- Market Twists & Turns

- Posts

- Choppy Monday – A Pause to Refresh?

Choppy Monday – A Pause to Refresh?

Market Taking a Breather After a Ferocious Rebound

Hey Market Timer!

Are You Ready to Climatize?

Climatize is an investment platform focused on renewable energy projects across America.

You can explore vetted clean energy offerings, with past projects including solar on farms in Tennessee, grid-scale battery storage in New York, and EV chargers in California.

Each project is reviewed for transparency and offers people access to fund development and construction loans for renewable energy in local communities.

As of November 2025, more than $13.2 million has been invested through the platform across 28 renewable energy projects. To date, over $3.6 million has already been returned to our growing investor base. Returns are not guaranteed, and past performance does not predict future results.

Check out Climatize to explore clean energy projects raising capital. Minimum investments start with as little as $10.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

Today we will be covering...

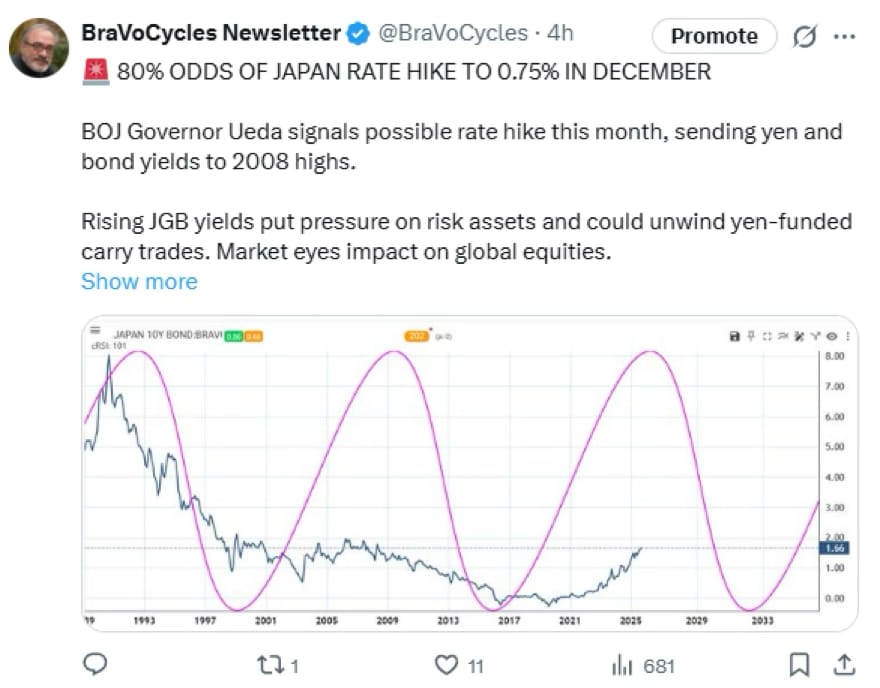

The mini-selloff on Sunday night in financial markets was likely caused by a hint from the BOJ Ueda about a possible Japan rate hike in December (see my X repost below). Today, we will examine controversies about Japanese bond yields and their impact on financial markets.

