- Market Twists & Turns

- Posts

- Buy the Dip Still Works

Buy the Dip Still Works

But for How Much Longer?

Hey Market Timer!

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

Today we will be covering...

Today, we will examine bonds.

In the next several newsletters, we will review the Magnificent Seven stocks.

Investor Allocation to Bonds

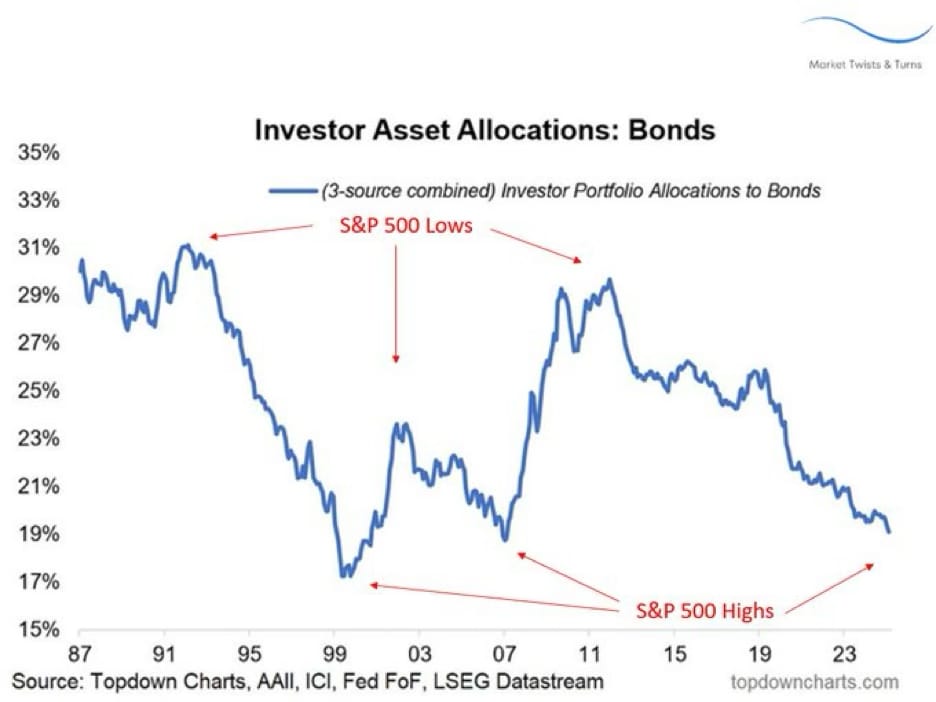

Investors maximize their allocation to bonds at stock market lows and minimize it at stock market highs.

Shouldn't they do the opposite?

Although investors have been reducing their exposure to bonds, there are no signs of a reversal yet.

TLT Cycles

Bond investors have experienced some rough slapping over the past 10+ years.

This weakness may have been caused in part by foreign banks selling US treasuries and buying gold, as we reported in a recent newsletter; foreign banks now, for the first time, own more gold than US treasuries.

Is it time to dip into TLT?

Cycles suggest waiting until late 2026 or 2027.

We will examine the EW count and cycles of the 10Y Treasury Yield Index in the Pro newsletter.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters.

What’s Next for the Stock Market?

The stock market made little progress since the October high.

Looks like a distribution pattern with an upside bias.

Buy the dip, sell the rip has been working nicely for short-term traders, but the choppiness was annoying for investors. . .

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply