- Market Twists & Turns

- Posts

- Bulls Are Trying, But Bears Have Upper Hand

Bulls Are Trying, But Bears Have Upper Hand

Crypto Special Continued?

Hey Market Timer!

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Today we will be covering...

Today, we will examine crypto sentiment in the Free newsletter.

In the Pro newsletter, we will continue with Crypto Special.

Crypto Sentiment

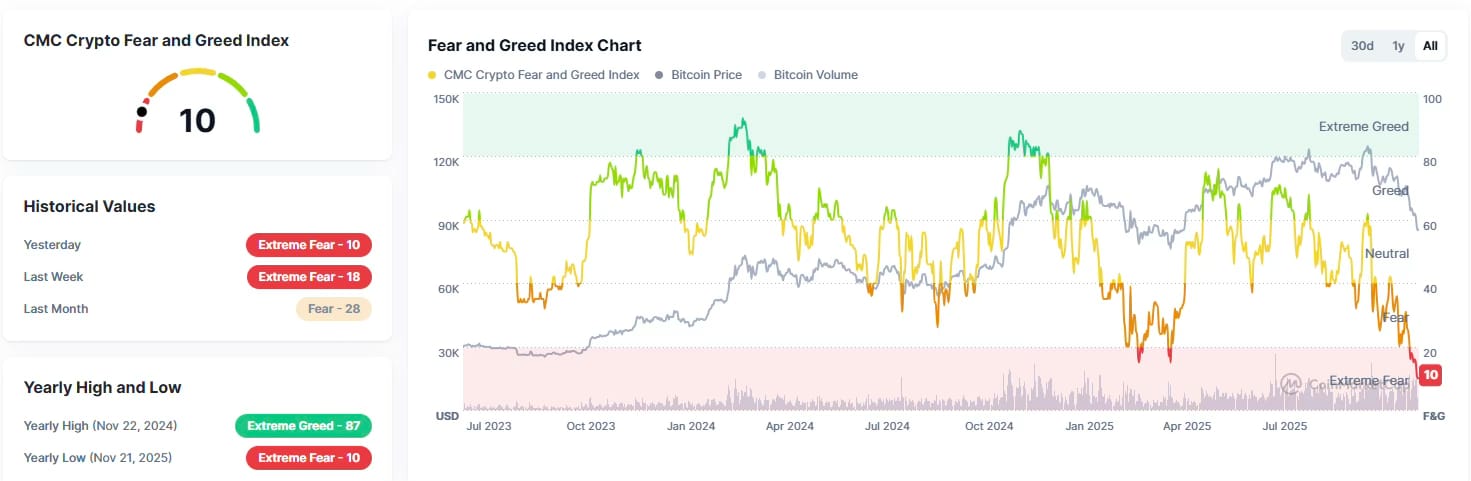

The Crypto Fear and Greed Index fell to a multi-year low.

It does not mean that Bitcoin is an automatic buy, as in crash conditions both the sentiment and crypto prices could still go lower.

Indeed, a few days ago, when the Fear & Greed Index reached the April’25 low, I warned on X that it could drop even lower.

In the Pro newsletter, we analyze new targets and updated Elliott Wave structure.

Watch the YouTube video for intermediate- and long-term cycles.

Expect short- and intermediate-term cycles to give way to long-term cycles that turned down several weeks ago.

You can also check out on my X profile several Bitcoin updates.

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters. Follow @BraVoCycles.

The CNN Fear & Greed Index is in Extreme Fear.

It is forming a wedge similarly to that in early 2025.

This warns of a potential stock market and sentiment bounce soon.

Once the wedge has been completed, with a confirmation by a break above the upper trendline, we could get a sharp snap-back rally in the market.

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply