- Market Twists & Turns

- Posts

- Choppy Stock Market Weak

Choppy Stock Market Weak

Intense Bull-Bear Intraday Moves Ahead of FOMC

Hey Market Timer!

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

Today we will be covering...

Today, we will examine the relationship between the US CAPEX and the stock market.

US CAPEX vs Stock Market

The US CAPEX (excluding the financial sector) is shown in the upper chart, and the stock market is shown in the lower chart.

Waves in the stock market mimic waves in US CAPEX; CAPEX waves often cause stock market bubbles due to the excitement about a new technological wave.

The peaks in CAPEX often lead the peaks in the stock market, and sometimes these peaks are about coincidental.

The latest CAPEX wave was led by technology investments, especially in the AI infrastructure, and appears to have peaked.

IBM CEO is skeptical that trillions of dollars invested in the data center infrastructure will pay off.

BravoCyles on Youtube

Watch my latest YouTube video about the Dow Jones Industrials 150 150-year super-cycle.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

Market Summary

A choppy week with multiple sharp intraday reversals.

One can say a consolidation with an upside bias, as we expected. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

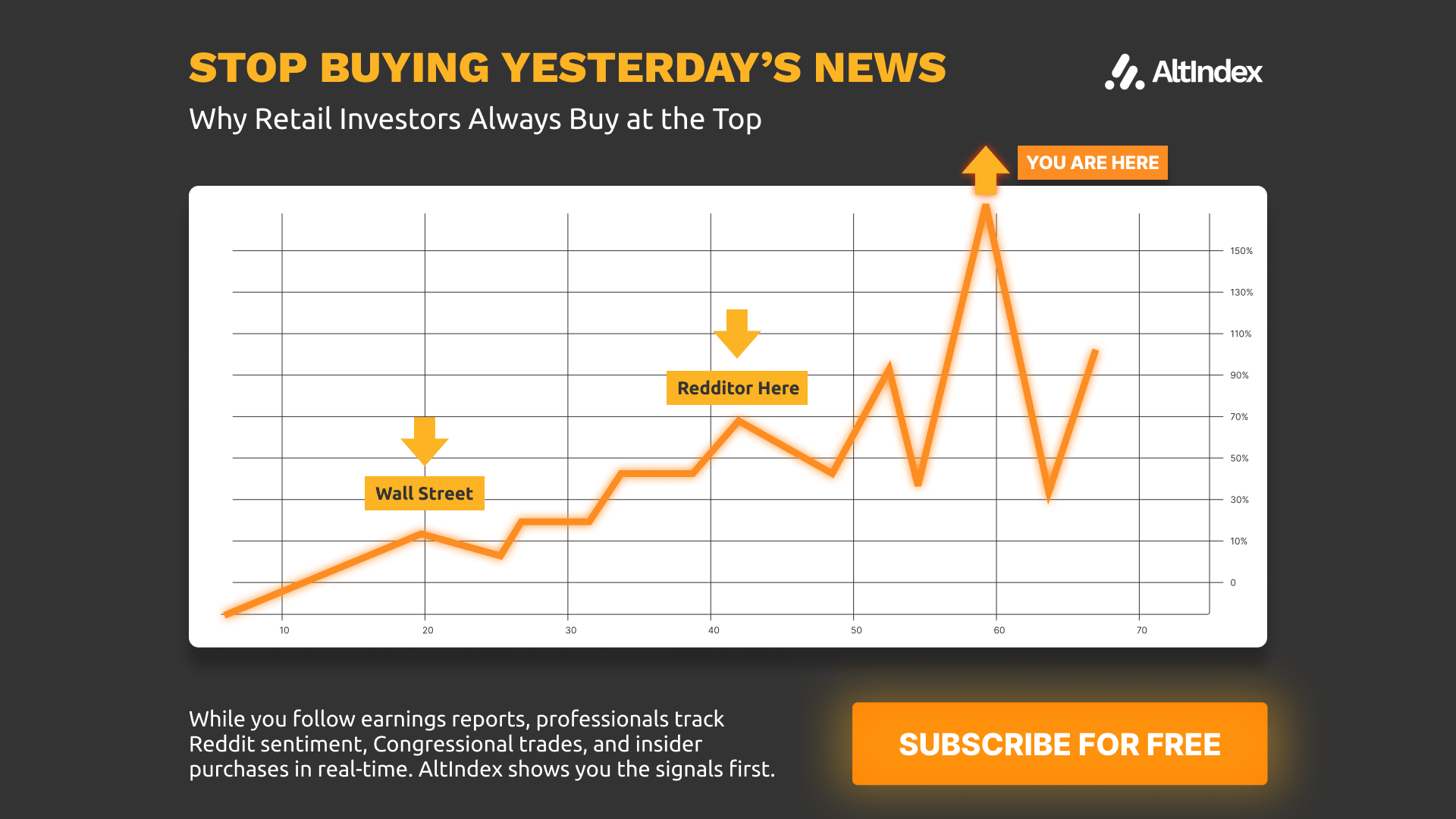

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply