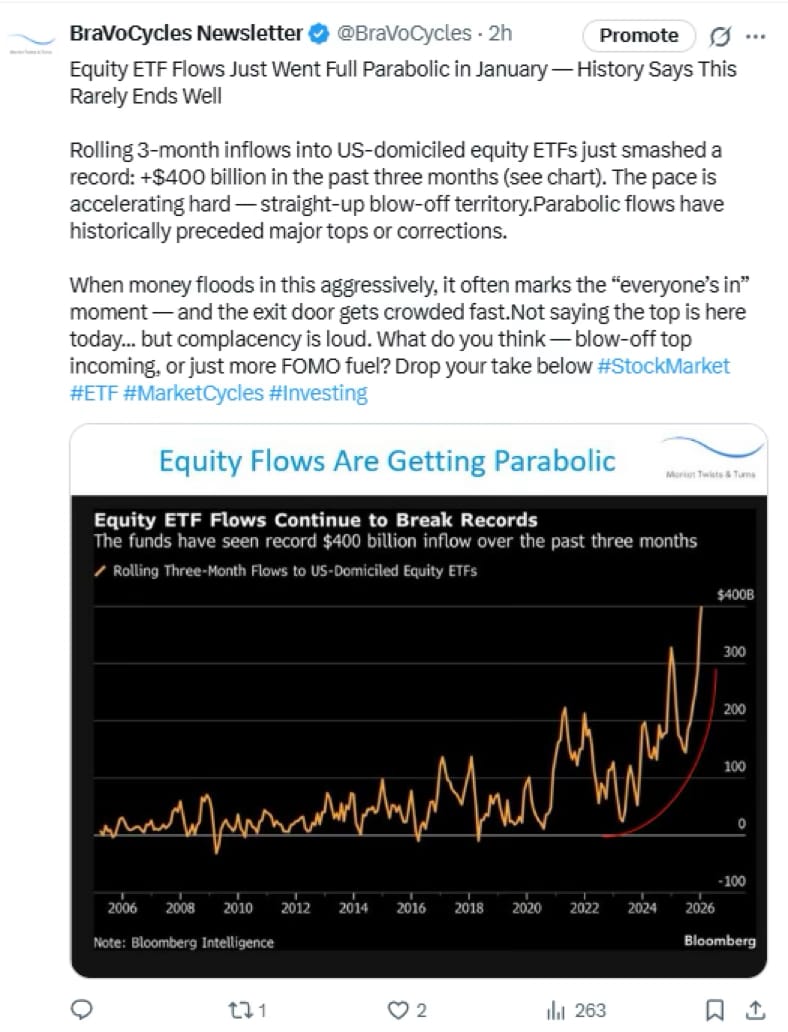

Extraordinary equity fund inflows in January!

What’s Next for the Stock Market?

We expected a correction, largely driven by the 11-trading-day cycle. It did happen, likely slightly exaggerated by the Greenland tariff tantrum.

Should the trade war escalate between the US and Europe, it can cause a significant correction, and the development should be watched.

We will track multiple indicators to stay ahead of the market moves. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Last chance on our a 3-month trial of Market Twists & Turns Pro for $1.95/month, which is an incredible 95% discount. This offer will be valid until 31 January. . .

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply