- Market Twists & Turns

- Posts

- Choppy Stock Market – Bulls Resist Bear Attacks

Choppy Stock Market – Bulls Resist Bear Attacks

Buy the Dip is Well and Alive, Until Further Notice

Hey Market Timer!

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Today we will be covering...

Less than a week until the FOMC meeting. Let’s examine whether the FED might do with the rates.

Increasing Odds of a 0.25% Rate Cut

The FED is between a rock and a hard place with respect to the FED funds rates.

Persistent inflation versus a weak job market.

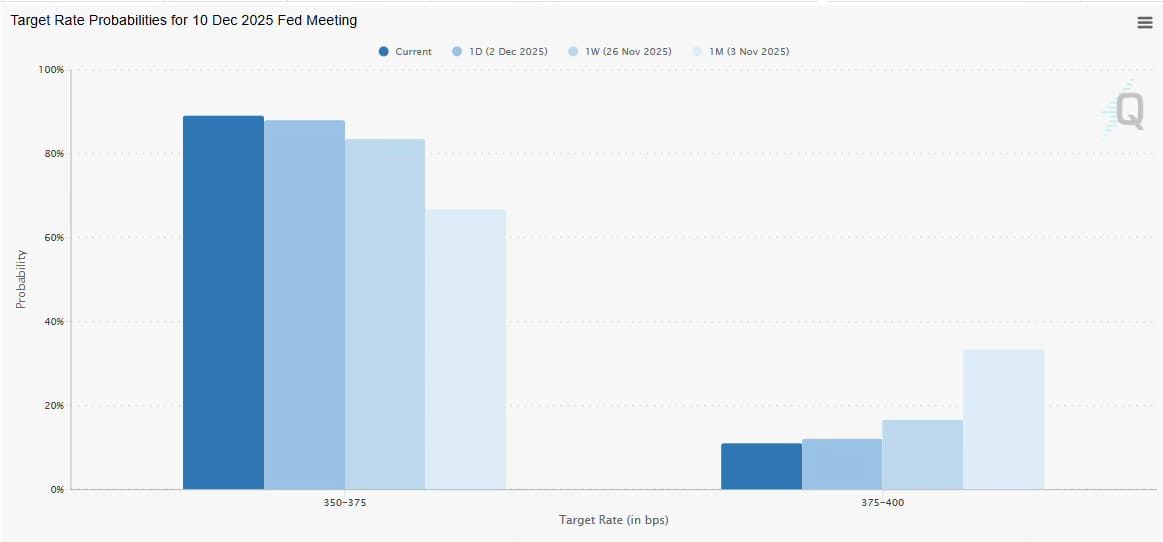

Nevertheless, currently, there is an 89% chance of a 0.25% cut, and these odds have been rising over the past four weeks; softer labor figures, slowing wage growth, and dovish comments from Fed officials (e.g., NY Fed's John Williams) have boosted expectations.

The odds are calculated directly from real-money bets in the futures market, specifically the 30-Day Federal Funds Futures contract traded on the CME (Chicago Mercantile Exchange).

Keep in mind these probabilities can change quickly with new data (for example, today’s jobs report).

For live updates, check the CME FedWatch Tool.

If inflation comes in hotter than expected, the no-change scenario could gain traction—but for now, a December cut remains the clear base case.

But some are going against the odds and doubt a rate cut.

BravoCyles on Youtube

Watch my latest YouTube video about the Dow Jones Industrials 150 150-year super-cycle.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

The AI Insights Every Decision Maker Needs

You control budgets, manage pipelines, and make decisions, but you still have trouble keeping up with everything going on in AI. If that sounds like you, don’t worry, you’re not alone – and The Deep View is here to help.

This free, 5-minute-long daily newsletter covers everything you need to know about AI. The biggest developments, the most pressing issues, and how companies from Google and Meta to the hottest startups are using it to reshape their businesses… it’s all broken down for you each and every morning into easy-to-digest snippets.

If you want to up your AI knowledge and stay on the forefront of the industry, you can subscribe to The Deep View right here (it’s free!).

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply