- Market Twists & Turns

- Posts

- Are We There Yet

Are We There Yet

Widow Maker Opportunity?

Hey Market Timer!

If you have money in financial markets and are not a Premium-Pro subscriber, you are missing a lot.

Our premium subscribers are well ahead of the market. This is what a long-term subscriber said on Friday.

We received the following feedback via email from one of our premium subscribers:

“You are the best.”

Jean-B. Neron.

Gif by amazonminiTV on Giphy

Get that 14-day Free trial now. You will love it.

Today we will be covering...

All through time, people have basically acted and reacted the same way in the market as a result of greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.

We’d like to take a break in our “regularly scheduled programing” to say Thank You for your responsiveness to our sponsors’ and partner ads, it greatly helps us publish this newsletter for free.

Today we have a sponsored message from: Cornbread Hemp

Sweet dreams are just a gummy away.

After a long day, all you want is a good night’s sleep. Cornbread Hemp’s Sleep CBD Gummies are designed to help you achieve just that. These USDA organic, full spectrum CBD gummies are crafted to promote relaxation and restful sleep. All-natural and vegan, they’re a guilt-free and melatonin-free addition to your bedtime routine. Imagine slipping into bed, feeling calm and at ease, knowing that sweet dreams are just a gummy away.

For a limited time, buy one and get the second free with code SUMMERTIMEBOGO.

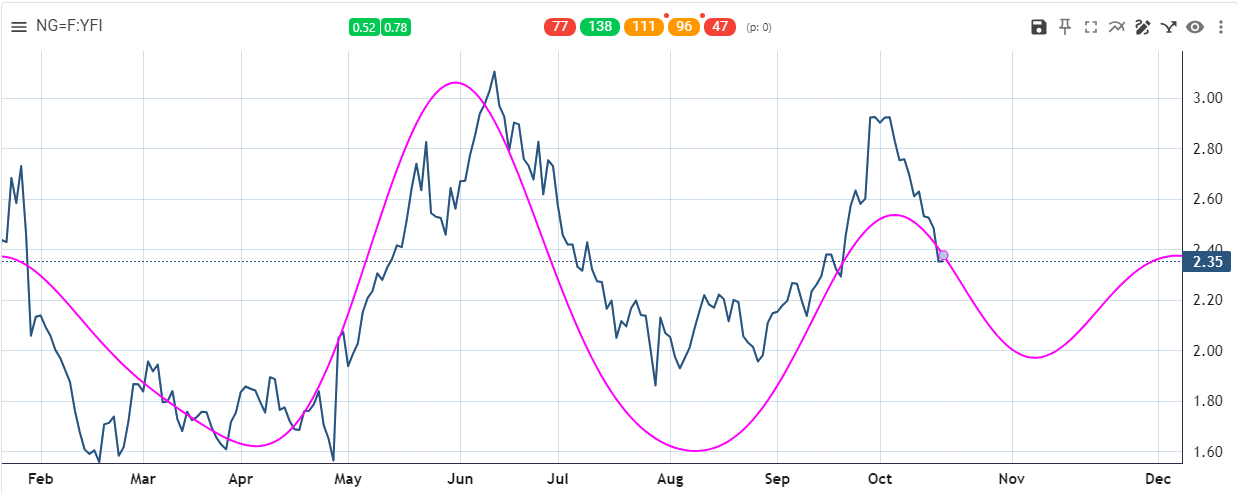

National Gas - NG

NG, often called widow maker, is expected to have a cycle trough around Election Day. A coincidence?

This may provide an excellent long-term opportunity considering a historically low price.

I will do a deep dive in the premium newsletter this Sunday.

Consider following me on X (former Twitter) in addition to the newsletter, as I often post valuable information there in real time between the newsletters.

Yesterday, I posted a chart on the long exposure of equity futures traders.

It exceeds by far any other measurement in the last 15 years.

Can they add even more to long positions? Anything is possible, but this is certainly a bearish indication from a contrarian point of view.

Can #futures#traders get more #bullish?

#StockMarket#sentiment#stockmarkets— BraVoCycles Newsletter (@BraVoCycles)

10:14 PM • Oct 16, 2024

To continue reading about Market Summary, US Markets, Elliot Wave and Technical analysis of US Markets, volatility, as well as commodities, bonds, forex, currencies or crypto, upgrade to Premium Pro. . .

Can’t get enough of high quality newsletters?

Subscribe to these #FREE #newsletters. Just click the images below.

This greatly helps us to publish our free newsletter.

Subscribe to Pro to read the rest.

Become a paying subscriber of Pro to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • All the benefits of our Entry and Basic tiers, plus

- • Daily updates and opportunities (5x/week)

- • International markets and Forex

- • Cryptocurrencies

- • Bonds and Commodities

- • Individual major stocks and ETFs

Reply