- Market Twists & Turns

- Posts

- Are Bears Winning?

Are Bears Winning?

Solar Cycles vs Financial Markets – Part 2

Hey Market Timer!

Do you Want to Feel Like a Smart Investor?

The Premium Newsletter provides key information about the stock market’s trends that you need to know.

Golden insights about the Stock Market, Commodities, Crypto, Bonds & Forex, several times a week.

Upgrade to Premium at a rock bottom promotional price of $29/month.

Today we will be covering...

News Buzz

U.S. jobs growth rebounded to 142,000 in August, the government said in Friday's nonfarm payrolls report, but fell short of Wall Street's 160,000 consensus. Steep downward revisions to the June and July totals reinforced ideas of a less vigorous labor market.

NVDA shed $406 billion in market cap this week.

Dow logs the worst week since 2023 after softer than expected jobs report.

We’d like to take break in our “regularly scheduled programing” to say Thank You for your responsiveness to our sponsors’ and partner ads, it greatly helps us publish this newsletter for free.

Today we have a message from: Mood Gummies

This cannabis startup pioneered “rapid onset” gummies

Most people prefer to smoke cannabis but that isn’t an option if you’re at work or in public.

That’s why we were so excited when we found out about Mood’s new Rapid Onset THC Gummies. They can take effect in as little as 5 minutes without the need for a lighter, lingering smells or any coughing.

Nobody will ever know you’re enjoying some THC.

We recommend you try them out because they offer a 100% money-back guarantee. And for a limited time, you can receive 20% off with code FIRST20.

Solar Cycles vs Financial Markets – Part 2

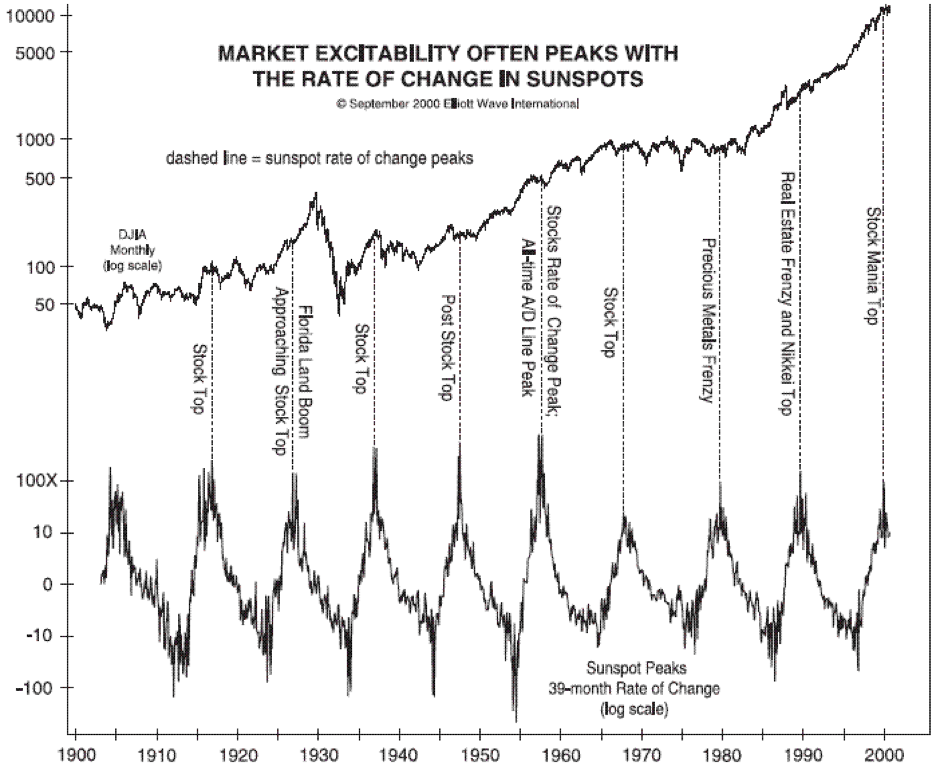

Prechter and Kendal further argue that the peaks in the rate of change of solar numbers correspond to the maximum excitement of investors.

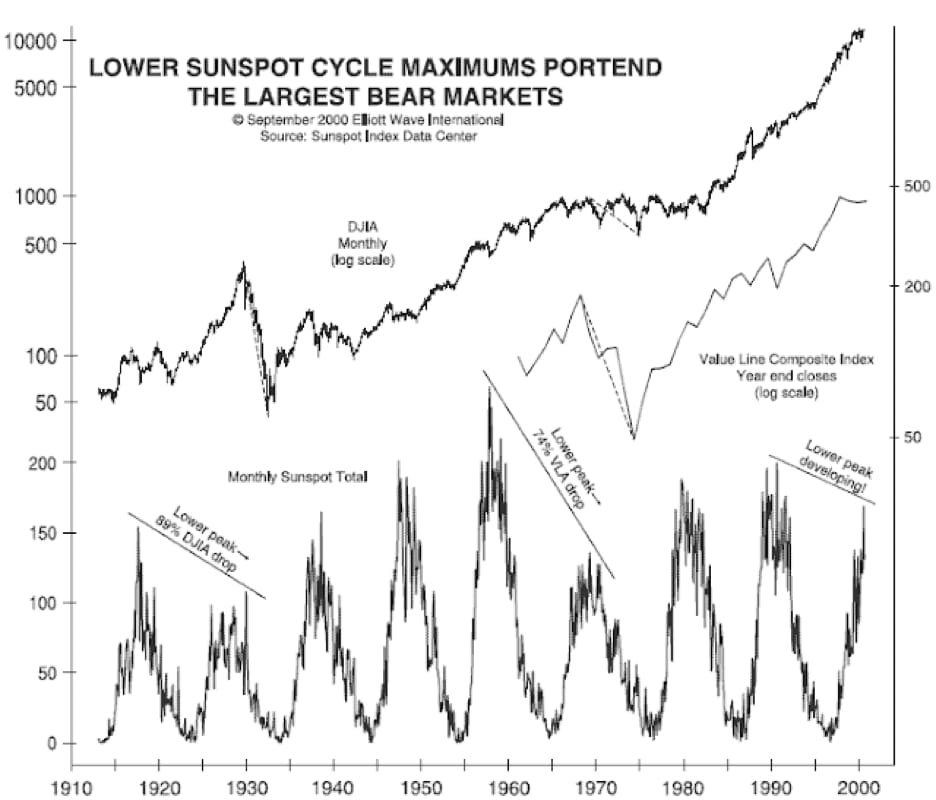

Prechter and Kendal also noticed that lower peaks precede significant bear markets, though the sample was small.

Indeed, lower peaks in 2000 and 2014 (see the 2nd chart below) preceded significant bear markets.

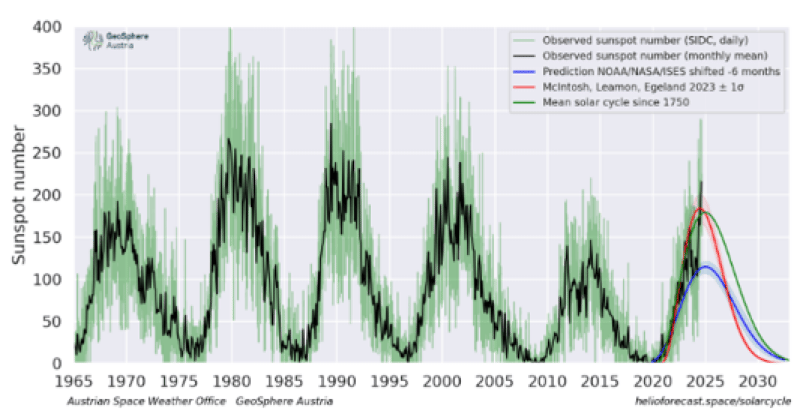

The sunspot number in the present cycle 25 already exceeded the peak of the 24-th cycle.