Japan Bond Yields vs Yen Carry Trade Explained

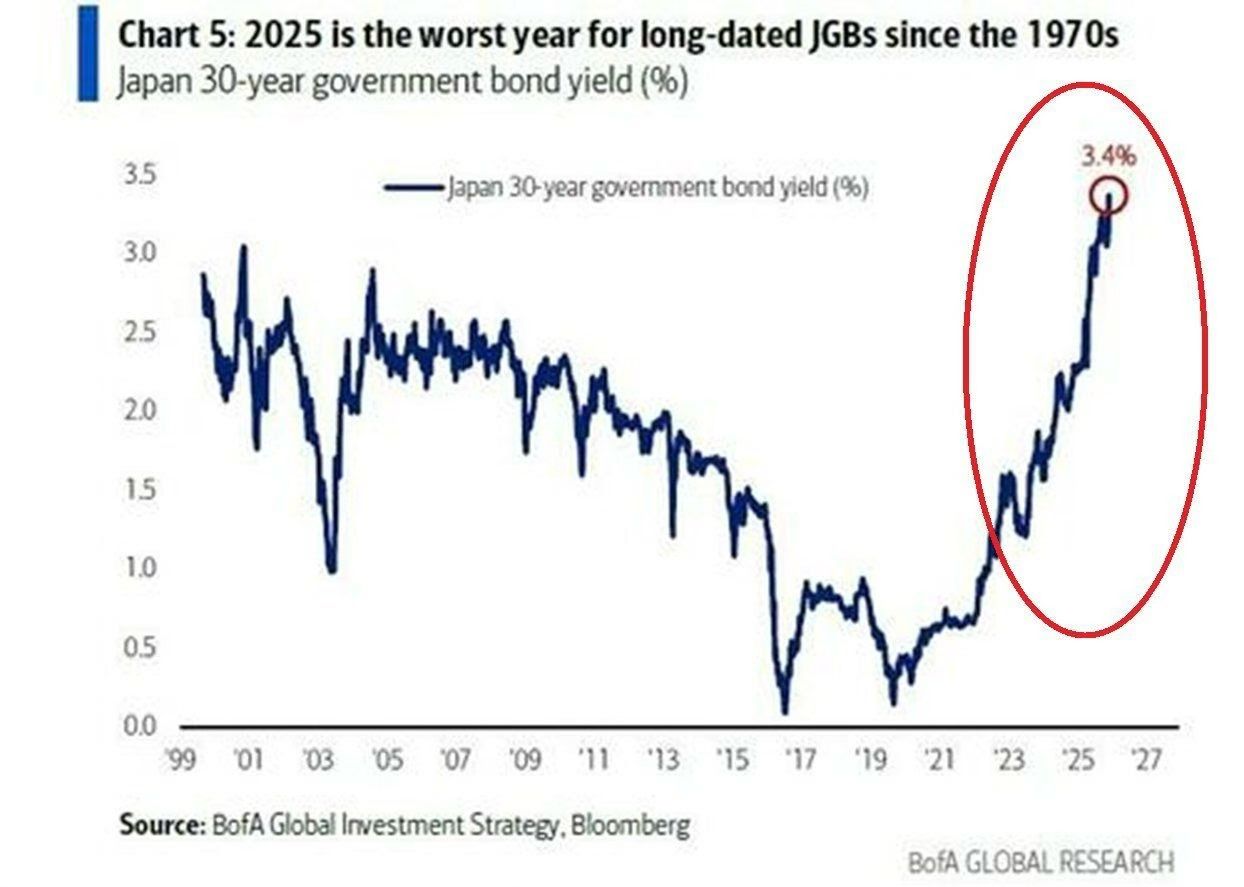

The chart below shows a strong growth in the Japanese long bonds over the last 5+ years, reaching the highest yield in at least 25 years.

Pundits are saying that rising bond yields will derail financial markets.

How does the Yen Carry Trade Work?

The Yen Carry Trade = borrow cheap ¥ in Japan (near-zero rates) → convert to USD/other currencies → buy higher-yielding assets (US stocks, crypto, EM bonds, etc.). What happens when Japanese bond yields rise (e.g., 10-year JGB yield ↑ from 0.9% → 1.5%+):

Higher funding cost → borrowing ¥ becomes more expensive.

Yen strengthens (or stops weakening) → traders must buy back ¥ to repay loans → rapid ¥ appreciation.

Unwind trigger → margin calls + risk aversion force traders to:

Sell the high-yielding assets they bought (↓ US stocks, crypto, gold, etc.)

Buy back ¥ → accelerates Yen rally and asset sell-off.

Result: Rising Japan yields = carry-trade unwind → global risk-off, higher volatility, and pressure on anything funded by cheap Yen (biggest since 2022 happened when JGB yield broke 1% in 2023–2024 and again in 2025).

Bottom line: Higher JGB yields → tighter Yen liquidity → forced deleveraging → pain for global risk assets.

Drops in Japanese Bond Yield Correlate with Stock Market Corrections

Falling Japanese government bond yields (especially sharp drops) are one of the strongest leading indicators of global stock market corrections or crashes in the past 15–20 years.

Historical correlation is very high (~80–90% of major S&P 500 corrections >10% were preceded by a notable drop in 10-year JGB yields within 1–8 weeks).

Why the Correlation Is So Strong?

Flight to Safety (Classic Risk-Off): Global investors panic → rush into the safest bonds → heavy buying of JGBs (and USTs) → Yields drop → Stocks Crash; The drop in JGB yields itself is usually the “calm before the storm” — it signals the peak of carry-trade leverage

What happens when the yields drop sufficiently?

Yen Carry Trade is the dominant marginal source of global risk capital. When JGB yields fall → borrowing ¥ becomes even cheaper → carry trade expands → risk assets (US tech, crypto, EM, high-beta stocks) get extra fuel → markets melt up.

And so on, rinse and repeat.

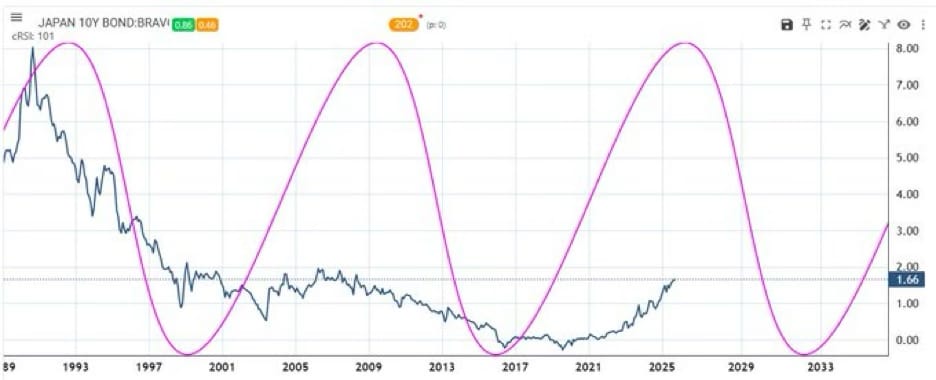

Based on the dominant cycle in the Japanese 10-Year Bond Yields, we might be approaching the end of the Risk-On Yen Carry Trade cycle and the start of the Risk-Off cycle.

BravoCyles on Youtube

Watch my latest YouTube video about the Dow Jones Industrials 150 150-year super-cycle.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

Market Summary

Financial markets were shaken overnight by a hint from BOJ about a possible rate hike in December.

A gap down invited the dip crowd, but the gap was closed only in NDX.

The moves look corrective. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

When training takes a backseat, your AI programs don't stand a chance.

One of the biggest reasons AI adoption stalls is because teams aren’t properly trained. This AI Training Checklist from You.com highlights common pitfalls and guides you to build a capable, confident team that can make the most out of your AI investment. Set your AI initiatives on the right track.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply