- Market Twists & Turns

- Posts

- Stock Market Review

Stock Market Review

Are We There Yet?

Howdy Market Timers,

The stock market will exhibit significant volatility this year, IMO. Our premium newsletters offer incredible guidance to help you navigate turbulent markets. It is a must for serious traders/investors. A value that you cannot find elsewhere.

If you’re unsure about our full premium newsletter, try out Market Twists & Turns and receive 2x weekly guidance and insights on major market indexes, for just $9/month (less than 2 coffees).

Today we will be covering...

Thank you for your responsiveness to our sponsors’ and partner ads, it greatly helps us to publish this newsletter.

Today we have a message from Rundown AI.

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join early adopters reading The Rundown– the free newsletter that makes you smarter on AI with just a 5-minute read per day.

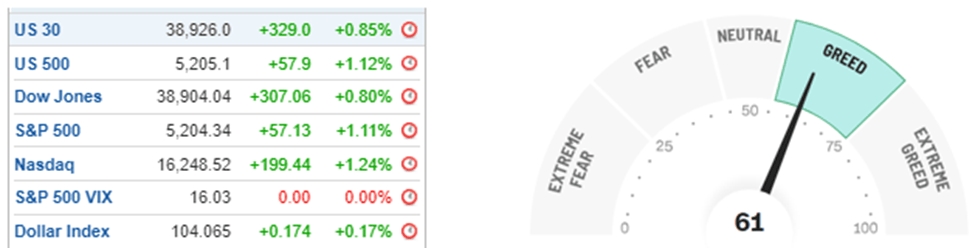

Market Summary

There has been little new information since Thursday’s report. We got the expected bounce on Friday, and there is a very good chance that the bounce will continue for a few more days. I discussed some options in the premium content, but they could not be summarized here easily, which may confuse many. Long story short, look for some more up, then down.

Repeat from before:

The short-term analysis is becoming more in line with the intermediate—and long-term analyses, which suggests a reversal is due. The lightning could strike unexpectedly around the tops.

My longer-term expectations do not change. I will repeat from the weekend report: “Despite the market's resiliency and FOMO, I expect a correction in the next 2-4 months, initially.

Gif by travisband on Giphy

Market data as of close on 5 Apr. 2024.

Subscribe to this #FREE #newsletter with just your email and make the most out of your investing.

|

Yesterday, I posted some of my good charts on X (former Twitter). Reposting from X with additional comments.

For short updates between newsletters, follow me on X (formerly Twitter):

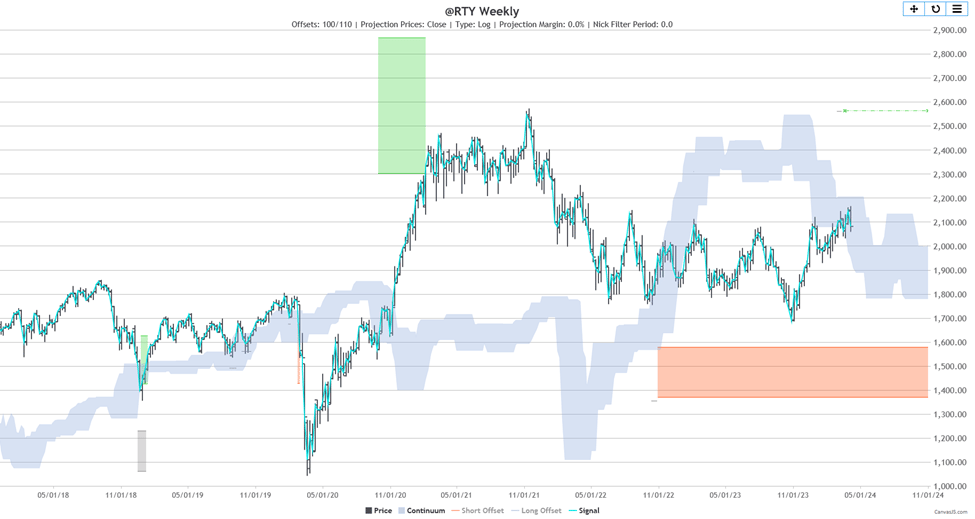

Chart of the Week

RTY has the 4Y cycle target of about 30+/-5% down. But it needs to stay below the upper boundary of the gray FLD band. This must be watched because if it crosses the upper boundary, it will invalidate the red box target and generate a green box target up to about a new high.

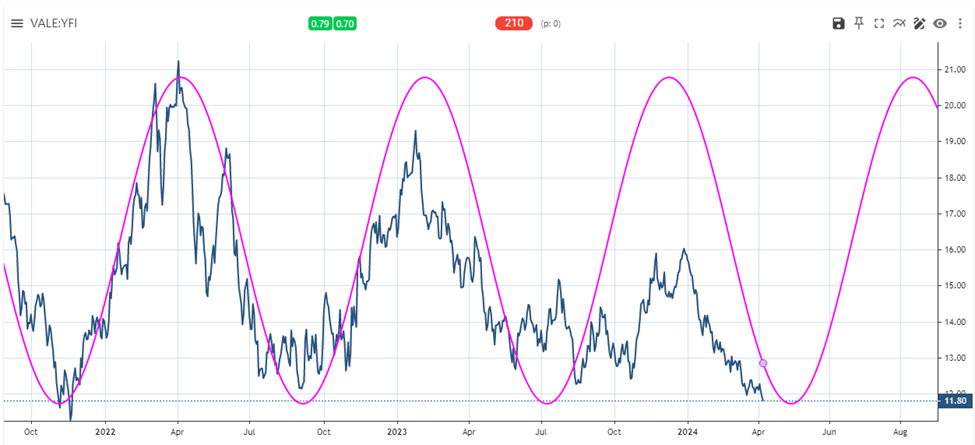

Chart of the Day

VALE is a Brazil-based metal mining (mostly iron ore) company with an 8% dividend yield. Respectable! Is there some bad news still to come? I do not know. But VALE has a very strong 210 trading days (TDs) cycle, which suggests it could trough within a couple of months and provide a nice opportunity.

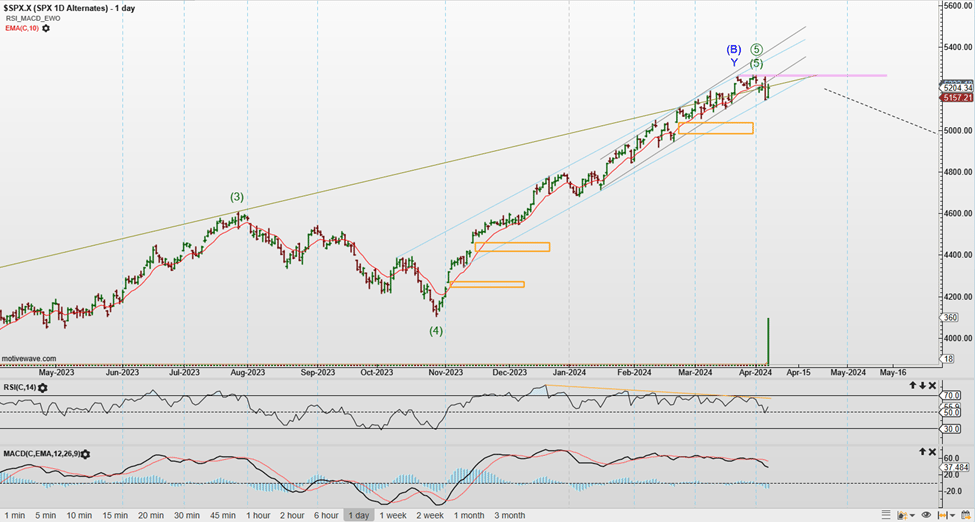

Technical Analysis

Reposting from X (former Twitter) with additional comments:

Channels, trendlines, Resistance & gaps:

The pink triple-top resistance is formidable. But it would not be unusual to poke above it to clean out the shorts, only to revert below it again.

SPX is dancing around the olive trendline.

The gray channel is broken; the next step is retesting the DTL. This could happen even at a slightly higher high.

To move down, SPX also needs to break the light blue channel.

Notable gaps (orange rectangles) are magnets. Eventually, gaps get filled.

Read our Disclaimer

Subscribe to the Pro Tier to read the rest.

Become a paying subscriber of Market Twists & Turns - Pro to get access to the rest of this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • In-depth analysis on SPX, NDX, DJI, RUT, VIX/VXX, plus

- • Cryptocurrencies, bonds, commodities, forex, international markets, select stocks, & EFTs

- • Technical & Elliott Wave Analysis (EWA)

- • Price projections using Cycle methods and Fibonacci levels

- • Ad-free & downloadable pdf version

Reply