Does that mean that the next bear market will not be severe? I do not think we can draw that conclusion.

For example, the peak in the late 30s was higher than the peak in the late 40s, yet DJIA had a significant bear market in the late 30s and into WW II.

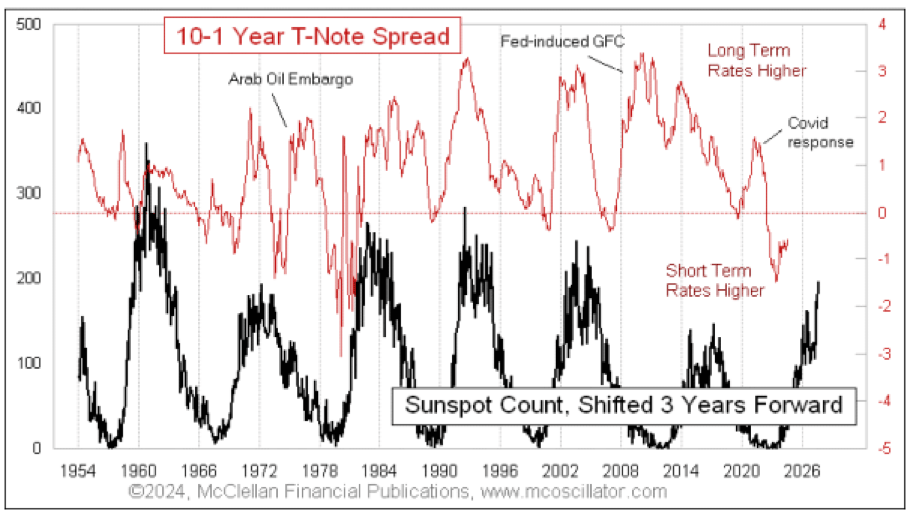

The chart below shows the correlation between 3-year shifted sunspot numbers curves with 10-1 Year T-Note Spread (courtesy of Tom McClellan).

If this correlation continues to work, we can expect un-inversion in the coming months and possible peaking of 10-1 Year T-Note Spread in 2028 +/-.

We uploaded the above lesson and many more on our website.

Check out our Education Resources page for more lessons at your fingertips.

Can’t get enough of high quality newsletters?

Check out this #FREE #newsletter. Just click the link below.

This greatly helps us to publish our free newsletter.

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters. On Friday I posted a timely Bitcoin update.

#Bitcoin finally reached the 40D cycle target.

No lower targets --> I expect a bounce from not much below the present level.

#BTC $BTC #BTCUSD $BTCUSD #crypto#cryptomarkets— BraVoCycles Newsletter (@BraVoCycles)

1:02 AM • Sep 7, 2024

Gif by ManneNilsson on Giphy

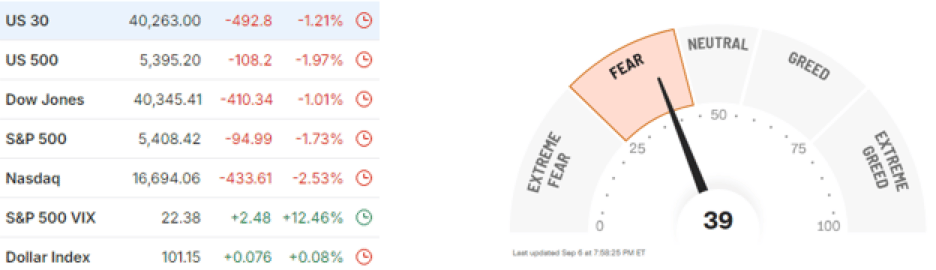

Market Summary

As of close on 6 September, 2024

. . .

To continue reading about What’s Next, US Markets, volatility, commodities, currencies, bonds, forex, or crypto, upgrade to Premium Pro. . .

Can’t get enough of high quality newsletters?

Subscribe to these #FREE #newsletters. Just click the images below.

This greatly helps us to publish our free newsletter.

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Cryptocurrencies, bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply