- Market Twists & Turns

- Posts

- Fed Giveth, Market Taketh

Fed Giveth, Market Taketh

FED’s Hawkish Rate Cut

Hey Market Timer!

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

Today we will be covering...

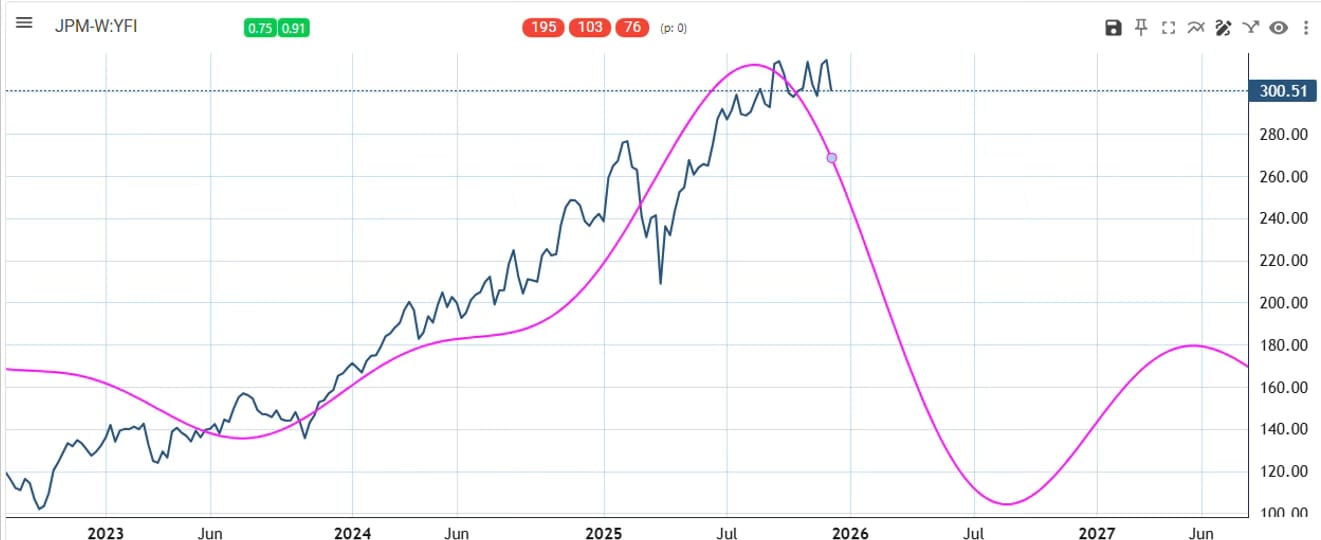

Today, we will examine the cycles and Elliott Wave count of JP Morgan (JPM), the largest US bank with $3.81 trillion under management.

FOMC December 10, 2025 – Super Concise Summary Decision

25 bps cut → Fed funds now 3.50%–3.75%

Most divided vote (9-3) since 2019

Key Takeaways

Only one more 25 bps cut expected in 2026 (Dot Plot)

Inflation still “somewhat elevated” → pause likely early 2026

Growth upgraded to 2.3% (2026), unemployment 4.4%, core PCE 2.5%

Tariffs seen as one-time price shock, not persistent inflation

Powell’s Presser (in 3 bullets)

“Close call” on the cut (9:3)

Labor market softening faster than headlines show

“Well positioned to wait” – data-dependent, no hurry to cut again

Will resume Treasury bill purchases ($40B starting Dec 12).

Market vibe: Hawkish cut → rates likely on hold for a while (not my opinion)

JPM Cycles

I posted before cycles, and Elliott Wave count for $XLF ( ▲ 1.2% ) , the financial sector ETF. The outlook was not positive for 2006 and the next several years.

The three dominant cycles from the $JPM ( ▲ 0.88% ) weekly chart suggest weakness much of 2026.

JPM has completed, or is about to do so, five primary waves from the 2009 low.

If my counting of sub-waves is correct, that should correspond to a cycle-degree wave V, and super-cycle-degree wave (III).

A multi-year correction should follow.

BravoCyles on Youtube

Watch my latest YouTube video about Apple: As Apple Goes, the Market Goes: Top Incoming in Early 2026?

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

The stock market reacted positively to the rate cut, but the gains were reversed in the after-hours session.

This may have more to do with about 10% drop in ORCL after disappointing earnings. NFLX may have also added some weight due to concerns about bidding for Warner Bros. Discovery. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply