- Market Twists & Turns

- Posts

- Climbing To the Top- Investment Cycle

Climbing To the Top- Investment Cycle

Investment Cycle

Hey Market Timer!

If you have money in financial markets and are not a Premium-Pro subscriber, you are missing a lot.

Our premium subscribers are well ahead of the market. This is what a long-term subscriber said on Friday.

We received the following feedback via email from one of our premium subscribers:

“You are the best.”

Jean-B. Neron.

Gif by amazonminiTV on Giphy

Get that 14-day Free trial now. You will love it.

Today we will be covering...

We’d like to take break in our “regularly scheduled programing” to say Thank You for your responsiveness to our sponsors’ and partner ads, it greatly helps us publish this newsletter for free.

Today we have a message from: Money

Gold hits new peak as the Fed cut rates

Following a bold 50 basis point rate cut by the US Federal Reserve, spot gold reached a peak of 2,687 per troy ounce. Experts predict that this bullish trend for the precious yellow metal may continue, so it may be smart to get in now before prices keep climbing.*

*The information provided in this email is for educational purposes only and is not intended as investment advice.

Investment Cycle

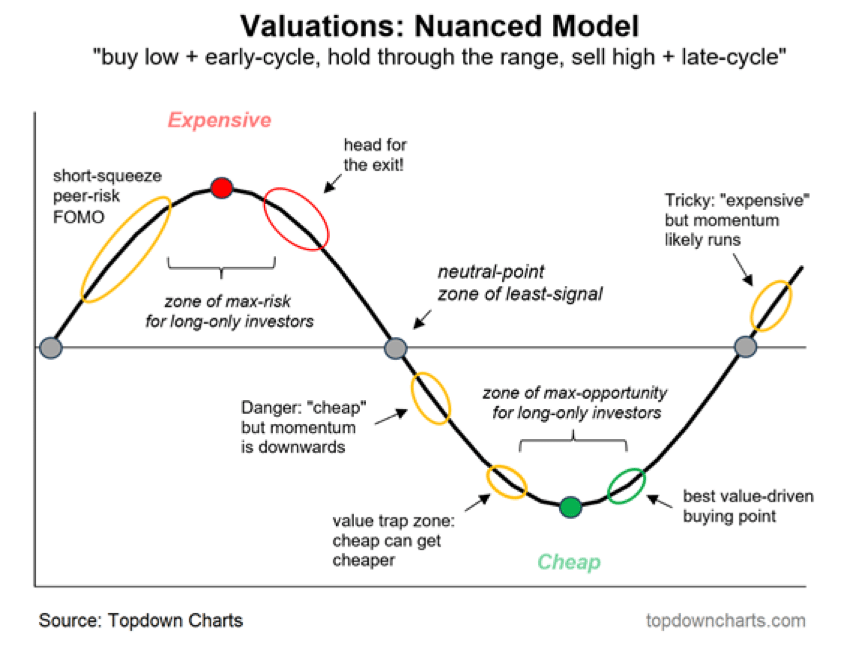

The chart below illustrates a typical investment cycle.

As reported multiple times in this newsletter, various long-term valuation metrics indicate extreme market valuation, some with a century-long record. I will post the Buffet Indicator again soon (the most recent update).

The market can be described as Expensive and is also approaching the peak of the dominant 3.5-year cycle (see my X post below).

However, the market might have some more bullish underpinning, possibly producing a blowoff top.

How is an investor to approach the market in situations like this?

A prudent strategy is to gradually raise cash on the short-term rips and prepare for inevitable market selloff when long opportunities arise (see Cheap in the diagram below).

Long-term investors need to play a “patience” game, both on the way up and on the way down.

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

For example, I posted the 3.5-year cycle on Sunday in NDX.

The 3.5-year cycle was discovered a century ago by Khitchin and has been studied and followed by many famous economists and cyclists since.

This NDX cycle should peak within the next several weeks and give rise to a weak NDX into 2026. I previously posted the same cycle for several major stocks and some other stock market indexes.

The precise market peak is determined by multiple, sometimes many, cycles.

The impact of multiple cycles, as determined by the cycle composite, provides more accurate peak or trough estimates.

However, one should not make investment decisions based solely on long-term cycles or cycles alone.

In the premium newsletter, we track cycles on multiple time scales. To precisely determine potential tops, bottoms, or reversals, we supplement cycle analysis with technical and Elliott Wave analysis to optimize buy-and-sell decisions in diverse financial markets.

Absolutely dominant 3.5-year cycle on the #NDX weekly chart should peak by the end of 2024.

$NDX #QQQ $QQQ#NQ $NQ #techs#techstocks#stockmarkets— BraVoCycles Newsletter (@BraVoCycles)

11:56 PM • Oct 13, 2024

To continue reading about Market Summary, US Markets, Elliot Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Can’t get enough of high quality newsletters?

Subscribe to these #FREE #newsletters. Just click the images below.

This greatly helps us to publish our free newsletter.

Subscribe to Pro to read the rest.

Become a paying subscriber of Pro to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • All the benefits of our Entry and Basic tiers, plus

- • Daily updates and opportunities (5x/week)

- • International markets and Forex

- • Cryptocurrencies

- • Bonds and Commodities

- • Individual major stocks and ETFs

Reply