- Market Twists & Turns

- Posts

- Bulls Are Running on Wall Street

Bulls Are Running on Wall Street

Did Reopening of Government Help?

Hey Market Timer!

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Today we will be covering...

Today, we will examine intermediate-term Bitcoin cycles.

What news flows this weekend!

$2,000 check to all US citizens, which, as clarified by Bessent, may be in the form of tax reductions.

50-year mortgage idea suggested by President Trump.

The end of the US government shutdown.

The stock market gapped up mainly on the latter.

Pundits consider it bullish.

Although the stock market has some more upside fuel, based on my analysis, I do not find this news especially bullish. After all, the stock market has been hitting new highs during the shutdown, and everyone could expect that this issue will be resolved, just like in all other instances in the past.

Bitcoin Cycles

In September, we accurately predicted the price level and timing of the Bitcoin peak, as reported in the Pro newsletter.

This was achieved by using our reliable multi-pronged approach comprising time cycles, cycle price projections, Elliott Wave, and technical analysis.

Bitcoin is now oversold, though it may be under pressure for a few more days.

The daily chart cycle composite warns that a 2-3 month rebound may start within days.

The next peak is expected in early February.

However, the longer cycles have curled down, and that early February peak may be left-translated, i.e., occur before February.

Whether this upswing will produce a new high or not is TBD. Elliott Wave counts support both options.

As usual, in the Pro newsletter, we will regularly track the evolutions of cycle price targets and Elliott Wave structure to anticipate the level of the next peak.

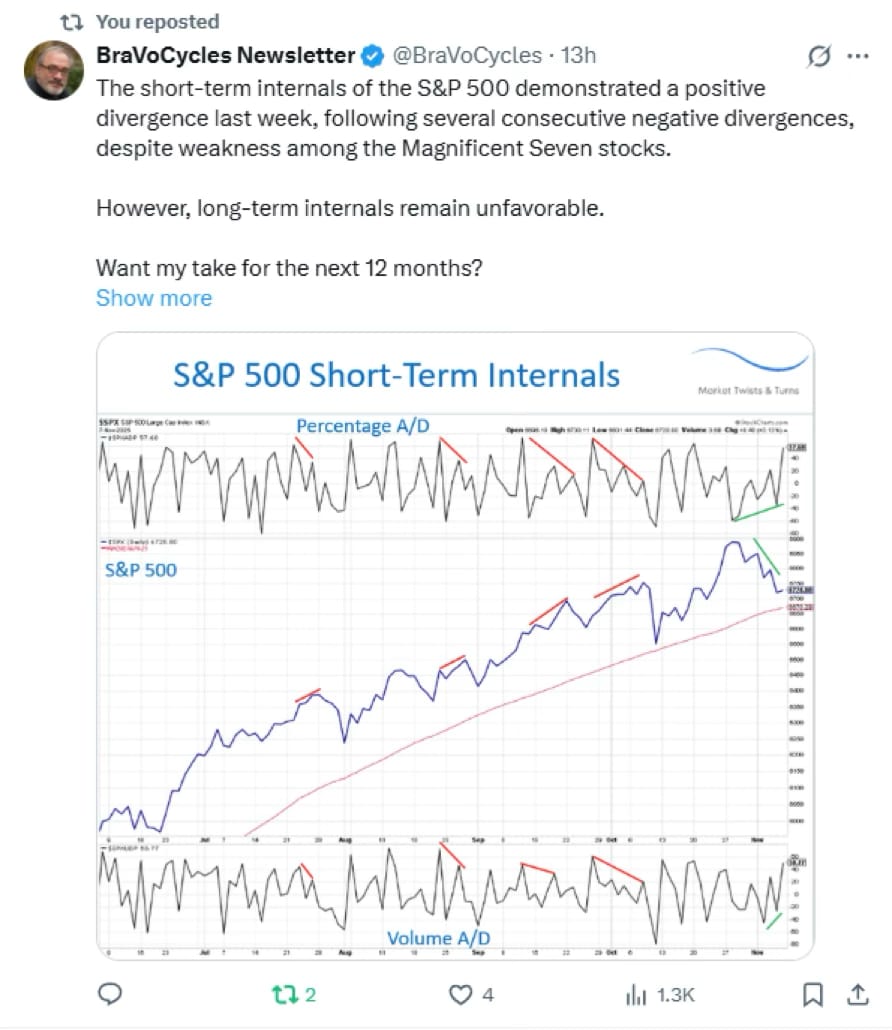

BraVoCycles on X

If you are interested in financial markets, you are missing out by not following me on X, as I do not have enough space in the newsletter to post all my research, which I try to share on X. Additionally, I frequently post important real-time updates between newsletters. Follow @BraVoCycles.

In the X post below on Thursday afternoon, I alerted about the NDX rebound and the exact area from which the rebound was supposed to happen.

It shows how important it is for subscribers to follow me on X.

I know that many do, but the majority do not. I strongly encourage you to do.

To continue reading about what’s next for the stock market, US Markets, Elliott Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies and crypto upgrade to Premium Pro. . .

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis & analysis multiple times/week on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply